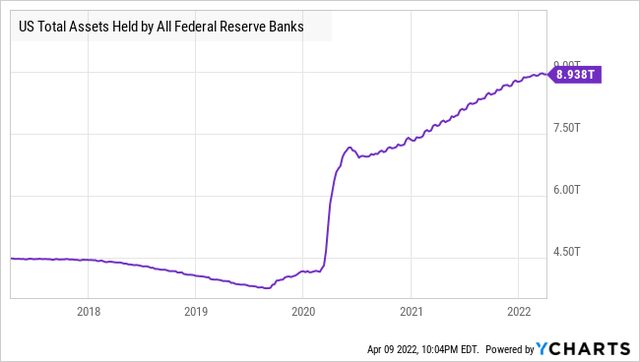

The Fed's Balance Sheet

The Fed released its minutes on Wednesday, which telegraph the Fed's plan for reducing the balance sheet. We've highlighted the Fed's balance sheet numerous times in the past. It is currently just shy of $9 trillion. Nearly double its pre-COVID record. The Fed failed to significantly shrink its balance sheet after the Great Financial Crisis. This is new territory for everyone, nobody has ever seen the Fed's balance sheet this large.

The Fed continues to be very cautious. The big plan is to shrink the balance sheet by allowing Treasuries and MBS to "run-off". Currently, the Fed reinvests 100% of the principal when its investments reach maturity. They will set a cap that limits the amount of principal that will be allowed to run off at $60 billion for Treasuries and $35 billion for Agency MBS.

This means, at most, the Fed will allow $95 billion in principal to mature each month. At that pace, it would take about 4 years to get to pre-COVID levels for the balance sheet. It would actually take a bit longer as agency MBS likely will not see $35 billion/month in repayments. There was $42 billion last month, and with mortgage rates climbing we can expect prepayments to slow down considerably going forward.

Some in the market were fearing that the Fed would just dump assets into the market and flood it with supply. Clearly, that is not going to happen. This Fed remains very cautious and is making changes one step at a time. Taking a step, checking the temperature, and then making another one.

In the past, the market has been surprised by sudden and unexpected moves from the Fed. It is clear that this particular Federal Reserve Committee is highly averse to making sudden changes.

What To Expect Next Meeting

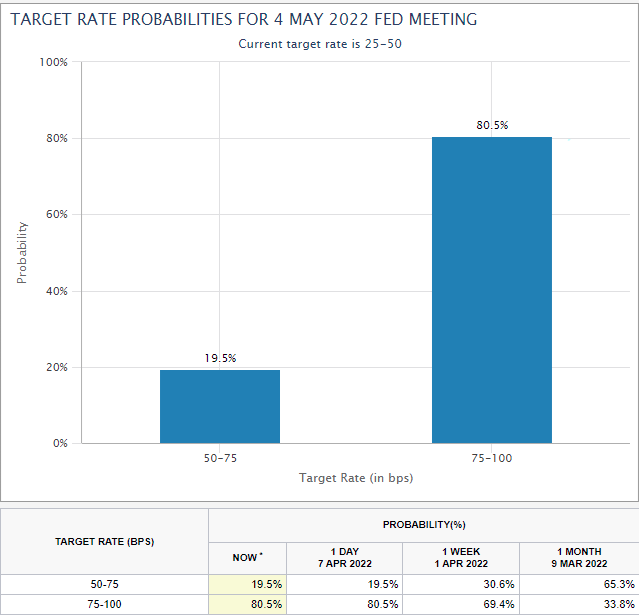

We are about a month away from the next Fed meeting. The prior dot-plot from the Fed implies that we should expect another 0.25% hike in the target rates. Yet the futures market is currently predicting an 80%+ chance that the Fed will raise 0.5% at the next meeting.

CME FedWatch Tool

The minutes provide little insight on this issue. The minutes report that

Many participants noted that one or more 50 basis point increases in the target range could be appropriate at future meetings, particularly if inflation pressures remained elevated or intensified.

This implies that a 50 bps increase might be in consideration. However, the minutes also describe the number of members who wanted a 50 bps raise at the last meeting as "many". On this issue, the Fed appears to be divided, with the more Dovish members winning out in the last meeting. This month's inflation data might make the difference in whether we see a 0.25% or a 0.5% hike next month. Whether or not Biden's nominees are confirmed by the Senate before the next meeting could be a major factor as well.

What does this mean for us? Let's take a look at some of the areas we want to invest in.

HDI, a service at EWT designed for income investors and retirees, offers a “model portfolio" targeting a yield of +9% Learn more here.