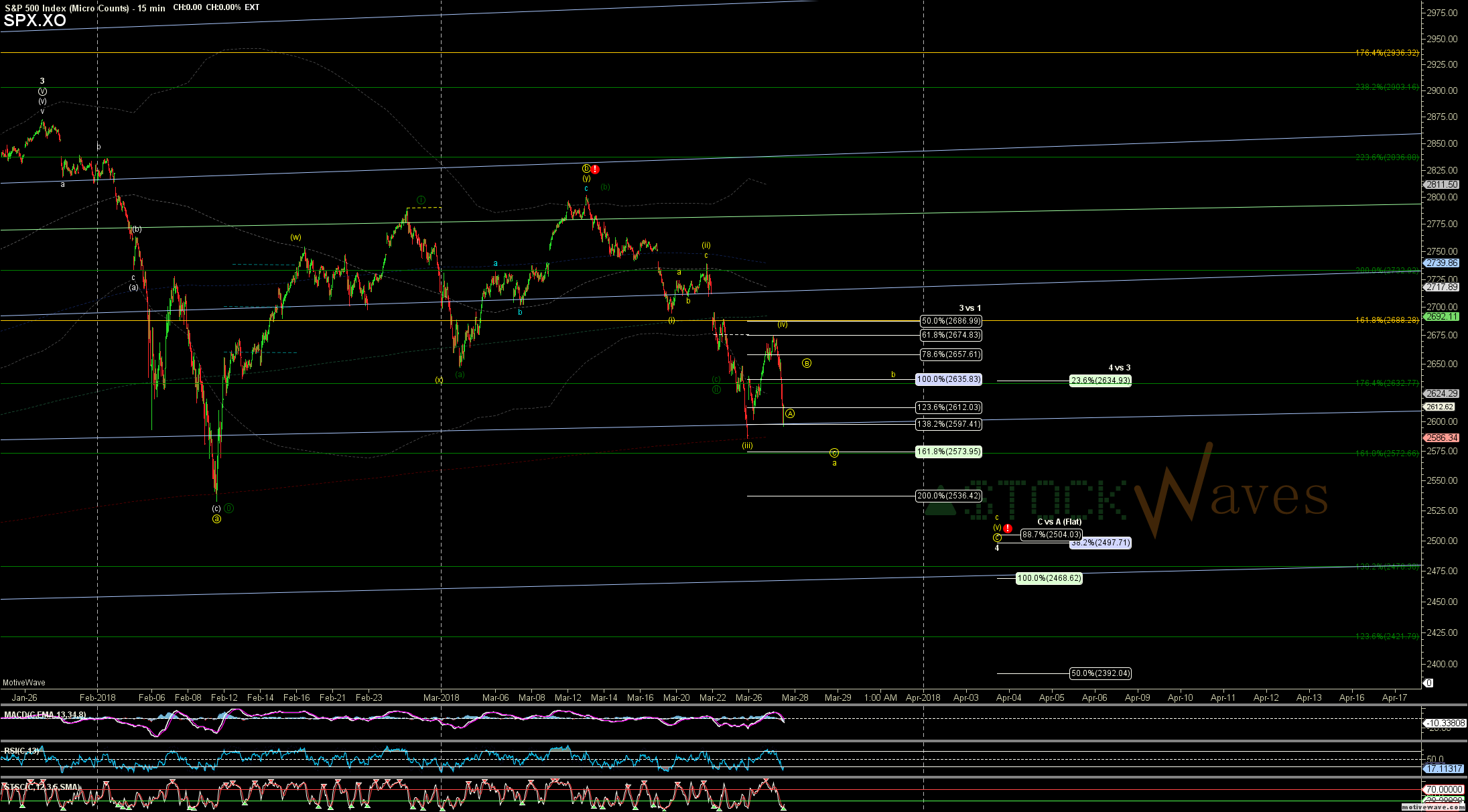

Swing Bottom Nearing - Market Analysis for Mar 28th, 2018

This could be just the a-b of (v)... but for now I am going to call it micro A-B* of a of (v) and look for another bounce a b after micro C finds some support in the 2550 region.... but the hrly shows how it can easily just stretch down toward 2530 region as all of c of (v).

The micro A-B of a though allows this (v)th to stretch more toward 2490s to tag that 38.2% retrace of the entire 3rd off the Brexit low.

