TSLA: In A Holding Pattern. Or, Something Else?

Tesla is one of the most sentiment-driven stocks that we track.

Fundamentals do play a role and we do discuss these below.

What are the nuances to our methodology and how can they help you trade Tesla on a short term basis?

by Levi at Elliott Wave Trader; produced with Avi Gilburt

What does that even mean, “sentiment-driven”? We’ll get into that. We also see a much better long-term entry point for those so inclined. What role do fundamentals play in (TSLA)? As well, we’re going to analyze the nuances to our methodology. Put simply, it’s not just Buy / Hold / Sell. Yes, those are the three options we are given here to “rate” a stock, but there’s much more to it. Let’s go!

The Fundamentals With Lyn Alden

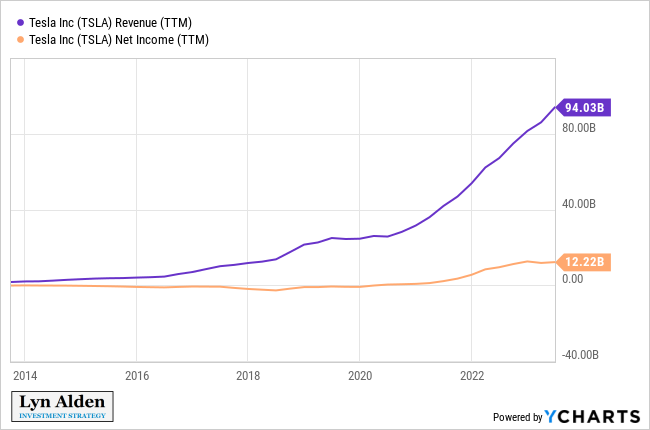

“I continue to view TSLA has having an unattractive risk/reward setup from a fundamental point of view.

While the company enjoys strong revenue growth, pricing cuts and other issues are providing some headwinds to their profitability. The company's gross margins are down over the past year.

At this high valuation, there is little margin of error and a lot of growth priced in. Back when interest rates were zero, investors were willing to pay up for companies with rapid top-line growth and dubious profitability, but in a world of persistently higher costs of capital, investors have safer alternatives, and tend to scrutinize fundamentals more closely.

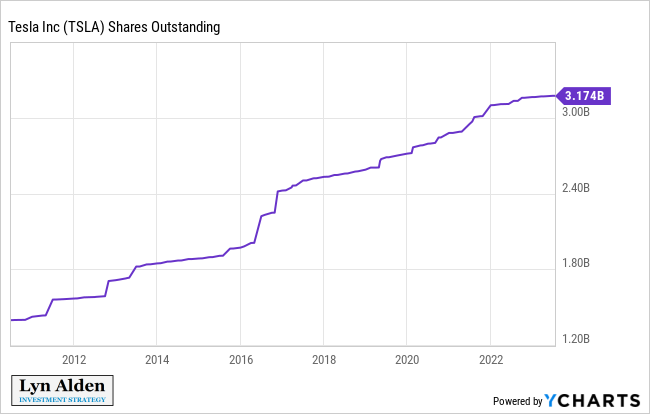

Tesla has historically been a constant issuer of new shares in order to fund its operations. Indeed, Musk's ability to sell a vision has helped the company transform from one that was at one time at risk from its debt, to having a strong balance sheet thanks to so much equity issuance. However, going forward that rate of new equity supply may be harder to pull off, and the company faces the risk of being valued more in line with hardware companies.”

The Technicals With Zac And Garrett

These are our lead analysts at StockWaves. You can see in this moment they are both in lock-step with their view on (TSLA).

