Tesla: Will This Taxi And Launch?

By Levi at Elliott Wave Trader; Produced with Avi Gilburt

In recent memory, TSLA stock is one of the greatest case studies that strongly affirms the effect sentiment plays across the markets. Now, granted, this is the subject of some debate, at times heated, in the world of fundamental analysis versus technical analysis. However, we say, “Why not use both?”. And that’s exactly what we do in StockWaves.

Let’s not wade into those muddied waters where the war of words rules. Instead, please allow us to share with you what method of analysis works for us and why. First, we will take note of some updated comments from our lead fundamental analyst, Lyn Alden. Then we will show just how we navigate the sea of sentiment no matter which way the winds blow.

What Is The Fundamental Snapshot For Tesla?

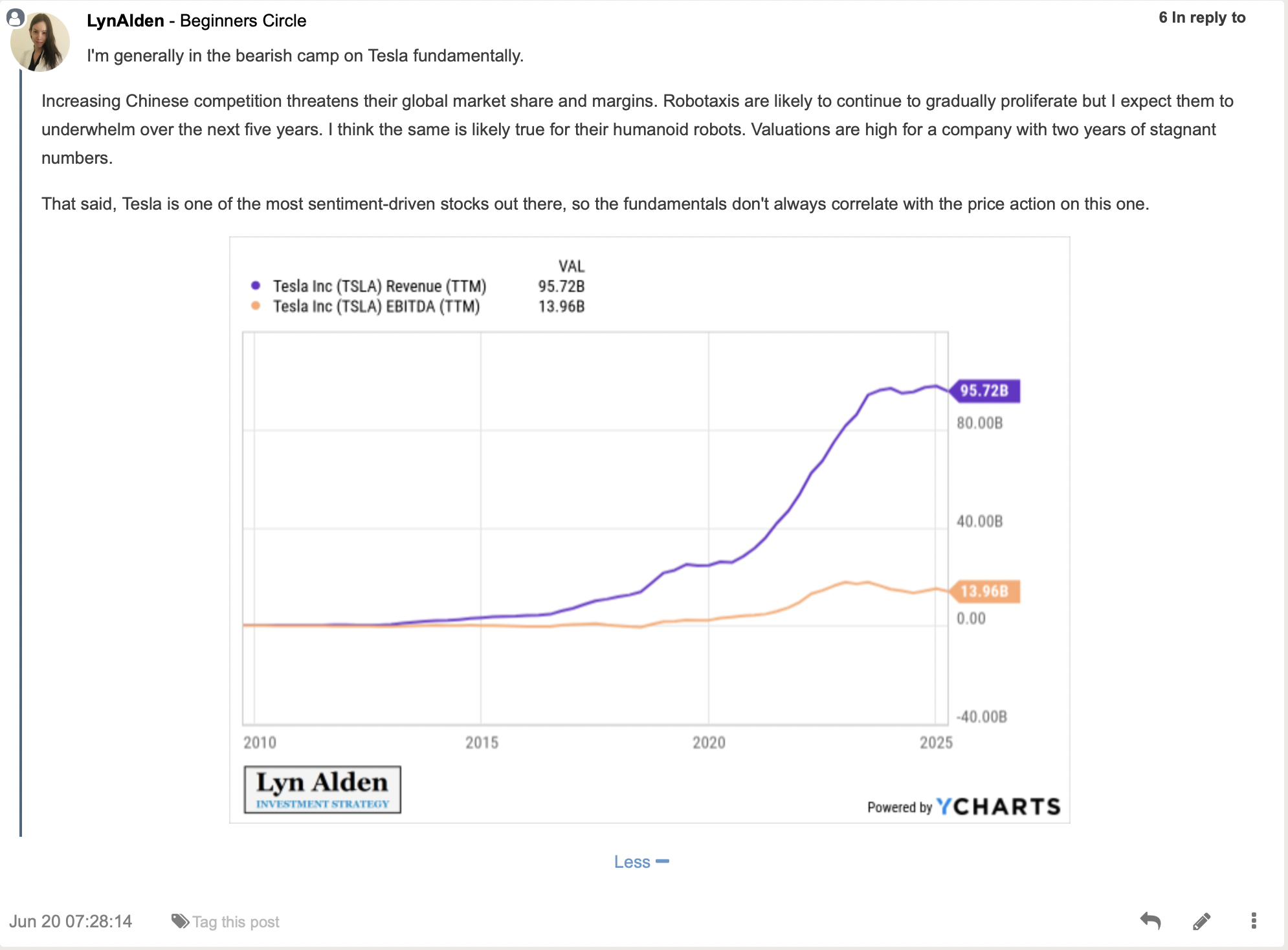

We highly esteem Lyn’s comments and conclusions regarding the macro economic picture, as well as company specific information. It is of particular interest to note her ending deduction as to what is driving TSLA stock.

Take note of Lyn’s comment at the end:

“Fundamentals don’t always correlate with the price action”.

That is particularly poignant for us. Why? Many in the investment world apply fundamentals to guide their decisions. It’s a narrative that they seek to grasp onto and use to direct commitment. How do we use Lyn’s conclusions then?

Especially in TSLA stock, we must look to crowd behavior and how this very movement can actually be tracked and projected in an efficient manner. Would you like to see how and why this consistently works? What’s more, we have quite a long track record of successfully analyzing TSLA, as well as hundreds of other tickers. The results are readily available to any that would like to review past charts and projections given ahead of time and then followed by their respective outcomes.

