The S&P 500 Index Breaks Above The 4000 Level

Finally, we have broken above the 4000 handle for the S&P 500 index. I have been projecting this move in many of my market updates over the past six months.

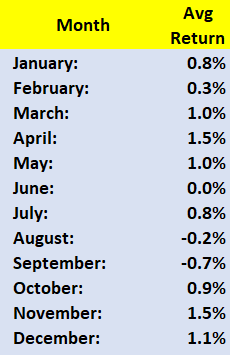

This step is very bullish and means that we are likely to reach the 4100 level for the index soon, most likely in the month of April. Keep in mind that April the best performing month of the year (along with November) as you can see in the statistics below (taken from years 1980 to 2019):

My projections for small and medium cap stocks are much more bullish. As our members recall, these smaller cap stocks that I have been highlighting, such as the ones that we hold in our portfolio, have the most upside potential. While here at HDO our main objectives are not capital gains, but consistent recurrent income, it is nice to see our secondary objective (to achieve long-term capital gains) materialize. Good things come to those who are patient!

The Case of Value Stocks

Value stocks have lagged the general indexes for the past few years as far as capital gains are concerned but yet have rewarded our retirement portfolios with the cash flow that we promised. In the past 6 months, the capital gains have been materializing. Year to date, our "Core Portfolio" has returned 15.4%, versus the S&P 500 Index of 7.6%, and the best is yet to come. Keep in mind that value stocks such as Property REITs, Mortgage REITs, BDCs (Business Development Companies), CLOs (Collateralized Loan Obligations), and Energy stocks have soared. But based on the valuation gap compared to growth stocks remains cheap. So there remains a lot of upside left.

We are particularly focused on economically sensitive U.S. stocks to benefit from a supercharged domestic economy. The current administration has set a path that is very friendly for equity investors, at least for the next two years through highly generous stimulus injections and infrastructure plans, in addition to near-zero interest rates. We have positioned our portfolio in a perfect position to benefit from both the highest income available, coupled with the most possible capital gains.

Please do not be blindsided by valuations such as high premiums to NAVs ( Net Asset Values). If you are searching for good deals such as BDCs or fixed income CEFs, do not look at premiums to NAVs. They do not mean much. The markets are always forward-looking. We have been criticized over and over for being bullish on investments that "seem to be very much overvalued based on NAV", such as PTY (PTY), NEWT (NEWT), PCI (PCI), ARCC (ARCC), and CSWC (CSWC), just to name a few. Yet these stocks were our biggest winners, and they were yielding +10% at the time of our recommendation. Still, there is a huge upside left if you are forward-looking.

Investors are best served by not looking at past data, but by projecting future outlooks, and this is why we are here for you at HDO. Often, investments that look expensive to most investors are actually cheap because these investors are looking at past data and stale data.

We always like to remind our members that having forward analytics of macroeconomics and market forces in play is more than 50% of the due diligence required to be a successful investor. You need to look forward, and past returns are never an indicator of future returns. This is where "value investing" comes into play.

Healthcare: Deep Value with High Yield

Looking for deep value in today's market? Look no further than the healthcare sector. This is one of the fastest-growing sectors on the planet, yet it has underperformed almost all sectors over the past two years. One reason could be attributed to fact that the Covide vaccines have been provided at a "cost price" due to the new technology involved and the "humanitarian aspect". These same new technologies will open new the door for new breakthroughs in the medical field, and will not be "subsidized". I am willing to bet that these new technologies will generate growth for this sector like we have never seen before. This is one reason that I am personally allocated 10% of my overall retirement portfolio to healthcare including HQH (HQH) yield 7.7% and THQ (THQ) yield 6.2%. Both are set to hike their dividend significantly by year-end.

What is Driving the Markets Higher?

Liquidity, liquidity, and more liquidity! Following the pandemic crisis, the economy was already flooded with excess liquidity because of a lack of spending opportunities. Due to a lack of investment opportunities, much of the excess liquidity flowed to equities.

Then comes the stimulus plans across the major global economies (U.S., Europe, and East Asia) by central bankers to stimulate the economy to pre-pandemic levels. More money is flowing to equities, but this time is increasing the risks of inflation expectations, and resulting in higher long-term interest rates. As a result, treasury bonds and investment-grade corporate bonds suffered the worst performance since the Global Financial Crisis. What we are seeing today is a massive move out of bonds into equities, which could mean that the recent highs in the stock markets are just the beginning of a very strong uptrend.

This strong secular bull market will keep surprising you. There is a lot of money to be made in the next two years. I have been getting messages from some of our members that are worried about the new market highs and considering taker profits. My replies have been:

I have been holding on to my positions and not withdrawing any penny. I see much more upside over the next 18 months.

From a Technical Perspective, the longer-term outlook remains very strong. It is liquidity that is the ultimate driver for the equity markets. And the hunt for yield that will be the main driver for "total return" for our portfolio". The sooner you lock those yields, the more you will get rewarded.

Renewable Energy Set to Outperform

There is a big opportunity for renewable energy. Following the Biden infrastructure bill, and its serious impacts and future impacts on the source of energy, this sector is set to soar. I would like to highlight Invesco Solar ETF (TAN). TAN is an ETF that provides instant diversification in the renewable energy space including companies such as First Solar (FSLR), and Enphase (ENPH) that could benefit from the situation. TAN has pulled back significantly from its recent highs and offers a good entry point.

TAN is not a dividend payer (0.1% dividend) and not part of our portfolio. But as an alternative, you can own a great high-yield renewable energy stock Atlantica Yield (AY) - yield 4.5% - that is part of our Core Portfolio. This one is good to buy and hold for the long term.

Best Course of Action

The month of April is likely to be a very strong one, with big capital gains across our portfolio. Following April, we are likely to see some price volatility and a consolidation pattern, with a bias to the upside. The question will arise from some of our members: Should we sell and lock in those capital gains?

The year 2021 is likely to end on a strong note, most likely higher than the end of April 2021, so any volatility in between should not matter if you are a buy-and-hold investor.

Importantly, as an income investor for the long term, I am inclined to say that I would sleep better at night knowing that my dividends are flowing than worrying about what to buy and what to sell the next day, or if I missed an opportunity. This is why we like to keep our trading to a minimum at HDO. We are long-term investors for both dividends and recurrent high incomes. This our recurrent income method.

I am very excited about the prospects of our core portfolio for the month of April and till year-end. I encourage our members to remain long-term investors and not to worry about short-term volatility that may come along. Any market dips are likely to be shallow and short-lived. The best course of action is not to time the markets. Patience, patience, more patience, is the key to success. High dividends and recurrent income is the key to our peace of mind and our success.

Good investing,

Rida MORWA

Disclosure: I am/we are long our "Core Portfolio" + our “Preferred Stock Portfolio” + SCCB + ECCX + GEO bond.