This Week: Global Tension

MarketMood Weekly Preview: Week Ending March 30, 2018

Last week's picture: "The mood pattern for the week ahead is somewhat ambiguous as there is a more bullish quality about it than the previous week, but there are several things about it that signal caution. 1) It's week 3 of 3 highly news and data driven weeks. The final week of a multi-week mood pattern is going to be the most intense whether positive or negative. 2) Looking at the momentum chart, the recent corrective bounce appears to be peaking. With weekly resolution, a topping could be sometime this week or next week." There was a lot of news and data -- FOMC, trade war vollies, Facebook, and John Bolton to name a few of the week's topics. The market struggled, but hung in there through Wednesday, and that was it. Needless to say, the topping we were looking for was this past week. The week ended down a whopping 6%!

This week: The week ahead is looking murky and somber. While the picture is overall bearish, traders are likely to find the markets a bit more challenging. The primary mood components portray victimization and risk aversion likely to be accompanied by a serious news event or events and overall downish markets. International issues or concerns should also be loudly playing in the background. The net result is a tension between a negative outlook, and a desire for stability both at home and globally.

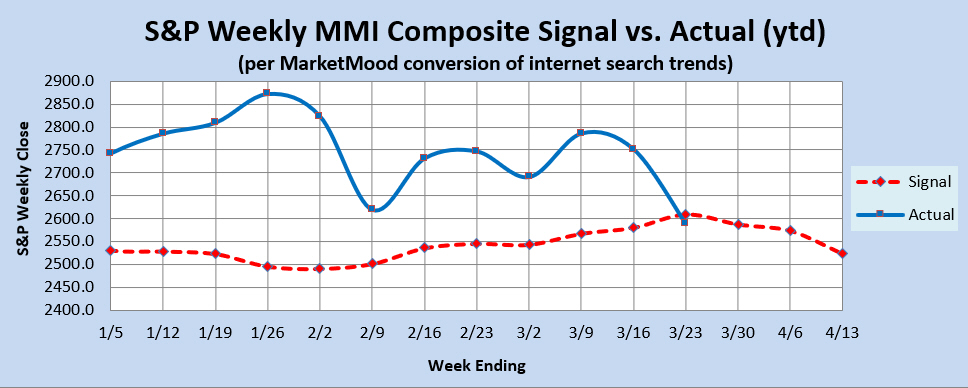

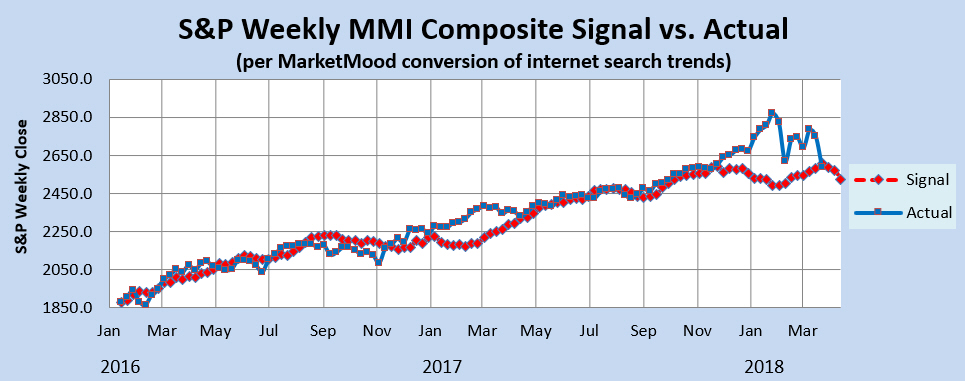

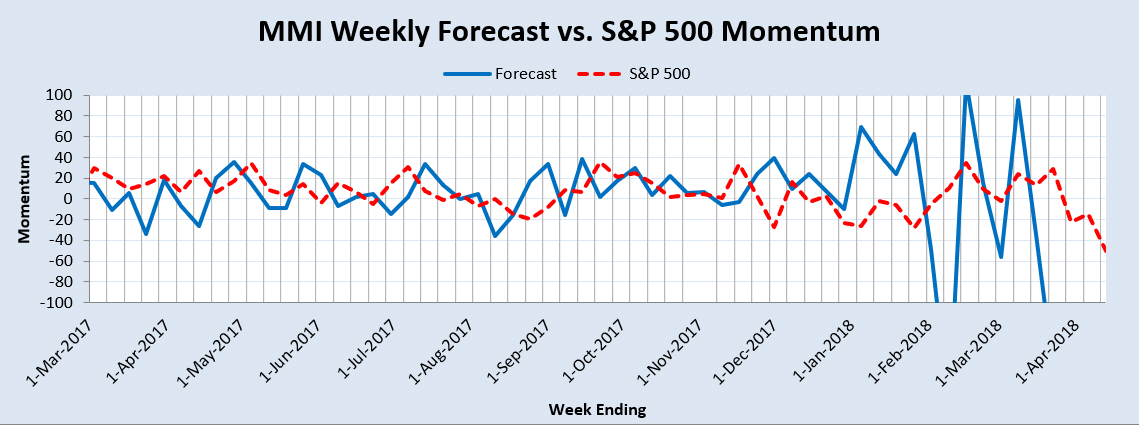

Market Charts: The weekly forecast charts (below) show that the overbought condition versus the mood generated forecast has been completely erased. The market is once again back where it "should" be. The weekly chart shows continued downside. The Momentum chart however, while supporting further downside in general, is at levels that could support serious short covering rallies.

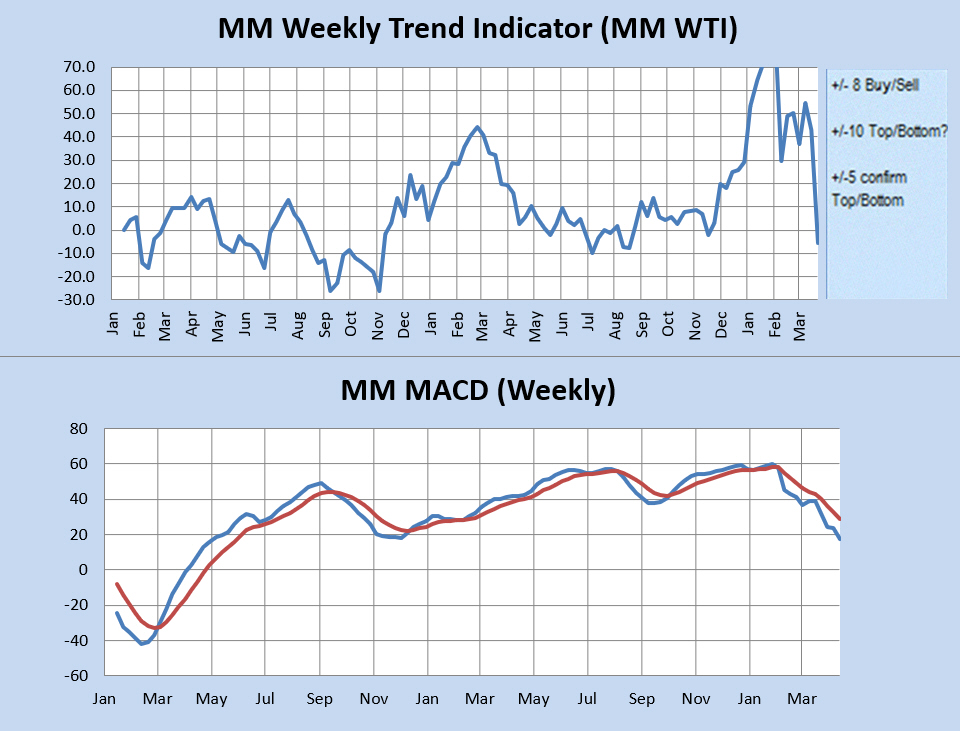

Trend Indicators-- the Weekly MM WTI and MM MACD:

The MM Weekly Trend Indicator (MM WTI) has moved from strong bullish territory to bearish. The weekly trend is now firmly down. A close (this week) above 2608 would signal "exit short positions." and a close above 2619 (this week) would signal a bullish trend change to the weekly trend. The weekly MM MACD now has a signal to SELL at or below 2584 SPX. It would need a weekly close above 2592 to change to neutral (exit short positions). There is no weekly close that will turn it to a buy for the following week.