In chatting with Zac while discussing the current outlook for (TSLA), we gleaned the following comments:

In chatting with Zac while discussing the current outlook for (TSLA), we gleaned the following comments:

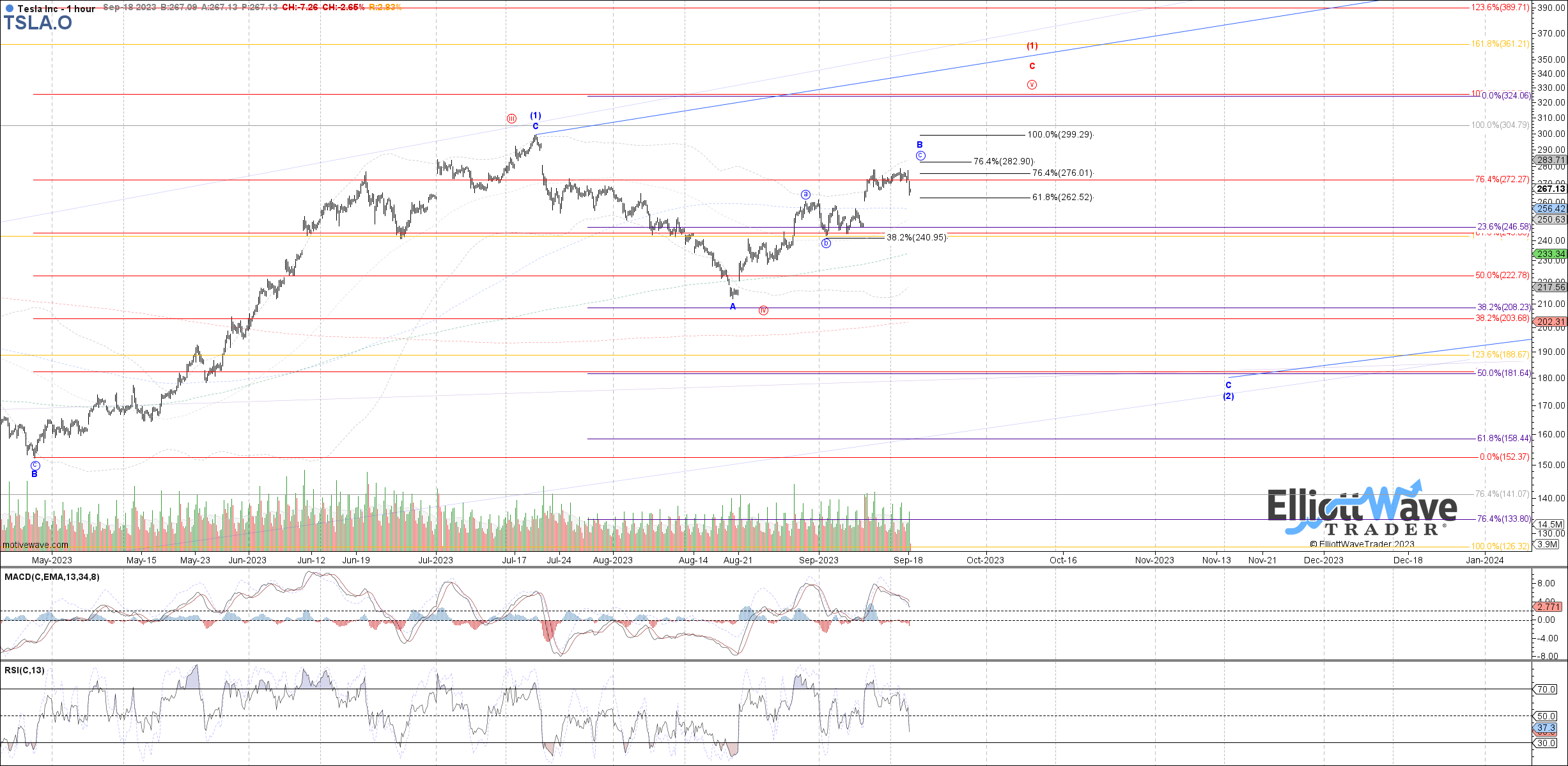

“The current system does not allow for our nuance... I would say that TSLA is a larger degree sell with possible scalp opportunity from a retrace holding $230’s.