Let’s First Lay The Groundwork

What is all this sentiment “nonsense”? We’ve seen our work called “hocus-pocus,” “mumbo-jumbo,” “reading tea leaves”. . . as well as a few other choice phrases. But what the detractors leave out is the results. Perhaps we mock what we do not understand?

Here is a brief excerpt from an article that Avi Gilburt wrote regarding sentiment (crowd behavior):

"Elliott theorized that public sentiment and mass psychology move in 5 waves within a primary trend, and 3 waves within a counter-trend. Once a 5 wave move in public sentiment has completed, then it is time for the subconscious sentiment of the public to shift in the opposite direction, which is simply the natural cycle within the human psyche, and not the operative effect of some form of ‘news’.

And, in 1940, Elliott publicly tied the movements of human behavior to the natural law represented through Fibonacci mathematics. Therefore, these primary trend and counter-trend movements in the market generally adhere to standard Fibonacci extensions and retracements.” - Avi Gilburt

Now, before you throw shade at the light, just let this marinate for a minute. It was these very movements that helped in the development of what we lovingly call “Fibonacci Pinball.” Basically, this is the seemingly orderly movement of a stock or market as its structure unfolds before us.

And, we see this “Pinball” displayed day after day in our trading room. In fact, we will track the Elliott Wave structure live and show our members key turning points, resistance, and support levels throughout the day. It is not a one-off. This has become our preferred way of tracking and trading the markets. Why? Because it works!

Not all paths will play out as illustrated. We view the markets from a probabilistic standpoint. But at the same time, we have specific levels to indicate when it's time to step aside or even change our stance and shift our weight.

