The More Things Change, The More They Stay The Same

Not much changes in the bigger picture. As Ecclesiastes noted, there is nothing new under the sun.

If you take the time to look back to the last time we struck a major top in the metals (2011), you will see the exact same analysts that were, at that time, claiming that we were only “getting started” with the metals rally, as they were falling over each other claiming higher targets than the next. At the time, the only argument one would see amongst them was how far beyond the 2000 level gold would rally.

Well, today, they are lining up in the same way. Many are now calling for levels well exceeding 5000 in gold and 100 in silver. But, I am sorry to note, (as we were the only ones who called both the top in 2011 and the bottom at the end of 2015), I am not seeing the targets they are presenting at this time in the same way as back then. Rather, they seem to have turned to cheerleading, with many of their followers doing the same. So, please make sure you are not turning into a cheerleader at this time.

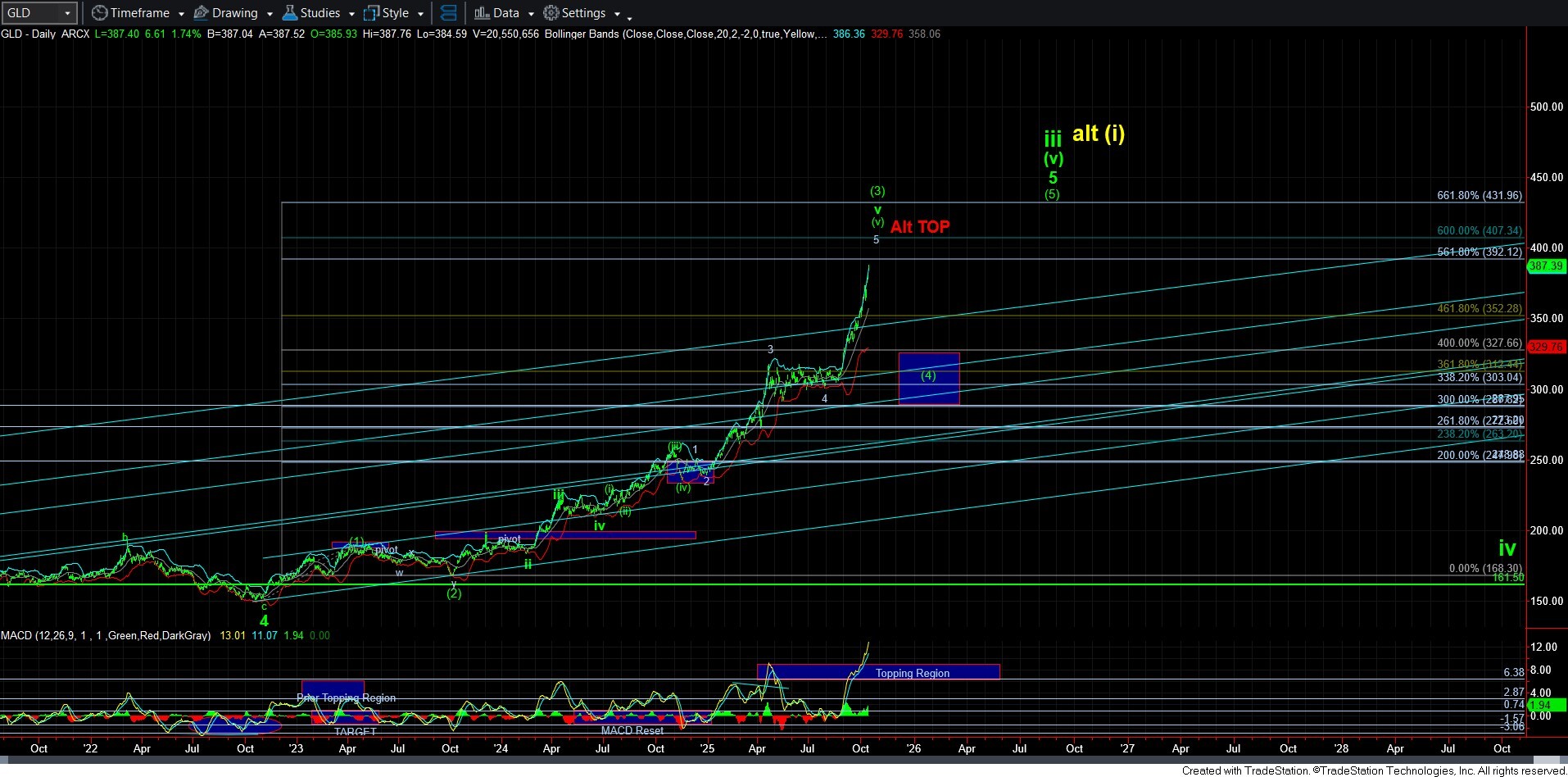

At this point in time, I would say we are well overdue for a 4th wave pullback. In fact, there is even some evidence that has developed that suggests this could be the final top we are creating in the metals complex as a whole. When I look at the MACD on the daily GLD chart, this is more typical of the blow off final top one would expect in gold. But, my primary analysis (for now) still maintains that we should see a 4th wave followed by a 5th wave before this long-term cycle completes.

Earlier this week, I said that something seems “off” in the silver structure. And, the action that developed while I was out for these last two days seems to explain what I was seeing as “off.” It would seem that the 5th wave of wave (3) is taking shape as an ending diagonal and that is why the standard Fib Pinball 5-wave structure looked “off.”

Yet, this structure has me assuming that we can still push a bit higher towards the 53-56 region to complete wave 5 of (3), followed by what will likely be a multi-week pullback in wave (4). And, I have placed a general target for wave (4) based upon a .236-382 estimated retracement of wave (3) expectation for that wave (4).

Again, based upon the 2010-2011 fractal, we can reasonably expect a multi-week wave (4) and it may only get back to the top of this target (the .236 retracement). So, if we drop down over the coming weeks to that support, along with the MACD dropping back to the BUY region or lower, then I would view that as our next buying opportunity.

Moreover, and needless to say, should we see a 5-wave decline in silver from the next top we strike, that would be a STRONG warning that a long-term top has actually been struck even sooner than I currently expect.

In gold we have seen a further extension to what I am viewing as wave (3). And, we will now need to break down below the 3900 level to suggest we are seeing the larger degree wave (4). Otherwise, if we hold the upper support box, then I will have to view the next pullback as wave iv of wave (5), and the completion of the long-term cycle.

GDX would have to see a sustained break down below the 70 region to suggest that the larger degree wave 4 is in progress. And, if it was not for the GDX, I may be more strongly considering that this long-term cycle is coming to an end now. But, since I really cannot identify a reasonable 4th wave in this structure, it leaves me wanting for a 4-5 before this long-term cycle completes.

So, even though we can see a bit higher in this immediate structure, all charts strongly suggest a sizeable multi-week correction is about to begin. So, rather than turning into a cheerleader like the rest, I have continued to reduce my positioning in the mining stocks I own in preparation for that likely multi-week correction. My own holding in mining stocks is now down to less than 20% of what I originally owned. In fact, I am fighting myself as to whether to attempt a short trade in gold right here.

Therefore, I am going to issue a warning about following or even becoming a cheerleader yourself, and make sure your risk management plan is well in place in the metals complex. The next bear market in gold will likely take us back down towards the 2000 region (and potentially below). So, please consider that in your risk management plan. And, consider this my first warning.