“The limitations of the Seeking Alpha rating system mean that we need to give it a "hold" rating here, but there is a tradeable potential for another nice move higher should support hold. MOST longer term investors will want to be raising there stops and preparing for a better L/T buying opp in the 180-150 region ideally.”

Risk: should price break above the recent high of $299 then as high as $326 is possible is an extension of the current wave [1] we are tracking.

A typical comment from those not familiar with our methodology could be something like,

“You are just throwing spaghetti against the wall and seeing if it sticks.”

Well, speaking of spaghetti…

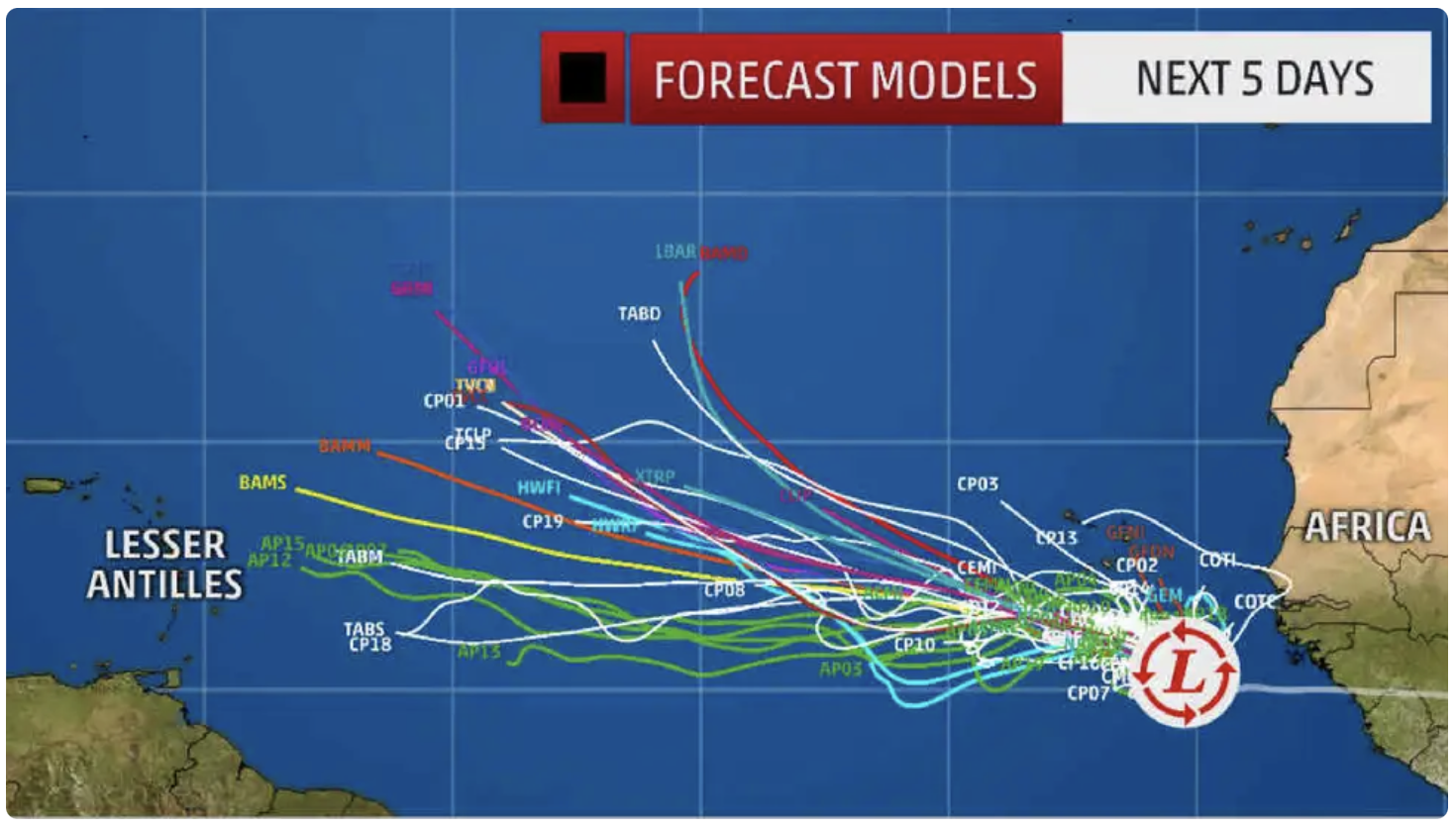

Enter Hurricane Models

In a search for some similar form of analysis, I came across how scientists track and project the path of hurricanes. Have you ever seen what is colloquially referred to as the “Spaghetti Model”?

When a hurricane is in its initial development phase, there are multiple upon multiple paths that it can follow. These paths are typically whittled down as the storm further shows its form and the past track. And, when the storm is even closer to land, scientists typically can predict with surprising accuracy the path and magnitude.

When a hurricane is in its initial development phase, there are multiple upon multiple paths that it can follow. These paths are typically whittled down as the storm further shows its form and the past track. And, when the storm is even closer to land, scientists typically can predict with surprising accuracy the path and magnitude.

There is a similarity to this type of forecasting. True, we are dealing with nature in motion vs human behavior. But the comparison of the multiple paths possible at initiation is similar to what we track via Elliott Wave theory.

With this in mind, you will then see that, like nature, human behavior is not as simple as Buy / Hold / Sell. Why is that? Because of what we refer to in our ‘Risk Management Caution’ letter to our members (it is shown in its entirety below).

“…markets are a fluid, dynamic, non-linear system”.

In human behavior, once certain levels via price are attained or lost, it will typically set off a chain reaction of sorts that will lead to a larger move in the path of the stock or the market itself.