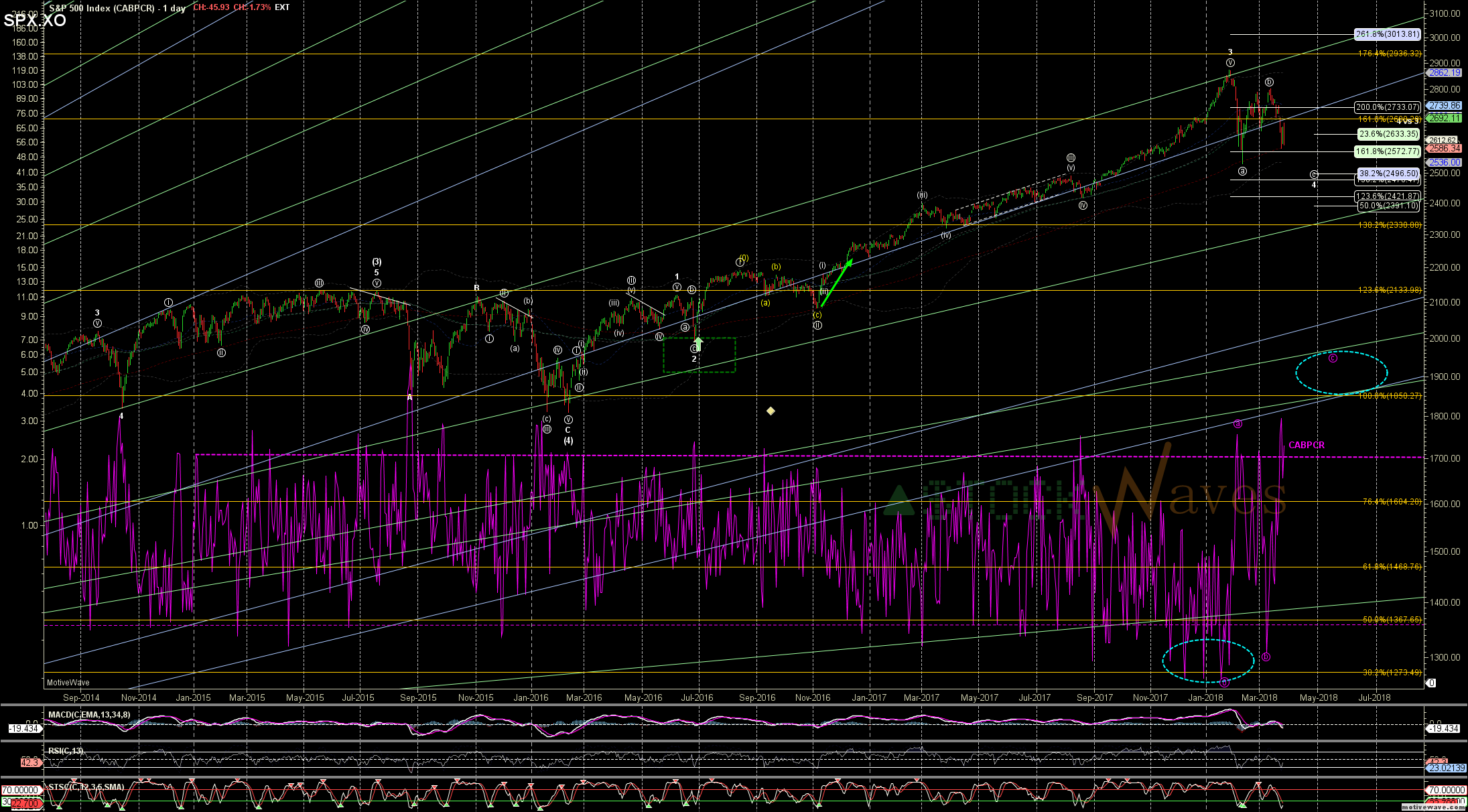

CABPCR is getting nicely into "extreme" territory, but I think we can get another (v)th of a purple c there up to the 5-7 region.

And Stochastics on the Daily should produce a nice bottoming signal soon.