How We Apply This To The TSLA Chart

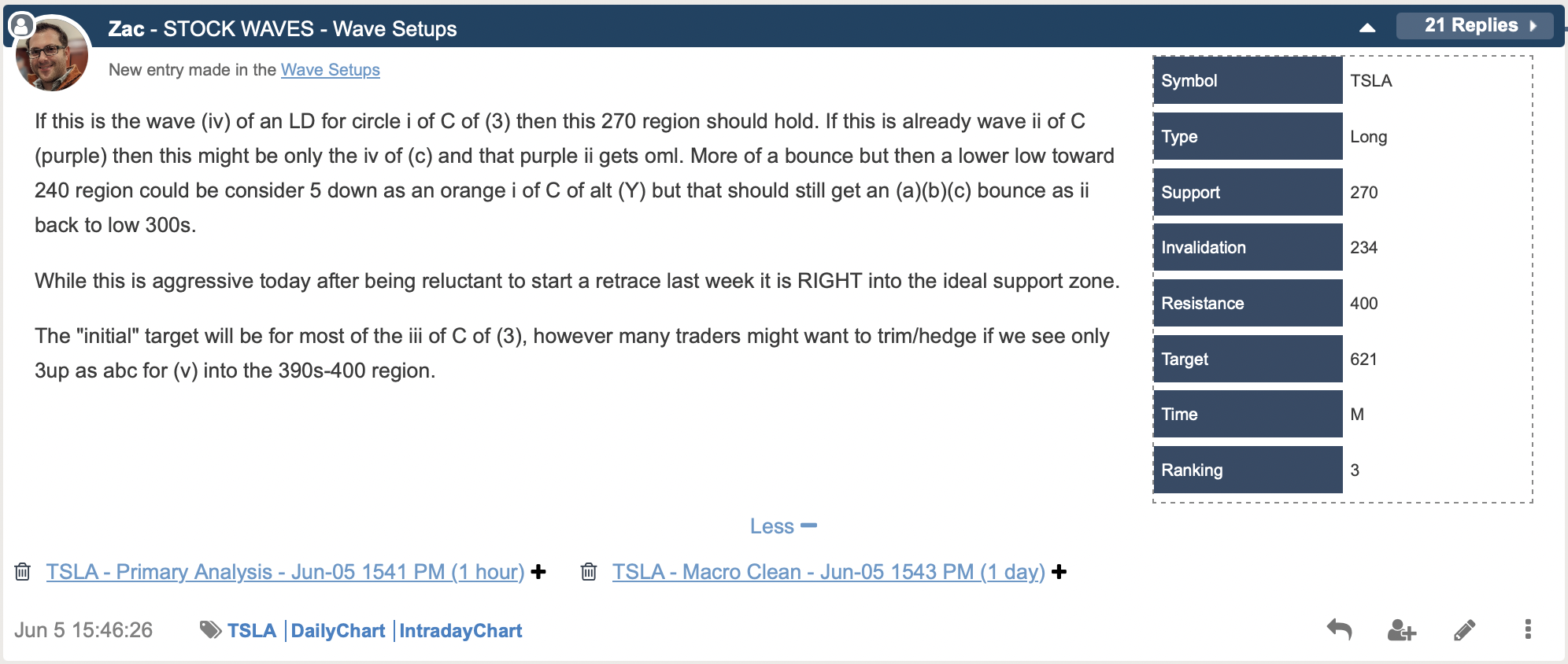

Zac Mannes is keenly focused on TSLA movements in the micro as well as the macro views. It is the context of the larger structure that helps guide what is most likely to happen next. Then, the near term smaller subwaves help fill in details for shorter term traders or for those seeking a new setup in either bearish or bullish scenarios.

Our latest official update to our Wave Setups feature was published right as TSLA was striking its last low. Here is that post from June 5 - quite timely!

So from this possible entry for some at that $273 area, what is most likely next? As a refresher, here is Zac’s latest daily time frame chart that shows the bigger picture projection with the probable path.

The hourly chart has our attention at the moment.

In the near term it would appear that we have a setup to reach the $346 area next. From there, we will closely track the subwaves of any pullback that materializes. As well, please keep in mind the specific price parameters shared in the Wave Setups table shown above.

As more data fills in the chart and targets or key price levels are fulfilled, then this ongoing Wave Setup will be updated accordingly.

Conclusion

Sentiment is simply human behavior, which is not logical or reasoned, in motion via the price of the stock or the index being analyzed. If TSLA trades mainly on sentiment, then how would it be possible to track something that irrational in any reliable fashion?

This is precisely why Elliott Wave Theory, when correctly applied, can help bring some structure to an illogical, emotional environment. There are some important and, for lack of a better word, fundamental guidelines that we must employ to understand the structure of price.

Yes, there are nuances to the analysis. Once familiar with our methodology, our members discover a powerful ally on their side to provide guidance and risk management in their trading/investing.

Many ways exist to analyze and track stocks and the market they form. Some are more consistent than others. For us, this method has proved the most reliable and keeps us on the right side of the trade much more often than not. Nothing is perfect in this world, but for those looking to open their eyes to a new universe of trading and investing, why not consider studying this further? It may just be one of the most illuminating projects you undertake.