Toyota Motor: Has It Lost That Loving Feeling?

Toyota Motor: Has It Lost That Loving Feeling?

- Some time back "Oh what a feeling!" was the ad slogan for Toyota Motor Corporation. Has it lost that feeling?

- Lyn Alden provides fundamental analysis and commentary that meshes nicely with what the chart is telling us.

- We look at what would provide us with a buy setup for the stock.

With Garrett Patten; produced with Avi Gilburt

Toyota Motor Corporation (NYSE:TM) has always had great advertising campaigns. Slogans that really stick with you. For those that remember, back, oh some years ago we will say, it used to be, “Toyota - Oh what a feeling!” And then someone would jump up into the air with glee and excitement.

But, has it lost that loving feeling? Some are saying that they will never catch up with the electrification of the industry. Others are worried about lack of growth compared to other automakers. And yet another group are staunch supporters of the quality and reliability of the brand. Who is right? Because that is a lot of feelings there.

Feelings are important. But perhaps not in the way you are imagining or have been conditioned to think. In our methodology, feelings equal sentiment. Sentiment is simply crowd behavior that manifests itself before our eyes in the structure of price on a chart. Once you learn how to track and project those feelings, it will open up an entirely new way of seeing the markets.

But fundamentals also matter. And that is why we use both. Welcome to World Market Waves. We seek the synergy between fundamentals and technicals to find high-probability setups across world markets.

We can benefit from world-class analysis by Lyn Alden and the view via fundamentals. Then we will delve into the technicals with Garrett Patten. It is the blending of these two views that shape our opinion for Toyota Motor going forward.

For now, you will see the rating at the time of publication as “Hold”. However, once certain conditions are met via the structure of price on the chart, that may readily change to “Buy.” Let’s dive in and find out.

Fundamentals With Lyn Alden

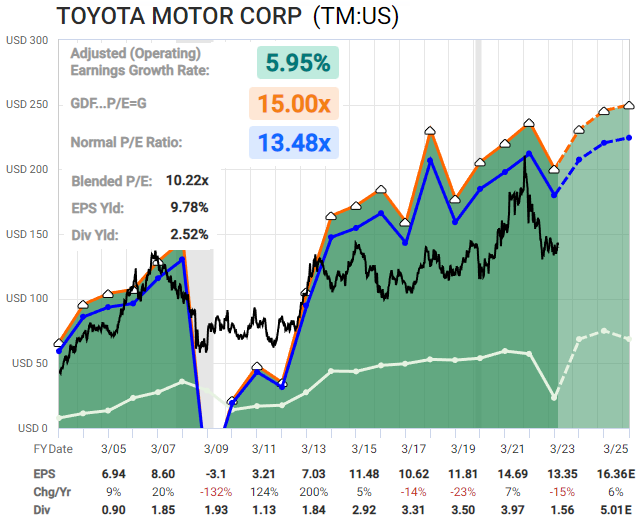

Toyota continues to be decent-but-lackluster, with a significant risk of being an ongoing value trap.

The stock is cheap and has a strong balance sheet, and after a big correction it is back down to the lower end of its trading range. This gives it plenty of appreciation potential over the next couple years as it potentially bounces back up to the higher end of its trading range.

However, longer-term, it's hard to see how the company is going to move the needle and provide better shareholder returns. The dividend yield isn't high enough for a low-growth stock.

Meanwhile, China is now eclipsing Japan as the largest car exporter in the world. We don't see the results much in the United States since we're not really a market for it, but globally, Chinese cars are taking market share.

Overall, while I wouldn't short Toyota, I have no plans to go long either. At this point I just view it as a trading stock rather than a long-term compounder.

Viewing The Big Picture Via Technicals With Garrett Patten

Garrett is a senior analyst at ElliottWaveTrader.net covering both U.S. and international equity indices as well as stocks. He is a key contributor of S&P 500 and other index analysis in our flagship service, Avi's Market Alerts, and hosts four other premium services on the site.

World Markets covers 10 international indices (FTSE100, DAX, Euro STOXX 50, Nikkei, Hang Seng, India's Nifty 50, Mexico's IPC Index, Brazil's Bovespa, Australia's ASX 200, & Shanghai Composite) as well as many key stocks from around the globe.

Garrett is also ElliottWaveTrader's chief educator. In his Live Video service with Avi Gilburt, Garrett provides not only his market analysis but an educational component on what the wave counts mean and how they were derived. He also takes turns with Zac Mannes in hosting the weekly Beginners Circle Webinar for new members, and is developing an educational course on Elliott Wave.

Without further preamble though, let’s see what Garrett gleans from the Toyota Motor chart at this moment.

