This Week: Short Tempers and Volatility

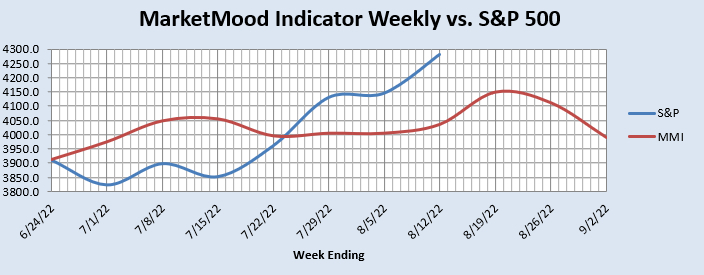

The mood pattern for this week implies short tempers and increased volatility. It would not take much this week for the geopolitical situation to become less stable or for the domestic political environment to become (unbelievably) less nice. The weekly chart (below) is looking for a local top this week or next.

A MM Turn Day (mentioned in this evening's regular MarketMood report) is telling us to be alert through Monday for either a trend change or a spike and reversal. These occur after periods of unfocused or ambiguous sentiment that are then often followed by an event or events that tend to get everyone's attention.

As was explained in this evening's report, we have determined that the signal orientation in our weekly chart had been inverted as evidenced by last week's consistently strong market and a primarily positive net effect of government actions (although there are no doubt strong negative feelings against some of them by a significant percentage of the American public). The recent "crisis alert" call is considered to have been incorrect, as the inversion of the crisis/disaster pattern is the "government stimulus" or positive government actions pattern. The positivity is judged by the market movement, not by political affiliation. In spite of this, the MM Turn Day cautions against complacency.