Third Wave Likely Underway For The U.S. Dollar

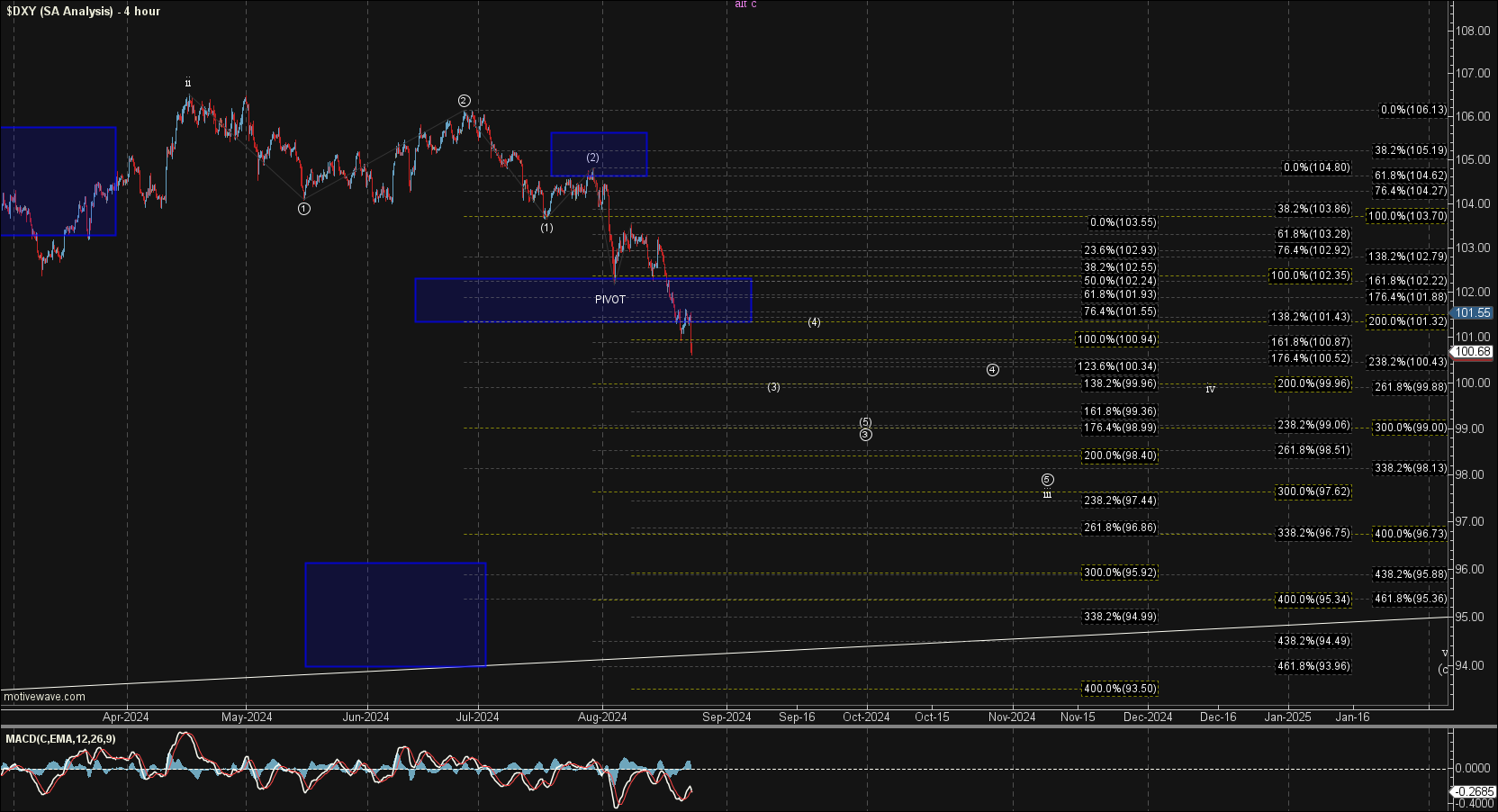

Last week we were once again testing the upper end of the downside pivot waiting for the DXY to confirm that we had indeed begun the third wave as part of the larger wave (c) down. This week we finally broke through that pivot thus giving us confirmation that we have indeed begun the third wave down and are now likely heading lower in the larger degree wave (c) towards the mid to low 90s.

From here it is simply a matter of watching to see if the DXY can continue to hold under resistance as we continue to move lower in the heart fo the third wave of larger c wave down.

Shorter Timeframes

Now that we have broken below the lower end of the pivot at the 101.43 level we further confirmation that we have indeed topped. From here we will need to hold under the 101.93 level and continue to push lower. That should then set us up for an ultimate move lower towards the low 90s as part of the larger wave (c) down. As Forex third waves often extend with very shallow retracements for their fourth waves I would expect this to see shallow retracements as we continue to grind lower. I will continue to update resistance as this moves lower but as long as that resistance holds it is becoming more an more probable that we will indeed see this move lower to finish off the wave (c). Once that wave (c) is completed we will look to the bigger picture count to help determine whether we have topped in all of the wave ((A)) or simple he wave (3) of a larger wave (A).

Until we see a break under the 99.58 level I can't fully take the purple count off of the table but with this continued move lower it is looking less and less likey at this point in time.

Bigger Picture

There is still no significant change in the bigger picture count, and as I have noted previously, I am counting the top in October as either the white wave (3) or the green wave (5) of ((A)).

The white count should head down towards the lower trend line to fill out that wave (4) before pushing higher once again to finish off the larger degree wave (5) of ((A)). The exact bottoming level for this potential wave (4) has become a bit more clear as noted above as we have likely topped in the wave (b) of that (4). Ideally, I would be looking for that to come in at the 93.11-90.20 region as this is the target zone for the wave (c).

The green count is suggestive that we have topped in all of the larger degree wave ((A)) and we are already in the wave ((B)) down. Both the white and the green counts are going to look very similar in the early stages of this move as they both are corrective in nature. The green count of course would give us a much deeper retrace for that larger wave ((B)) before turning higher.