These are the nuances referred to above by Zac and what we use in our analysis every day. It’s also the ‘why’ of the message reproduced below. The very word “nuance” means different shades of the same color. So, is it Blue or not? Well, it may very well be a few different shade of blue. These are the intricacies of the markets that we track and trade every day.

From the Elliott Wave Trader Home Page, a message from Avi Gilburt:

Important Risk Management Caution: We want everyone on Elliott Wave Trader to understand that markets are fluid, dynamic, non-linear systems. In order to trade such systems, one has to develop the experience necessary to navigate its complexities. Therefore, we strongly suggest that a trader takes the time to learn Elliott Wave and supporting technical analysis BEFORE beginning to trade his or her hard-earned money. Unfortunately, we have seen too many new traders attempt to jump in with both feet without an appropriate background. This is the easiest way to blow up your trading account, so we strongly caution against it. Also, our general advice is that you do not enter any trade with more than 3% of your trading account and ALWAYS use stops.

Conclusion

We are viewing TSLA as a “neutral” or “hold” as the rating system here allows. But that does not mean that we are without multiple trading opportunities inside of this current structure. As well, we are tracking the possibility of a long-term entry point as discussed by Zac in the analysis above.

Yes, there are nuances to the analysis. Once familiar with our methodology, our members discover a powerful ally on their side to provide guidance and risk management in their trading/investing.

We have an extensive Education library available at Elliott Wave Trader. As well, we want to teach others this methodology. Three times a week we have beginner and intermediate level videos where we show the exact way we count the waves and give in-depth analysis techniques. This methodology, if you give it the chance, will change the way you invest forever. More on that can be found here.

There are many ways to analyze and track stocks and the market they form. Some are more consistent than others. For us, this method has proved the most reliable and keeps us on the right side of the trade much more often than not. Nothing is perfect in this world, but for those looking to open their eyes to a new universe of trading and investing, why not consider studying this further? It may just be one of the most illuminating projects you undertake.