The Importance of Diversifying

One frequent question I get is some variation of "if you had to pick one stock...." or "if you have $X and which 3 stocks would you buy?" My answer is that I wouldn't buy just one or split some amount of money among just a handful of stocks.

Investors are often tempted to load up on "the best" stocks. If you have a portfolio of several dozen stocks, odds are that a few of them are going to underperform. Some will even be outright losers. The more stocks you pick, the more likely it is that at least one of those picks is going to perform poorly.

So investors looking at their portfolio will see the lowest performers glaring red in their account and think "What if I had only bought my top stocks?". To the extreme, what if you only bought the top-performing stock in the entire market?

Don't Let Hindsight Fool You

The inherent problem with buying only the "best" stocks at any given moment is that nobody knows which stock is going to be the best one. The best stock to buy on January 2, 2020 was Novavax (NVAX). If you had a time machine and wanted the highest possible return in 2020, with NVAX you would have gained an incredible 2,700%.

Yet who could have predicted on January 2, 2020 that COVID-19 would lead to a global race to a vaccine and a rush to invest in vaccine developers like NVAX?

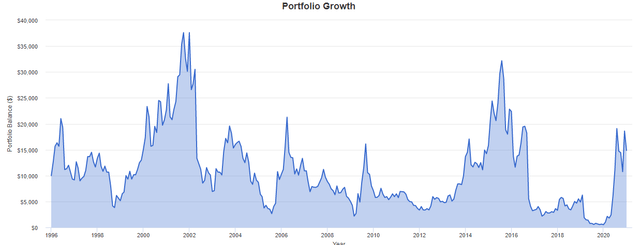

Historically, NVAX has an abysmal track record. If you had invested $10,000 in 1996, it would be worth approximately $15,000 today AFTER a 2,700% rally.

Source: Portfolio Visualizer

Source: Portfolio Visualizer

Making the decision to buy NVAX on January 2, 2020 would have hit the jackpot, but just like playing a slot machine, it would have been luck. Even those who were bullish couldn't have predicted the extent of the run-up that was only made possible by COVID-19.

We can look at the past and choose which stocks would have been the best to buy from any given point. But when we are buying today, we do not have the luxury of such a clear vision. You will always be investing into the unknown. You have to assess probabilities of what might happen, without the certainty of what will happen.

If you are investing long enough, the improbable will happen from time to time. That could be good as sometimes an investment you own will dramatically outperform your expectations. Sometimes it will be bad as some event demolishes your investment thesis.

Diversify To Protect Yourself

It is not realistic to expect that every investment you make is going to be all roses and sunshine. Sometimes events will happen that you couldn't have predicted or perhaps just considered improbable. Management teams will make poor and sometimes perplexing decisions. Market sentiment can turn negative, even if the company is posting good numbers. Sometimes, and I know this is hard to believe, you will simply make a bad investment. It happens.

By diversifying your income stream so that you are getting dividends from at least 40 investments, you can protect yourself. If you have 3 investments, and one of them cuts their dividend by 50%, that substantially reduces your income. If you have 40 investments and one cuts its dividend by 50%, it has little impact on your overall cash-flow.

When you need an income stream for retirement, having a diversified portfolio with income coming from different sources will provide you with stability. With $0 commissions now prevalent, it is possible to achieve substantial diversity even with small amounts of capital. Over the short-term, any number of high fliers will outperform a well-diversified portfolio. Over the long-term, a diversified portfolio will build wealth methodically and provide great returns with far less risk.