The Case For Small-Cap Value Stocks

At HDI, we have been positioning our model portfolio to maximize our exposure to stocks that would strongly outperform in an economic environment shaped by the following forces:

- A high inflation cycle.

- Strong economic growth, and even a "red hot" economy.

- Mildly higher but historically low-interest rates.

- A highly liquid environment with a "bubble of cash" on the sidelines.

The above forces strongly favor "value stocks," and, in particular, medium and smaller-cap "value stocks" that are economically sensitive.

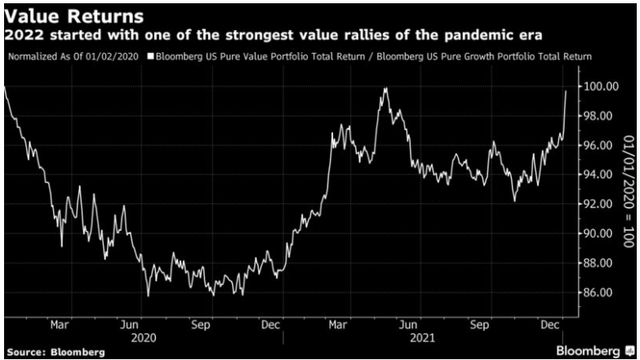

Historically, higher inflation and faster rate hikes will benefit value stocks, while mild inflation and declining rates could favor growth stocks. This pattern was evident during most of 2021 and will be more pronounced in 2022.

In November last year, we saw an underperformance in the value sectors, which opened the door for some great buying opportunities. We quickly called for our members to "buy the dip" and lock in the high yields offered by the markets! Still, 2021 was a great year for value stocks, and the beginning of 2022 looks very promising!

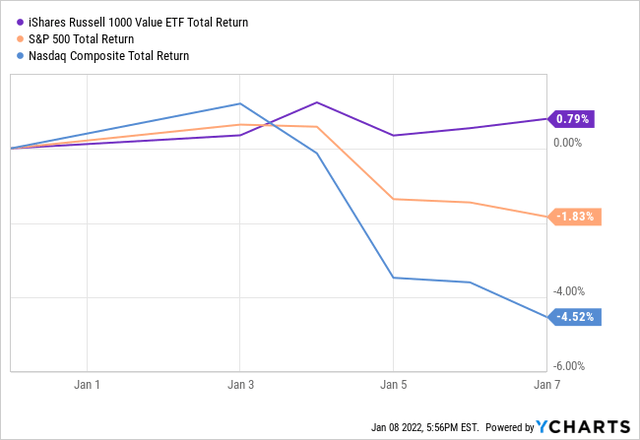

With that we are in the first week of trading for the year 2022, a new rotation has started, with the Russell 1000 Value ETF (IWD) -- which correlates most strongly with the HDI model portfolio -- seeing significant outperformance, and with the S&P 500 pulling back and growth heavy NASDAQ dropping fast.

This is directly caused by the rotation from Growth to Value that we have been talking about and especially strong performance from small to mid-cap Value stocks.

Quite a few of our HDI positions saw a huge rally, especially in energy – notably Oxford Lane Capital (OXLC), Antero Midstream (AM), Global Partners (GLP), and Blackrock Energy & Resources Trust (BGR) all up more than 5.5% last week.

Our portfolio was weakest among REITs as we saw profit-taking from last month's run-up. This sell-off was likely in reaction to Treasury rates going up, which many Wall Street traders use as a signal to sell equity REITs. This impact is usually brief and is a buying opportunity, especially with Q4 earnings and 2022 outlooks expected to be very strong.

It seems that investors are finally realizing that inflation is here to stay and even treasuries started to notice. We saw the 10-year Treasury yield rise to 1.76%, matching the highs of 2021. This triggered profit-taking on high growth and big tech stocks.

Growth and technology stocks tend to lag during periods of rising interest rates. In fact, it was reported by Goldman Sachs this week that Hedge funds have begun the new year by ditching software and chipmakers at a furious pace. During the four sessions through Tuesday, those sales reached the highest level in dollar terms in more than 10 years, according to Goldman Sachs. The U.S. Nasdaq 100 dropped more than 3% on Wednesday, its worst day since February of last year.

The rotation from Growth Stocks to Value Stock is a welcome development in a bull market where a handful of tech giants have increasingly dominated equity gains, leaving the market vulnerable to company-specific risks. Broader participation in the equity markets is also good news. I expect that the rotation to Value stocks is a trend that will continue throughout the year.