The BNB Token - Market Analysis for Jul 20th, 2019

In the article ‘Crypto Biz Models’ I discussed how cryptocurrency was challenging classical business models, as well as the means by which one evaluates an investment. The decentralized nature of cryptocurrency forces a different lens by which we view fundamentals. As I said in this article, I am not cheerleading. I am not touting that this ‘different model’ is also ‘good’, only that norms are challenged. I believe it will take many years for us to know whether decentralized business models will live or die. Further, I expect the lines of what is considered ‘crypto’ blur. We’ll see ‘partially decentralized’ assets as well as fully centralized assets like Facebook’s Libra inhabit blockchains. This will cause confusion amongst the less well read and less tech savvy investors in the space.

Introducing BNB

One of the strongest ‘alt coins of this year has been Binance coin (BNB). Since the December bottom in this year’s bull run, it has outrun Bitcoin. Few coins have. Fans of BNB argue that strong fundamentals underpin this run. The Binance coin, which was issued by the Binance exchange has two benefits to holders:

-

Holders of BNB on Binance exchanges can elect to use BNB to pay commissions. When they do they receive a 25% discount.

-

Binance agrees to use 25% of trading profits to ‘burn’ BNB supply until 50% of the original 200 million remain, resulting in a supply of 100 million BNB.

Therefore, holders of BNB receive a ‘utility’ in the discount trading on Binance.com or the Binance decentralized exchange. And, they participate in the profits of Binance, indirectly, through the burning of supply. The latter benefit is much like a successful publicly traded company buys back shares.

From a fundamental perspective, I see more both of these benefits as a legitimate reason to hold BNB. However, the supply constraining effort of burning, comes without the transparency you’ll find, as required, of publicly traded company. The information asymmetry involved in buying BNB is much akin to buying shares in a private LLC or silicon valley startup. Binance discloses how many BNB will be burned each quarter, but not its overall balance sheet and profits. That is left to trust.

Further, BNB lacks the decentralization of other cryptocurrencies. Binance controls the BNB token, not a community of holders, and not a small group of miners or block producers. Only Binance. While this is of little value to many, cryptocurrency enthusiasts, like myself, consider decentralized a value. Decentralization is a reduction in counterparty risk, as discussed by previous articles.

Perhaps Binance could introduce a transparent approach to centralized crypto by reporting company profits and ‘burn funds’ on the blockchain. The idea is at least novel, and I’m sure some crypto companies may try it.

BNB is only ‘crypto’ so far as its ledger is transparent and transactions are transmitted via blockchain. But its similarity with cryptos like Bitcoin stops there.

Regulatory Concerns

The SEC has been actively classifying cryptocurrency along two lines: utility vs. security. And, taking action on companies that release coins they deem ‘securities’, that have not been registering them. The dividing line is based on the Howey test. If I wear my ‘SEC glasses’ my personal belief is that the BNB is a security token. Thereby, I will be surprised to not see SEC action against Binance.

Binance has already been under pressure from US regulatory oversight, and announced, come September, that Americans will not be allowed to trade on Binance.com but a new site, Binance US, will be launched through the help of a partner. This site will have all users ‘KYC’d’ so their identities will be tracked. And, no securities tokens will be offered. I am not clear what that mans for American access to BNB tokens.

