They Are Trying - Market Analysis for Apr 7th, 2021

With the metals trying to rally again, we have our parameters to watch for a confirmation for a low. But, until that happens, I am still a bit skeptical. Yet, PLEASE recognize that whether we get that lower low or not, we will likely see much higher levels in the coming months, and anything bought down here will likely be looked upon as a good buying opportunity in hindsight.

That being said, I am going to repost the updates I put out earlier this week:

GDX: “Again, the structure does not allow for a lot of clarity just yet. BUT . . . if there really is a bottom in GDX already, then we are completing wave 1 of (iii) of the bigger wave i, with a target in the 40 region. Again, this is where the BIG BUT (only one T) comes in. We need to see the market pullback from the box - which is the .618-764 extension of waves (i) and (ii) in green - in a corrective fashion, and then rally over the high struck at the box. That would suggest we are potentially breaking out in wave 3 of (iii) of wave i - heading to 40 region - and you can place your stops at the bottom of the box.

This is still preliminary, and I am still not certain whether the bottom is indeed in place or if we get that dreaded lower low.”

As it stands now, we have topped for the moment in the pivot, and have been pulling back correctively. Should we take out the pivot, you can always go long that break out with a stop just below the .618 extension in the 33.80 region.

If we do see that lower low down towards the 29/30 region, I am going to have to revisit the alternative counts as it would really be too big to consider this being wave [4]. In fact, it has already pushed the limits of that count. But, as I outlined in today’s member video, I will make that determination based upon how we rally to our blue target box for wave 3 overhead on the daily GDX chart.

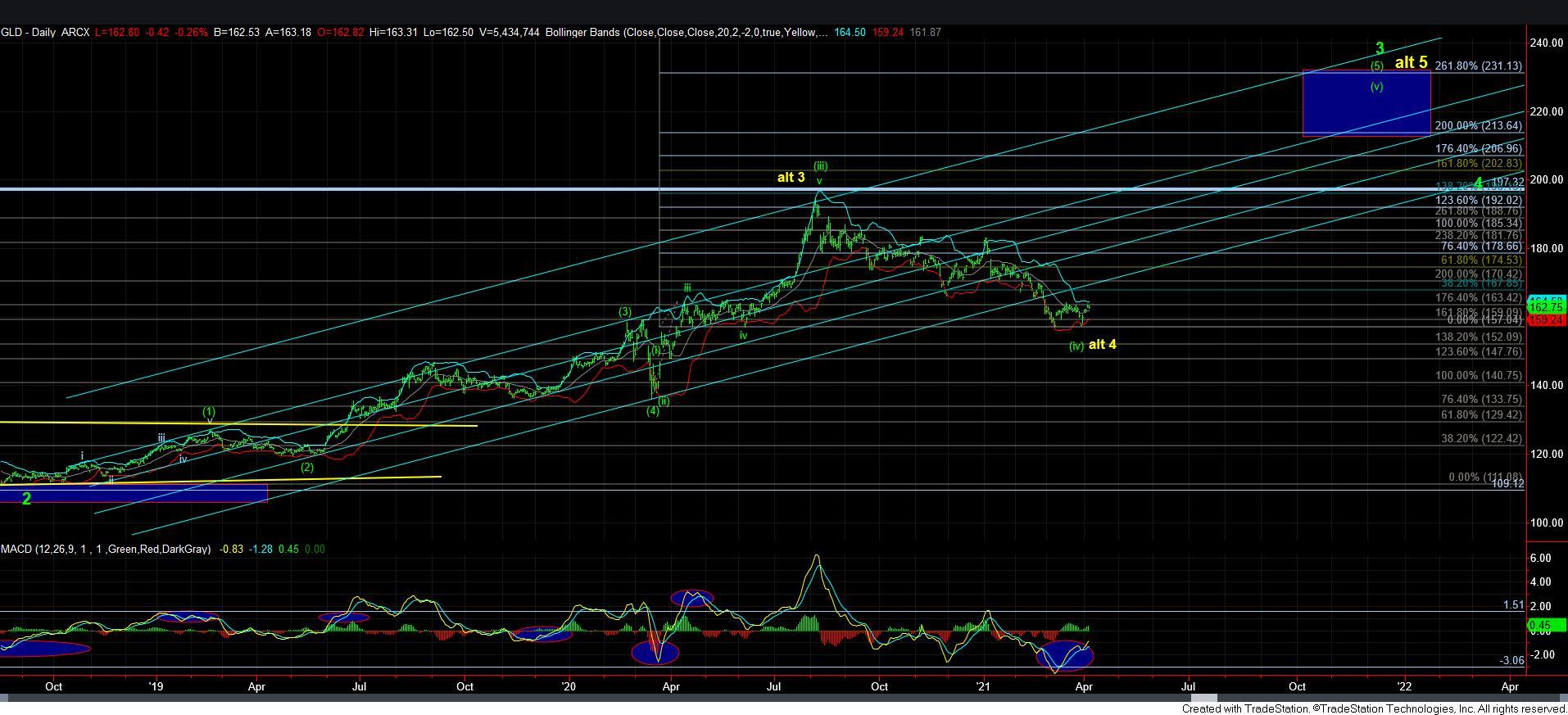

GLD: “When I look at GLD, I am not nearly as enthused in the micro as the silver and GDX potentials may seem. The GLD is looking more like an a-b-c off the lows if we cannot get through the 164.50 region. Again, the double bottom makes it unclear whether this is an a-b-c structure, or if we have a truncated bottom in GLD.”

And, as long as we remain below the 164.50 region, I am concerned this is just a big a-b-c for a 4th wave in the final c-wave decline in GLD, as outlined in grey on the 8-minute GLD chart.

As far as silver is concerned, it can also go either way with a lower low being a bigger wave iv as we have been highlighting in yellow. But, I will note that silver has a micro 5-wave structure off the last low, which does give the bulls the edge at the moment in the micro structure.

The main point to take away from all these products is that the divergences we have on the charts suggest that whether we get that lower low or not, the market is going to be moving into a bullish phase again in 2021. The only question is if that lower low is in place just yet. And, the structure of the market has been terribly overlapping and unclear, so I cannot provide any strong probabilities as to whether that lower low is a high probability or lower one. How we resolve the current rally this week will likely be the tell.