This Week: Bulls Run Out of Gas

MarketMood Weekly Preview: Week Ending June 28, 2019

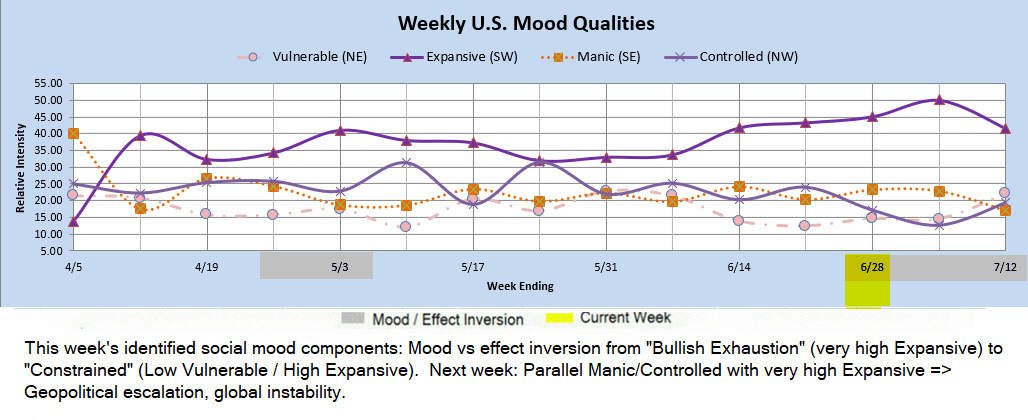

This week a signal inversion (flip) takes the mood pattern from "bullish exhaustion," the final push by bulls in an uptrend, to one with a bit more constraint and possibly bearish leaning. Next week's mood pattern (the first week of July) is perhaps even more interesting as it reflects global instability and geopolitical or possibly military escalation. MMI continues to point down into the second week of July.

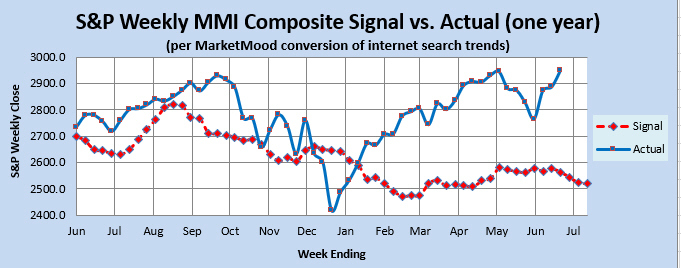

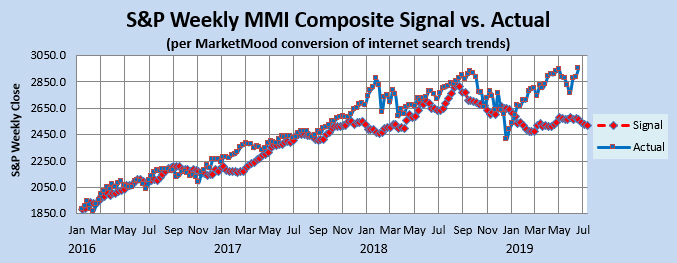

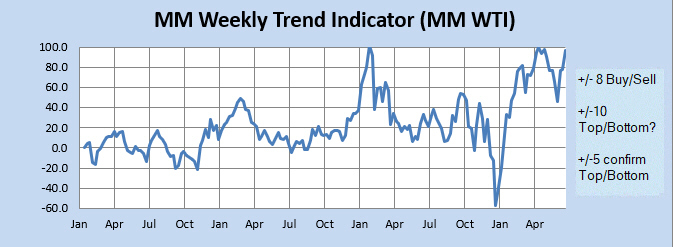

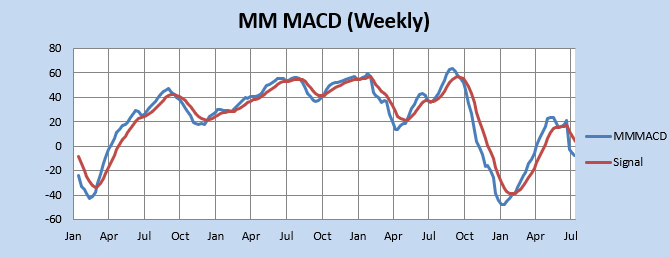

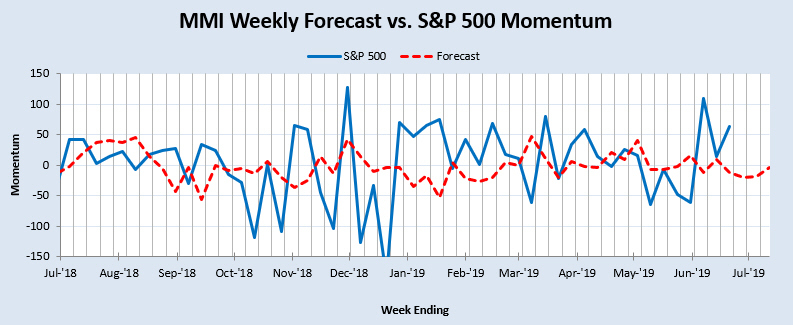

Market Charts: The SPX forecast charts (immediately below) are showing a market that is extremely overbought per sentiment and ready to correct this at any moment. The derivative indicators are mixed. The Momentum Indicator reflects a market that is ready for about a two to three week correction. The Weekly Trend Indicator (WTI) remains in extreme bullish territory. The Weekly MM MACD remains neutral (unconfirmed sell in an uptrend).

Trend Indicators-- the Weekly MM WTI and MM MACD:

The MM Weekly Trend Indicator (MM WTI) is in extreme bullish territory. The market would have to close down over 13% this week (not expected) for it to turn neutral from bullish. Also, the WTI had confirmed an important low in place from December, and there has been no signal to the contrary since. The weekly MM MACD is neutral (unconfirmed sell in an upward trend). It would take over a 13% drop this week (not expected) for it to turn bearish.

The MM WTI measures trend strength using the divergence between the market trend and the forecast trend. A move above +8 or below -8 is bullish or bearish respectively. A value over 10 or under -10 followed by a move back through +/-8 signals a high or low is likely in. A subsequent move below +5 (or above-5) signals a trend change to bearish (or bullish).

The MM MACD is similar to a standard MACD, except that it uses the MMI signal data to extend several weeks beyond today, while the standard MACD relies solely on historical market data.

Momentum Indicator: The weekly momentum indicator shows a market ready for correction over the next two or three weeks.

Qualitative Analysis Notes: This week's identified social mood components: Mood vs effect inversion from "Bullish Exhaustion" (very high Expansive) to "Constrained" (Low Vulnerable / High Expansive). Next week: Parallel Manic/Controlled with very high Expansive => Geopolitical escalation, global instability.