The Global Story - Market Analysis for Dec 2nd, 2022

The Global Story

For a number of years, we’ve been tracking oscillating social mood qualities on a daily basis for the United States. Because the themes in topics people are collectively focused on (per top internet search trends), precedes general themes in the news and even the markets, this has allowed us to spot significant upcoming shifts in the news cycle and at times has alerted us to certain types of events to anticipate. Recently, a similar project has begun watching several other countries to see what can be learned regarding the Global Story…

General Context

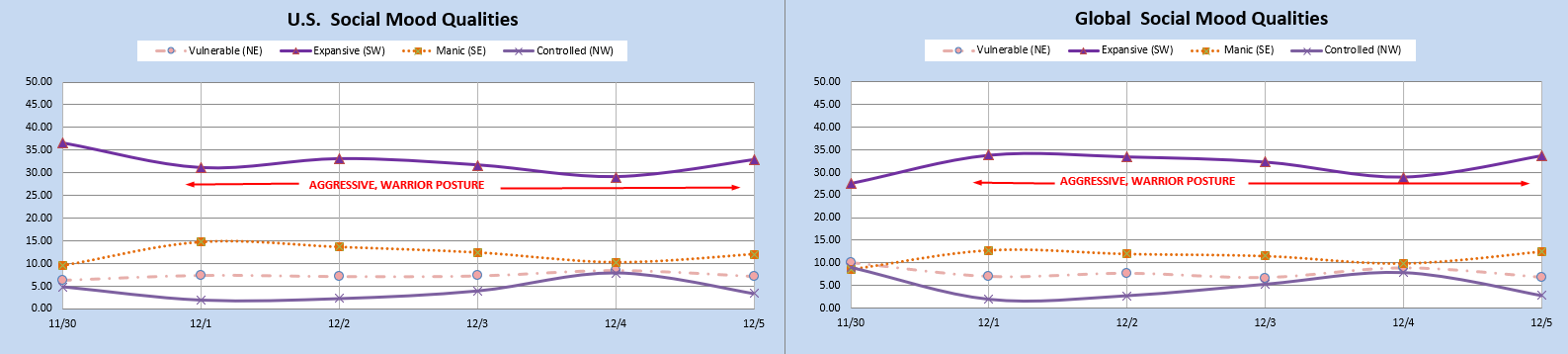

While the overall Global mood is currently showing as “Aggressive, Warrior Posture,” this well reflects the global battles being waged at the World Cup in Qatar. This is the background focus of the world as a whole and is reflected in the primary internet search trends in the data of all currently observed source countries.

China

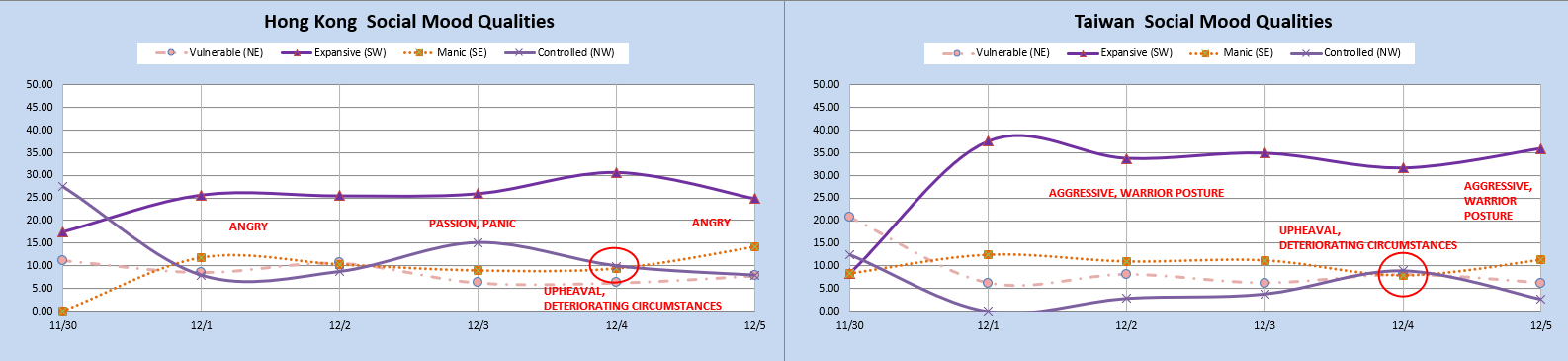

The best information we have at this point for China, comes from a combination of Hong Kong and Taiwan data. A few days prior, we noted that 30 November stood out as an “abrupt change” pattern in the Hong Kong data signaling a potentially serious event. It was also noted on 29 November that the next market close might give us a clue as to whether the fallout from this would be positive or negative, since preliminary models were showing the market direction for both the Hang Seng and TAIEX to continue in the same direction on the first of December as they did on the last day of November.

