This Week: Misplaced Hopes

MarketMood Weekly Preview: Week Ending June 15, 2018

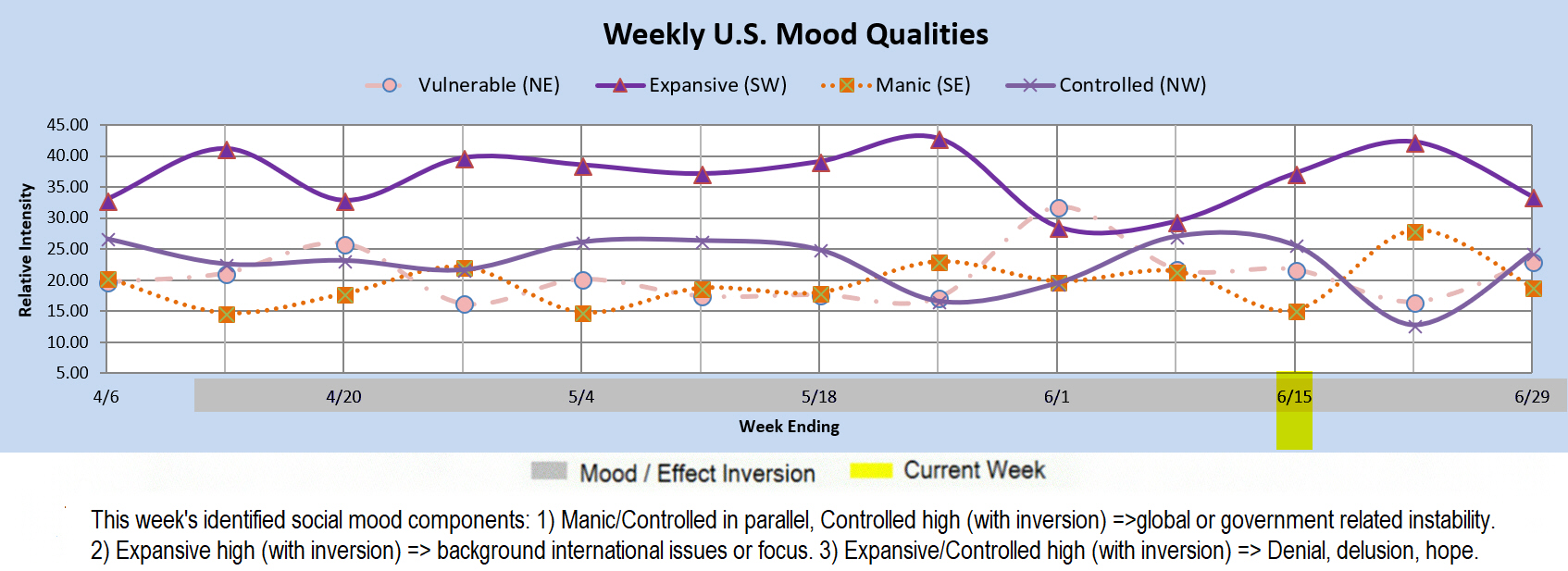

This week: the mood pattern for this week points to a background focus on governmental or global issues, as well as a component that is associated with hope, but also delusion or denial. This makes sense with the North Korea summit coming up. The primary component for the week however, points to government related instability or various other crises. Whether people will find that to be about trade war concerns, a North Korea summit gone bad, or something else we'll have to wait and see what happens as the week unfolds.

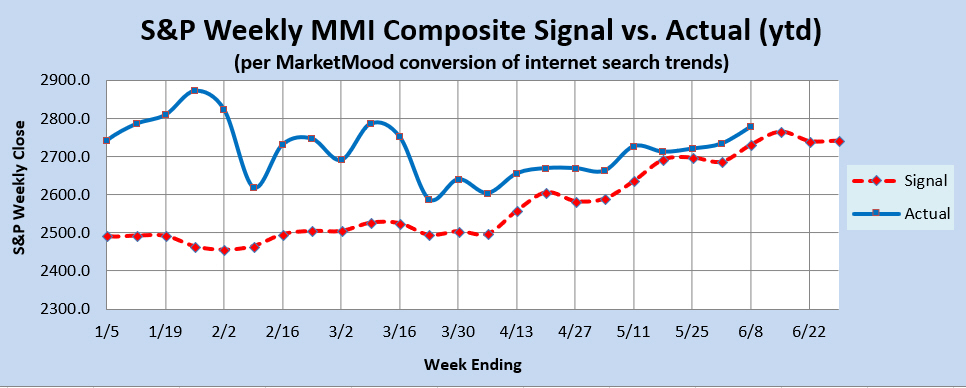

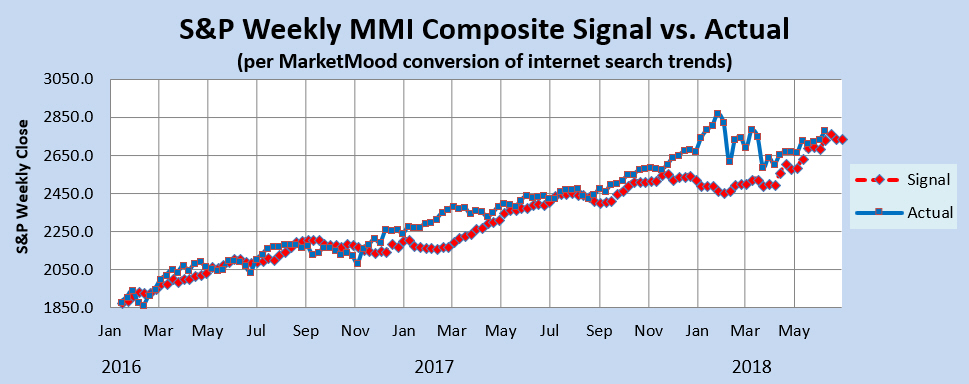

Market Charts: Charts are showing that the market is very near at least a local top. The weekly trend indicator remains in bullish territory, but the market has to gain a little over a half a percent for the week for it to remain so. The MM MACD is still bullish, but could turn neutral with a little less than a half a percent drop for the week.