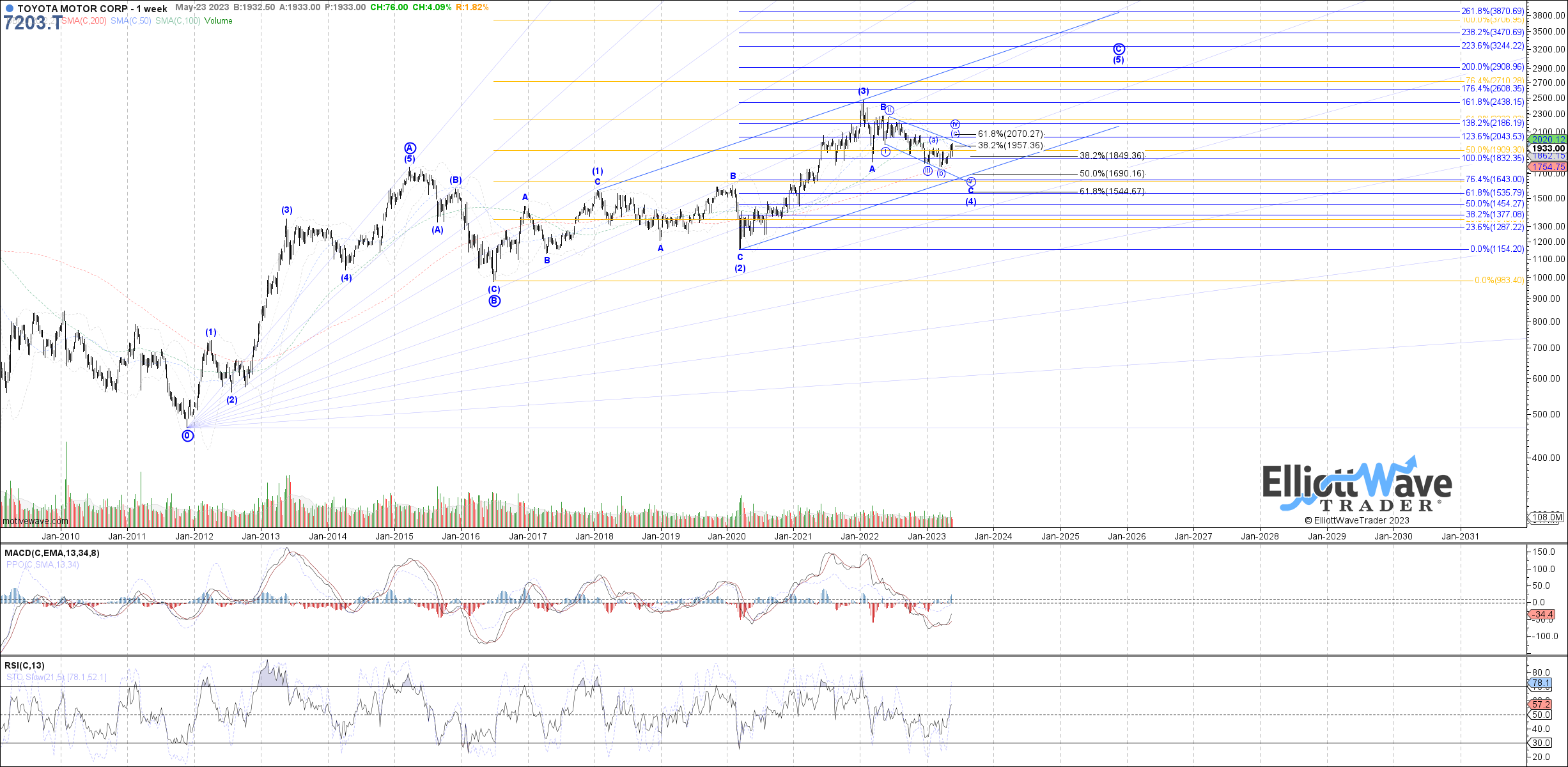

You will see that while we do anticipate Toyota stock to find one more swing low relatively soon, it may then embark on a rally phase that could take it to as high as the 2900 level.

In the near term, we see the most likely path as having price move into the 2000 area before a pullback in what you see as wave ‘v’ of C of [4]. That pullback could see price finish in the 1600’s. It is from there that the next larger rally may take shape as described above.

Risks: should price instead decide to move directly from here above the 2200 area it would shift the probabilities to the stock already having found an important low and could be on its way to the 2900 price target sooner rather than later.

Conclusion

In the weeks to come you will see many more articles from us that cover key stocks from key companies around the globe. Ours is a unique methodology that blends fundamentals with technicals. And not just technical analysis as you may have come to know. This is the study of crowd behavior that unfolds before our very eyes via the structure of price on the chart in real time.

Don't be thrown off by your prior opinions or experiences. Nor should you allow those to prejudge when you hear the words "Elliott Wave" or "Technical Analysis". This is much more than trendlines and momentum. Avi Gilburt has published extensively on the how's and why's of our way of looking at the markets. All of those articles are available to you under his author page (here).

For an introduction, you may want to start with Part 1 of the 6-part article series, "This Analysis Will Change The Way You Invest Forever" (here).

There are many ways to analyze and track stocks and the market they form. Some are more consistent than others. For us, this method has proved the most reliable and keeps us on the right side of the trade much more often than not. Nothing is perfect in this world, but for those looking to open their eyes to a new universe of trading and investing, why not consider studying this further? It may just be one of the most illuminating projects you undertake.