This Week: Early Phases of a Pullback

MarketMood Weekly Preview: Week Ending June 22, 2018

Last week: the mood pattern for this past week pointed to a "background focus on governmental or global issues, as well as a component that {was} associated with hope, but also delusion or denial." This made sense with the North Korea summit coming up. The primary component for the week however, pointed "to government related instability or various other crises." Besides N. Korea, a couple of issues that came up were the G7 summit, and more about trade wars and tariffs. Charts were showing that the market was "very near at least a local top." The market tried to go up all week, but petered out as it wore on, closing nearly unchanged for the week.

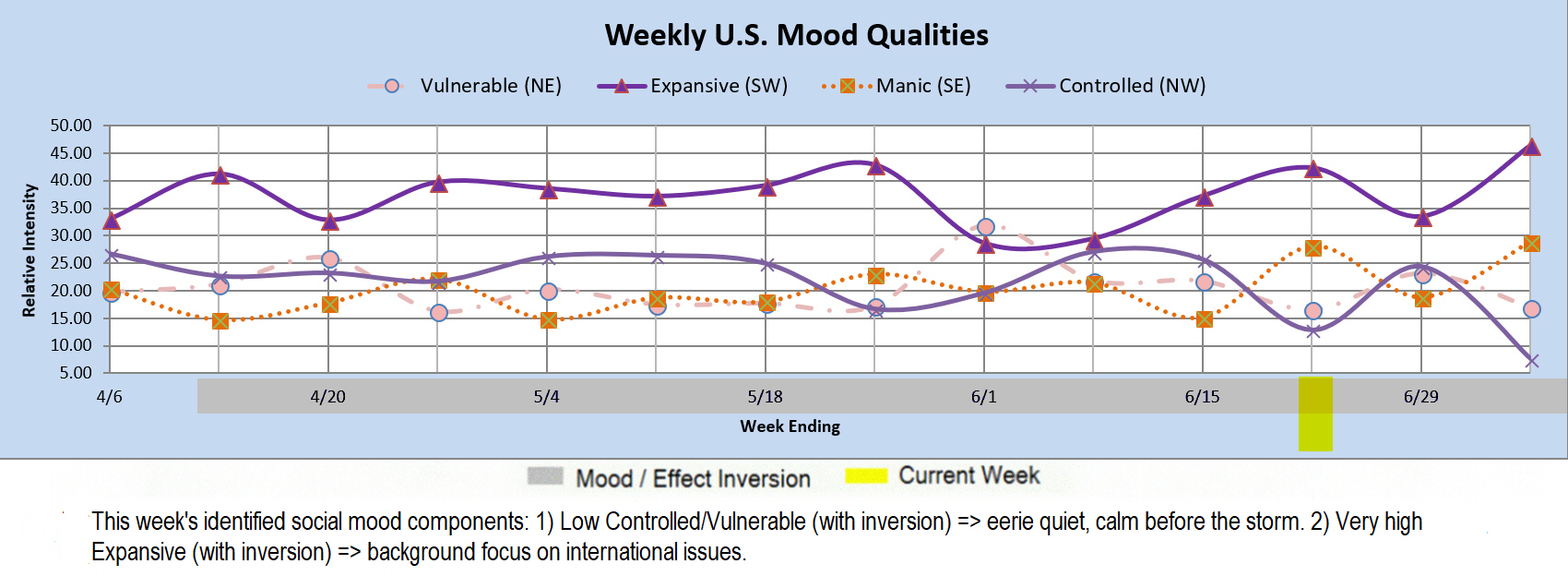

This week: the primary mood component reflects an eerie quiet or "calm before the storm." There is another component pointing to geopolitical issues in the background. While the "calm before the storm" component is usually near term positive for the market, last week's "denial" component is usually followed by a pullback. Perhaps this week will be a mixed bag as far as any kind of trend goes.

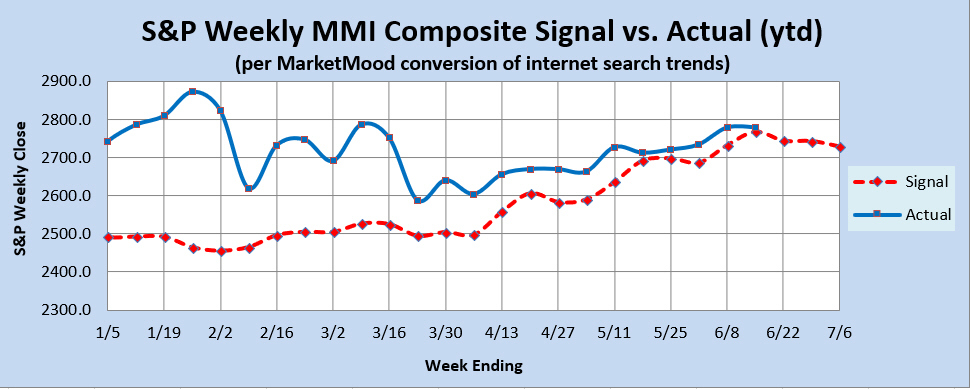

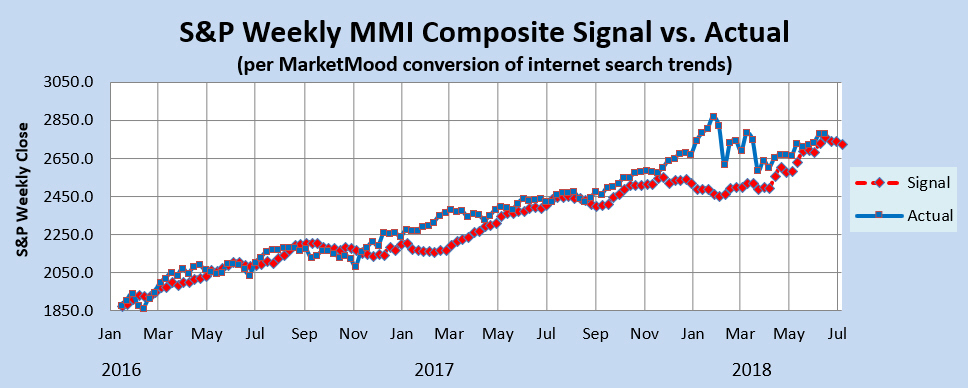

Market Charts: The forecast charts (below) are showing that the market should be starting a pullback.

Qualitative Analysis Notes: This week's identified social mood components: 1) Low Controlled/Vulnerable (with inversion) => eerie quiet, calm before the storm. 2) Very high Expansive (with inversion) => background focus on international issues.

Qualitative Analysis Notes: This week's identified social mood components: 1) Low Controlled/Vulnerable (with inversion) => eerie quiet, calm before the storm. 2) Very high Expansive (with inversion) => background focus on international issues.