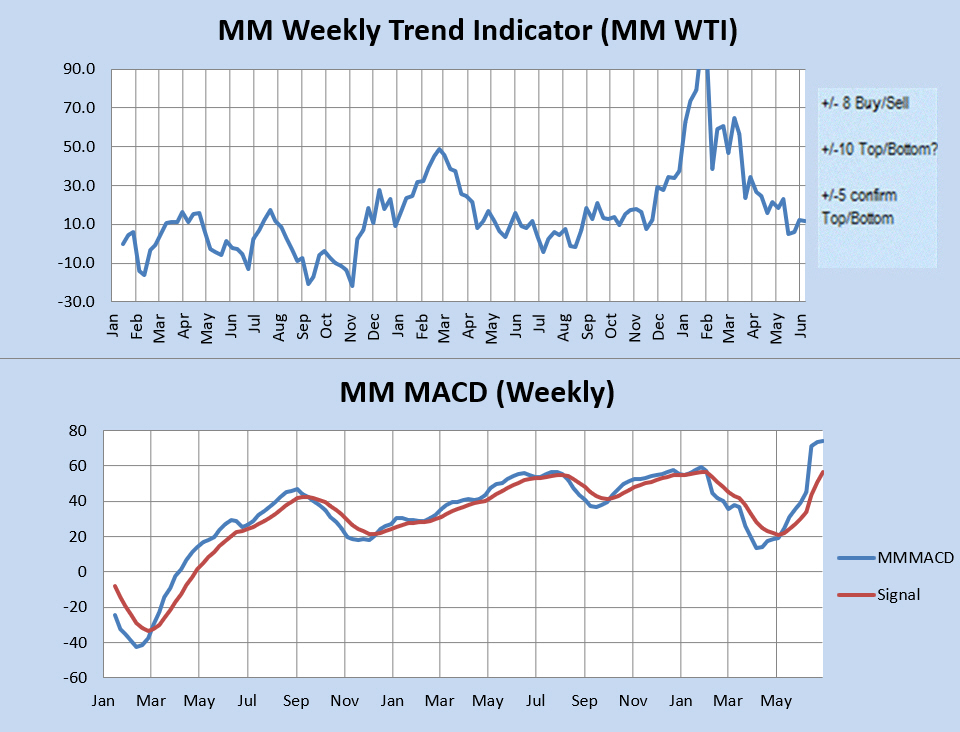

Trend Indicators-- the Weekly MM WTI and MM MACD:

The MM Weekly Trend Indicator (MM WTI) remains in bullish territory, but is right on the edge. The market must close up this week (above 2797) for the trend to remain bullish, otherwise it turns neutral. A less positive close for the week won't cut it; below 2785 turns the weekly trend to bearish. The MM MACD is currently bullish, but a close for the week below 2767 will turn it to neutral. There is no reasonable close for the week that will turn it bearish.

The MM WTI measures trend strength using the divergence between the market trend and the forecast trend. A move above +8 or below -8 is bullish or bearish respectively. A value over 10 or under -10 followed by a move back through +/-8 signals a high or low is likely in. A subsequent move below +5 (or above-5) signals a trend change to bearish (or bullish).

The MM MACD is similar to a standard MACD, except that it uses the MMI signal data to extend several weeks beyond today, while the standard MACD relies solely on historical market data.

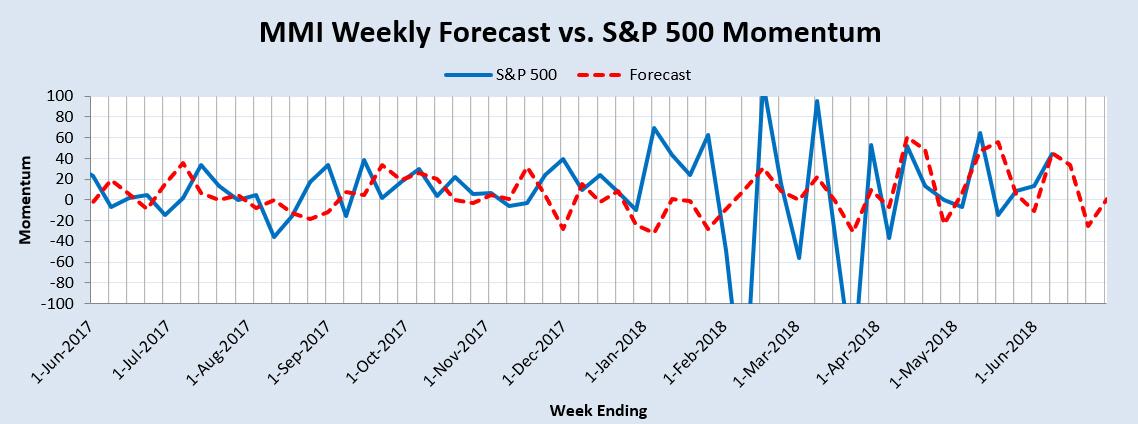

Momentum Indicator: The weekly momentum indicator is still looking up this week, but also pointing to a slowing down of gains and a near term top just around the corner.

Qualitative Analysis Notes: This week's identified social mood components: 1) Manic/Controlled in parallel, Controlled high (with inversion) =>global or government related instability, or other various crises. 2) Expansive high (with inversion) => background international issues or focus. 3) Expansive/Controlled high (with inversion) => Denial, delusion, hope.