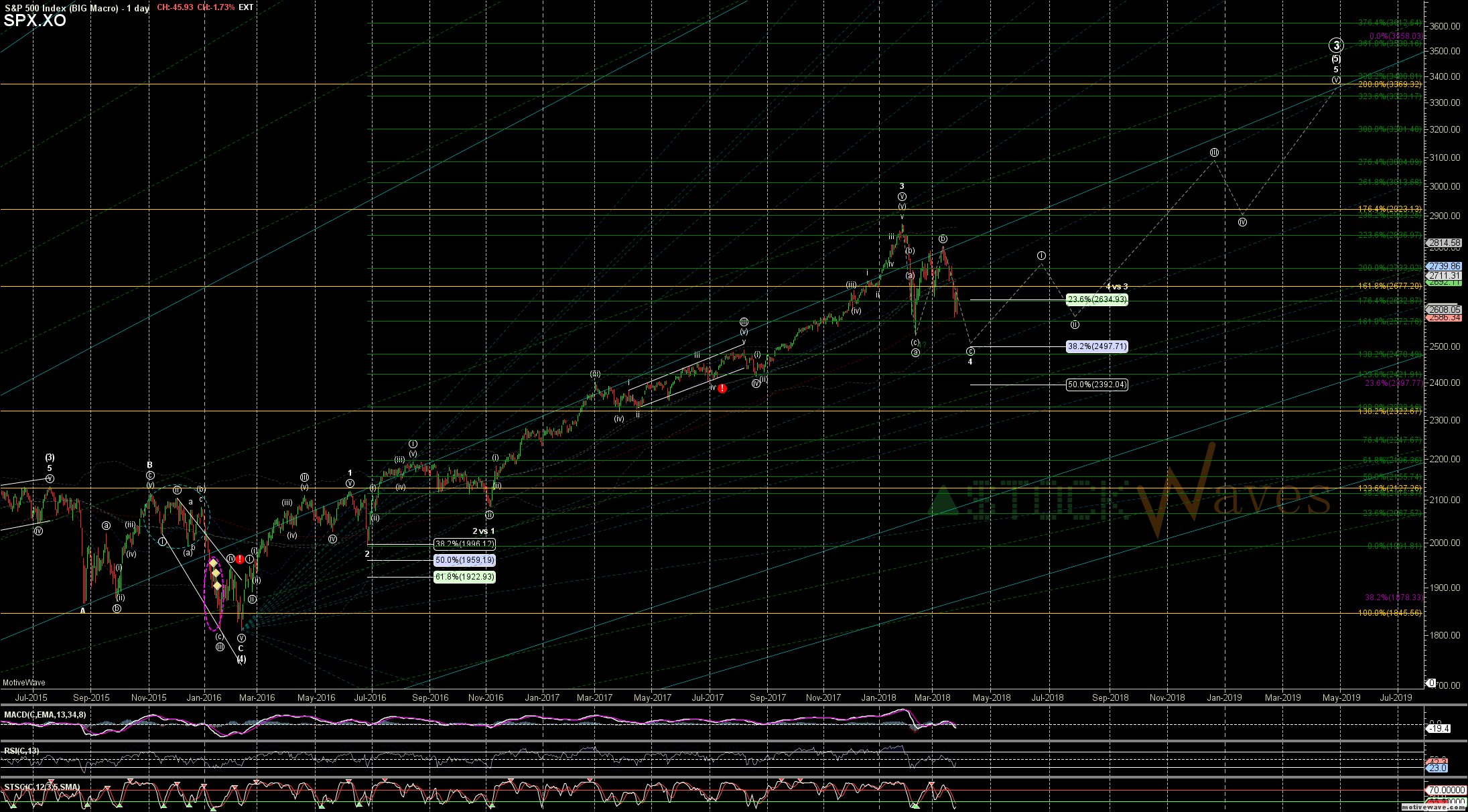

There is still plenty of room for downside extension in this c of 4, but we are nearing the end and should have a nice rally from 2500 region up toward the 3300s over the next year.

To borrow from a twitter discussion w/ Ryan: L/T positions should be like Ogres, Onions, Cakes & Parfait (Everybody Loves Parfait)... they should have layers or "tranches". ONE of those tranches could be a spec entry at a likely bottom and those who are able to catch that initial "V-bottom" can be nicely rewarded, but markets tend to make a few false bottoms first. Another tranche can be deployed when one sees the first micro 5up 3 down for likely i of (i) of circle i of 5**. And yet another tranche on the (i)-(ii). And so on... this way one can also have tranches to TAKE OFF into tops of likely wave (i) and circle i, looking to add them back on the (ii) and circle ii continuing to layer and build a larger position.

Feel free to check out StockWaves tho for MORE diversification. ![]()

We will continue to looks for shorter and longer term setups for out performance of sectors and many individual names.

*3min ES and 15min SPX

**Based on normal proportions for a 5th to 3369 from 2500: circle i targets 2750, so within that a normal (i) might target 2600, and within that a normal micro 5up for i of (i) would be the first ~50pt 5 wave move up.