Switching Gears - Market Analysis for Nov 10th, 2021

As I am sure you gleaned from my update yesterday on GDXJ, I was starting to switch gears as the potentially bearish near-term downside structure invalidated. Moreover, with silver making a higher high today, and gold seemingly completing a leading diagonal as well, there is much more evidence upon which I can rely to be a bit more bullish.

Now, I want to state outright that none of these patterns are terribly clean. The cleanest would be if GC sees a wave [ii] pullback, followed by a break out over the high we create here. That would have me considering an aggressive long position in GLD.

But, the issue I have with GDXJ is that the rally we are currently seeing clearly began with a 3-wave move. Therefore, I am still viewing this as a b-wave within wave [ii]. So, ideally, I would like to see a c-wave decline to complete wave [ii]. Should we see that and begin another impulsive rally, I will consider aggressive long positions in GDXJ as well.

However, if the GDXJ breaks out through the pivot noted on the chart, then those that are looking to add to their regular long positions may do so with a stop just below the 47 level. It should ideally rally to 59+, but I cannot say I have enough confidence in a direct break out to play the long side aggressively.

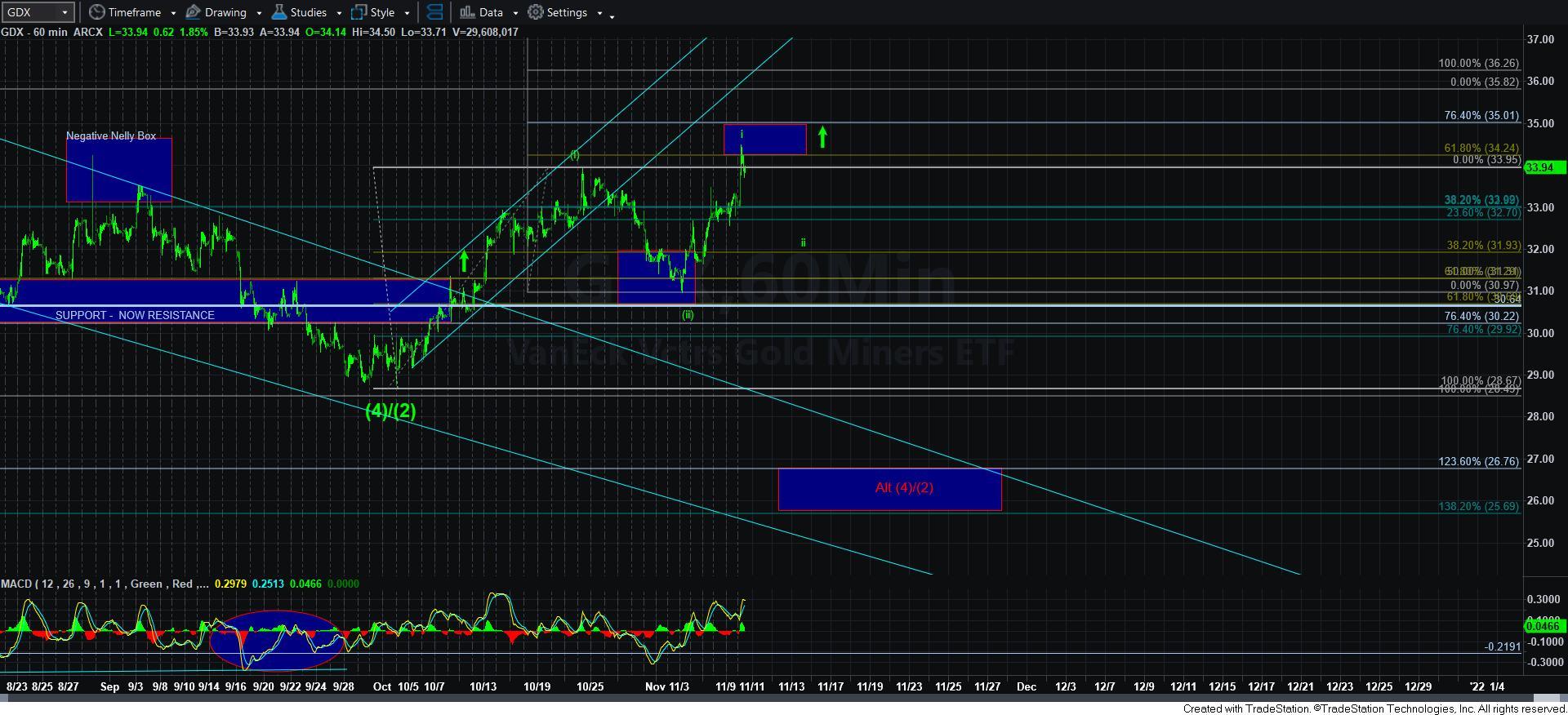

The same applies for GDX. I have added a similar pivot and a break out of the pivot can allow you to add regular positions, with a stop at 34, with a target at 41+.

But, again, I want to note that I would not have enough confidence in this structure to play the upside aggressively unless we got one more pullback.

Silver seems to have completed a leading diagonal, for wave [1] which now requires a wave [2] pullback. Should we see that set up, and then a follow through back over the wave [1] high, then I would consider an aggressive position in silver as well, again, only if that pattern develops as I just explained.

However, if the market should continue higher in a direct fashion without the corrective pullbacks I want to see, I will warn you that the trading could be quite treacherous as it would indicate that the rally is part of a larger diagonal. And, they are not incredibly reliable to trade in as exacting a fashion as a standard Fibonacci Pinball structure. For this reason, I have learned from experience to stay away from trading it aggressively on the long side, since the up/down structures are not anywhere near as reliable.

In the meantime, the action we have been seeing over the last few days suggests that pullbacks can be buying opportunities for those that want to round out their regular long positions. One way or another, the action of late has made it more likely that we will be heading higher over the coming months. But, the path is still a bit unclear.