The Global Story...

For a number of years, we’ve been tracking oscillating social mood qualities on a daily basis for the United States. Because the themes in topics people are collectively focused on (per top internet search trends), precedes general themes in the news and even the markets, this has allowed us to spot significant upcoming shifts in the news cycle and at times has alerted us to certain types of events to anticipate. Recently, a similar project has begun watching several other countries to see what can be learned regarding the Global Story…

General Context

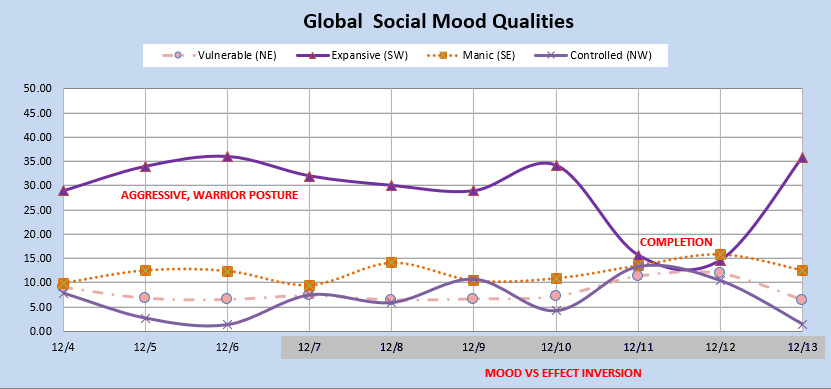

Through early last week, the overall Global mood continued to show as “Aggressive, Warrior Posture,” well reflecting the global battles being waged at the World Cup in Qatar in conjunction with a willingness to fight for what’s important in various locations. Slightly less than 1/3 of the time, an inversion occurs where the mood detected from source data internet search themes leads to an opposite effect in observed themes in the news as well as the way our market models behave. Such an inversion was detected starting around 7 December. Following this, a phenomenal shift was observed in news out of China as well as Russia-U.S. negotiations. Around 11-12 December, a completion pattern alerts that a chapter is finishing up in the global story. Oddly, what’s so far emerging for the 13th looks very similar to what came before. It’s particularly interesting that on the 13th, the data from all five countries being tracked once again appear to more or less align with the global pattern.

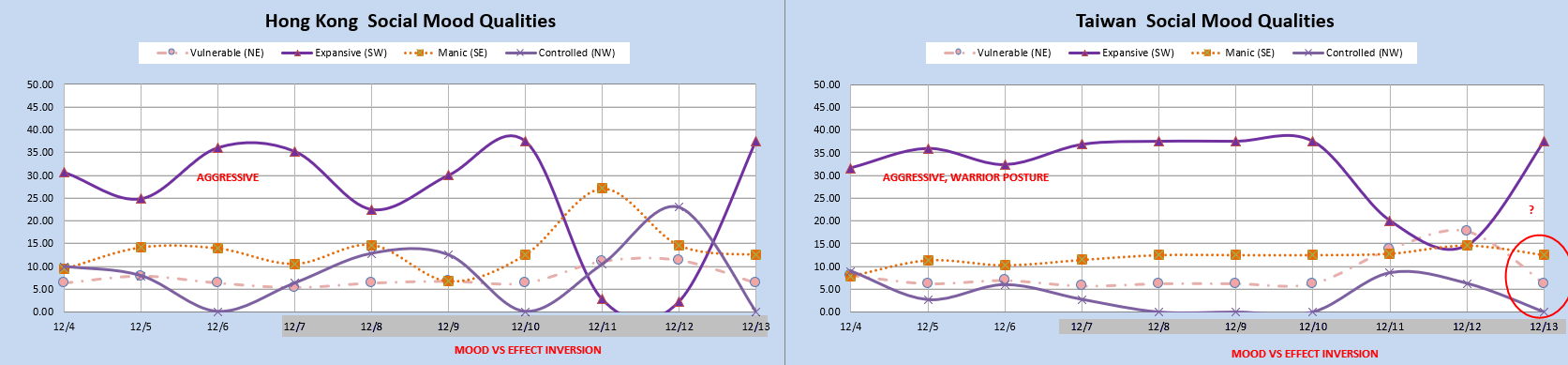

China

The best information we have at this point for China, comes from a combination of Hong Kong and Taiwan data. The Hong Kong patterns tend to reflect mainland China news themes better than those from Taiwan. As the mood vs. effect inversion took place around 7 December, the Chinese government announced some modifications to their Covid-19 protocols. There was no noticeable shift in the Taiwan pattern as the primary coherent focus of internet trends continued to be the World Cup. However, there is a marked shift observable in the Hong Kong (and assumed mainland China) mood pattern to something not yet clearly definable, as people and government sort through all the changes and what they mean. The circled area in the Taiwan chart for the 13th is very similar to a crisis pattern, but not exactly. It may be implying an acute period of economic or governmental turbulence.