Momentum Indicator: The weekly momentum indicator is showing a sharp move down in progress. However, it's also at such oversold levels that could support strong short covering rallies.

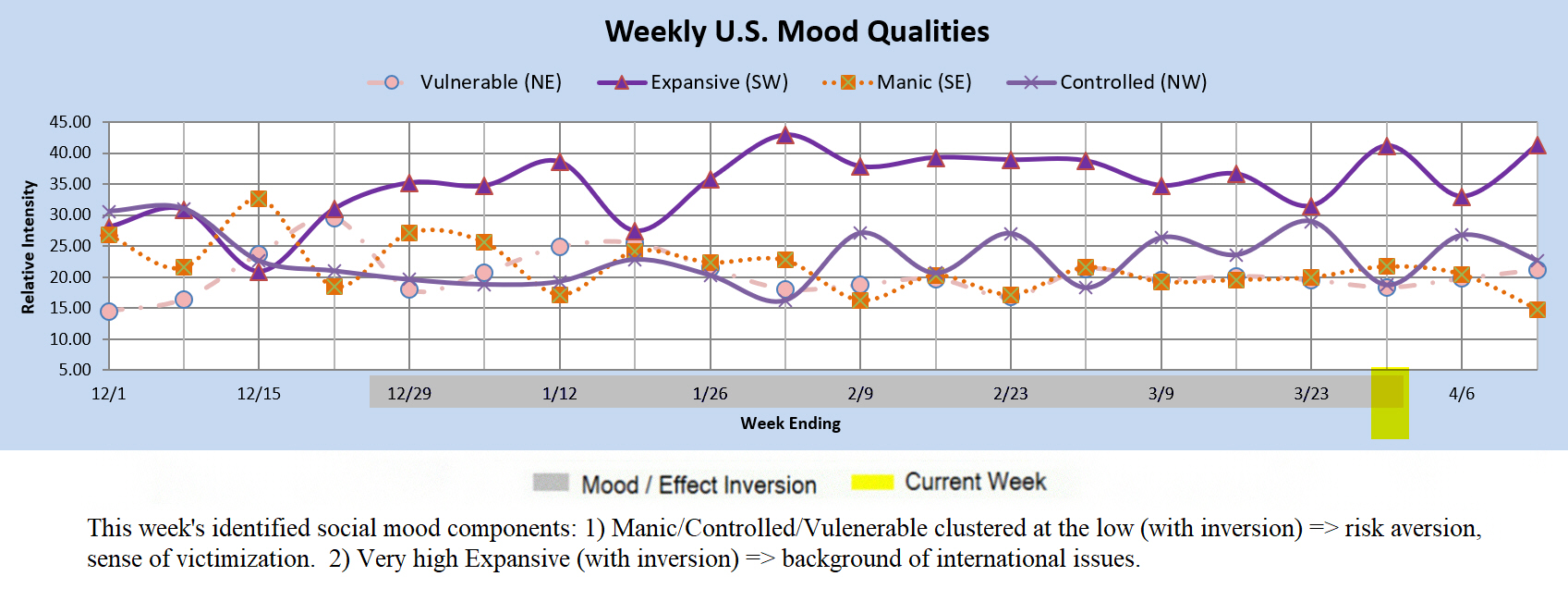

Qualitative Analysis Notes: This week's identified social mood components: 1) Manic/Controlled/Vulnerable clustered at the low (with inversion) => risk aversion, sense of victimization. 2) Very high Expansive (with inversion) => background of international issues.