While not specifically mentioned, our primary concern was that a reenactment of the Tiananmen Square tragedy might be about to take place in conjunction with the abrupt change/serious event indication. What did happen was that the market closed reassuringly positive on the 30th and then continued up on the 1st of December in alignment with our models. Also, a somewhat positive Chinese government response was observed on the 30th, in that it at least signaled a willingness to move in a direction of less strict protocols. That also appeared to continue into the 1st. Concurrently, a serious event did occur in the death of a previous Chinese president, Jiang Zemin on 30 November.

In the coming weekend, there is a subtle shift from the background angry/aggressive mood detected for China. On Saturday, the mood pattern for Hong Kong, which has been more reflective of mainland China than Taiwan, is showing a raised potential for heated emotions. On Sunday, the mood pattern for both Hong Kong and Taiwan reflects a crisis or the perception of deteriorating circumstances. It should be noted that this is not necessarily reflective of a China-local crisis but could be related to international or global events. Because this crisis pattern is not showing in the data outside of China, nor in the Global composite, this is more likely reflective of events either in China or nearer to China relative to the rest of the world.

Russia-Ukraine

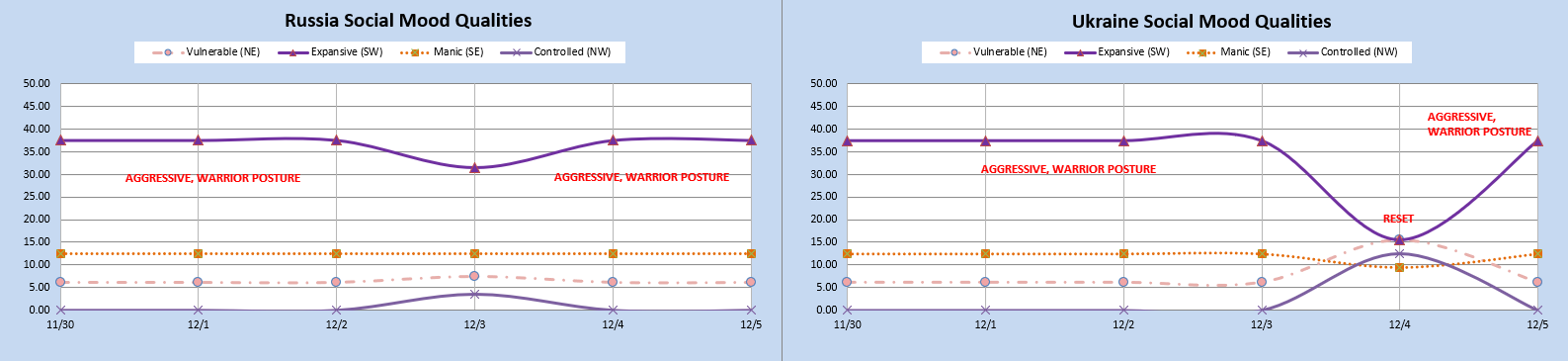

There is an interesting pattern shift this weekend from the global background showing for Russia and Ukraine. In spite of an actual war going on, the people of both countries have also predominately demonstrated a primary internet search pattern related to the World Cup games which happens to reflect a battle-oriented social mood. Because of the sensitive nature of a war in progress, I don't want to comment much, but I will say that I find it somewhat encouraging (albeit as much as can be with a war going on) that the charts imply a back to business as usual by Monday.

U.S. and Global Composite

The charts below reflect the predominate World Cup focus in the U.S. as well as in a Global composite picture of all five data sources, equally weighted. The U.S. and the world as a whole are ready to fight for what matters most. Hopefully, much of that stays confined to the battleground of the soccer fields.