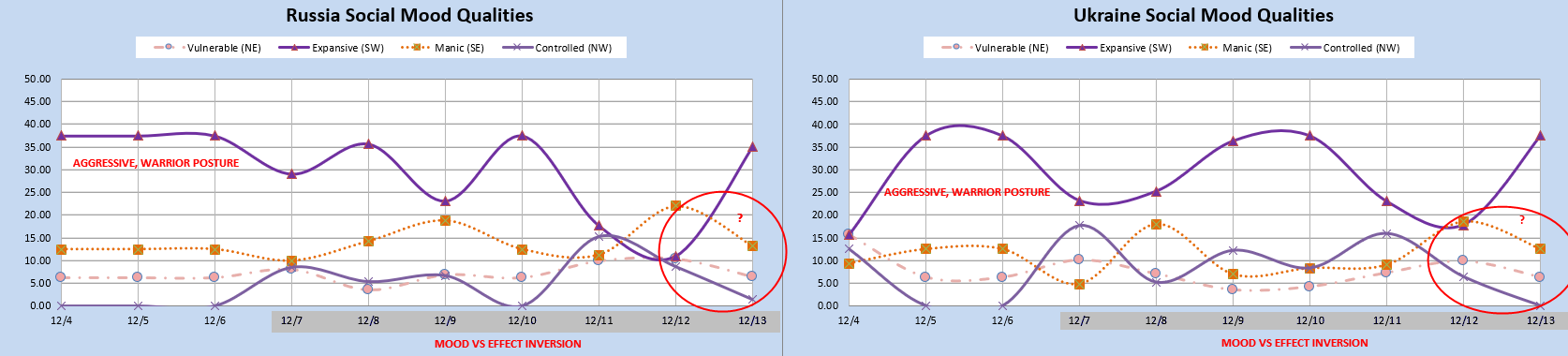

Russia-Ukraine

The most notable thing so far to come out of the recent inversion in this arena is the successful conclusion to Russia-U.S. negotiations that led to the release of Brittney Griner. The specific patterns during this inversion period and their potential meaning are not very clear through the 12th. For the 13th, there is a configuration very similar to a crisis pattern showing for both Russia and Ukraine implying a possible brief period of economic or governmental turbulence.

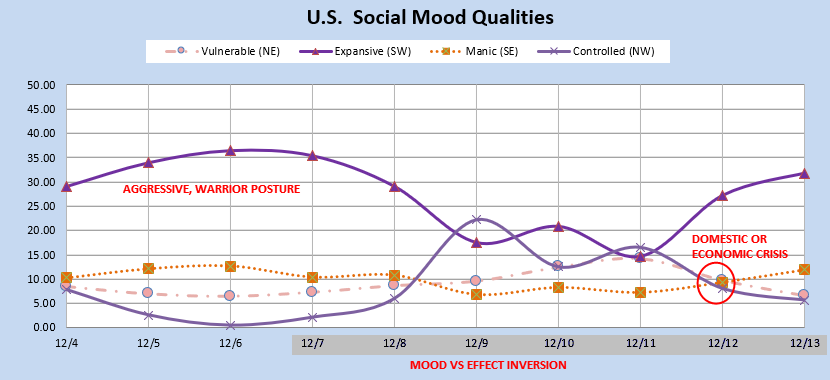

United States

Several source countries have shown something similar to but not quite a full-on crisis pattern on the 13th. There is specifically a crisis pattern appearing in the U.S. mood qualities on 12 December which would be anticipated to show itself in the news cycle in some manner on the 12th or 13th. While this pattern can reflect a systemic or global event, it seems to be primarily highlighted in the U.S. chart. It’s possible that what has been seen on the other charts for the 13th are “echoes” of what takes place on the 12th related to the United States, but that is yet to be seen.

In our daily market reports, we have noted a “Sharp Drop Alert” through Monday informing readers that while this is not considered a “sell” signal, there is an elevated chance of increased volatility through Monday and for a larger than what has been the recent norm of daily market moves lower. It should be also noted that because the weekend pattern is "undefined," it's unclear how markets are likely to open on Monday or how Monday might close relative to Friday's close.