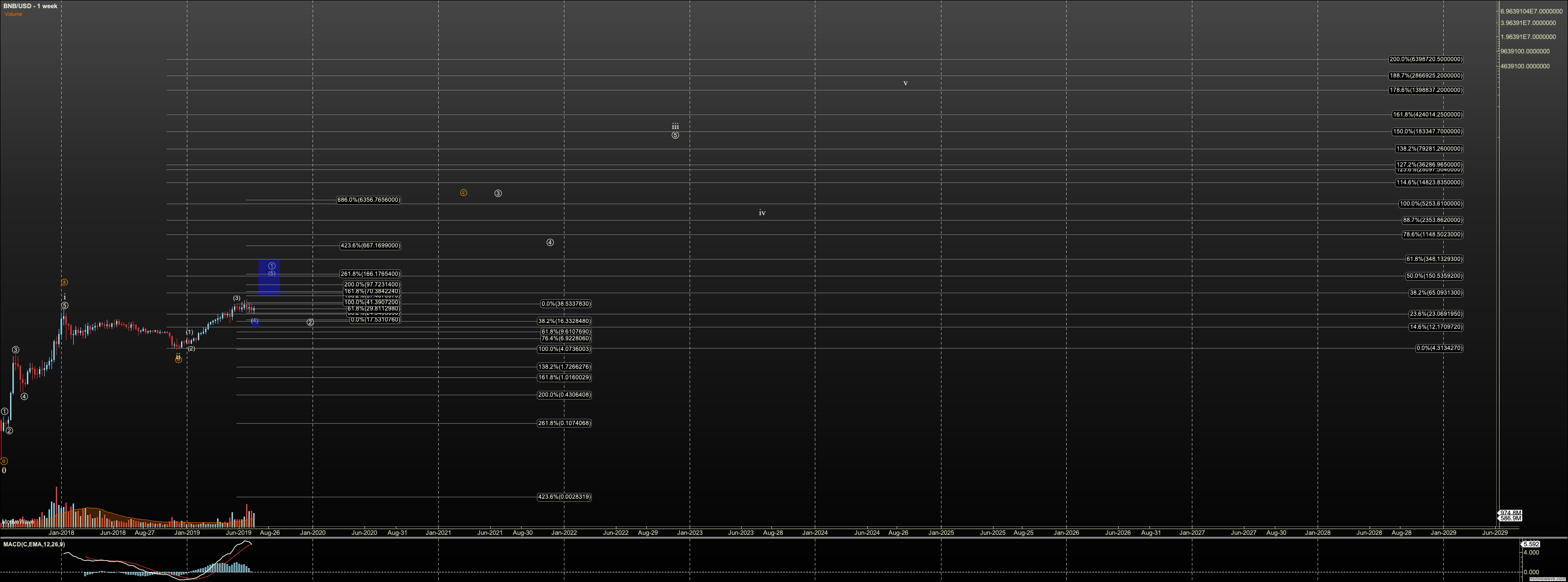

Elliott Wave Perspective

From a chart perspective, I consider the chart of BNB very bullish as you’ll see. Note my projections are a bit on the wild side as is typical when applying Ellliott Wave analysis to this volatile asset class. Many of my charts have played out ot targets, particularly in 2017. But as I advise, playing for long term targets, without being concerned about daily movements may result in being caught in a breakdown. That said, I am looking for a top in BNB near $65 with a small chance of seeing $150 before a deeper pullback. How it handles the coming pullback will tell me whether the long term chart is likely to play out or not.

I would say fundamentally, I would say these targets are possible if Binance continues to be one of the most popular crypto exchanges, and as the overall adoption of the space grows. But both are just 'ifs'.

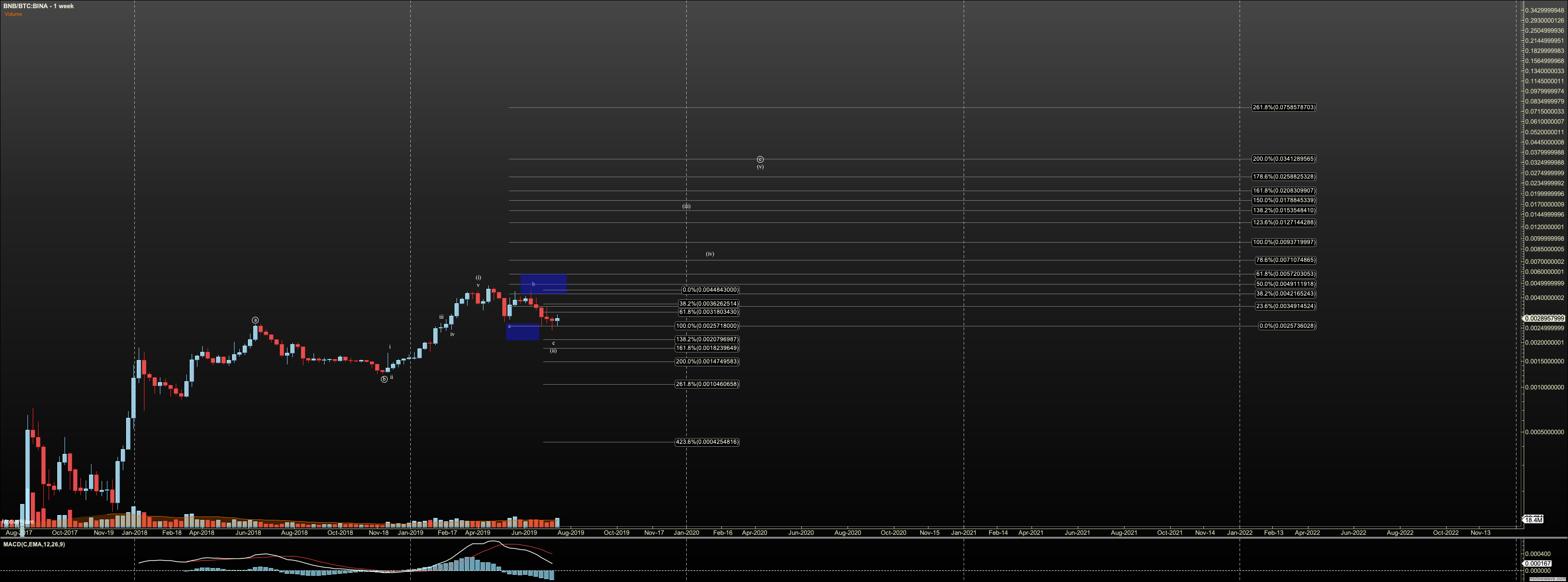

I’ve also shared the BNBBTC chart (BNB traded in Bitcoin basis) which suggests outperformance of BNB for the time being.

In conclusion, I wanted to share a quick example of a crypto company that has built a seemingly successful token model. This model mixes cryptocurrency function with characteristics of a security in a private company, while being ‘publicly’ traded globally. This presents a very interesting challenge for users of the token, and investors expecting a return from holding.