Surprise Surprise, New ATHs Fulfilled

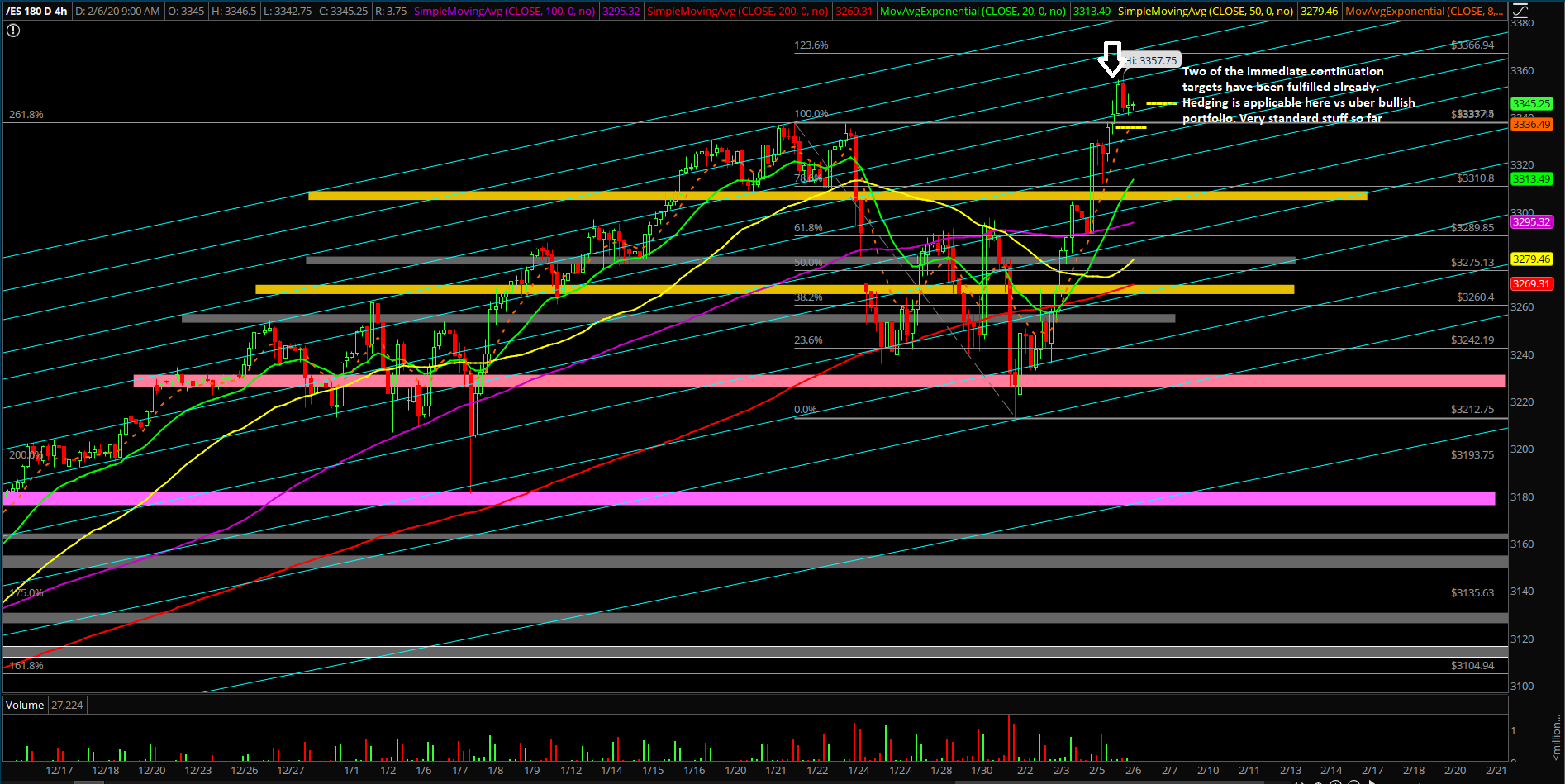

Wednesday’s session epitomized the grind up/high level consolidation bias, as we expected. This was the Day 3 movement based on the week’s bottoming setup of 3322 on the Emini S&P 500 (ES). Essentially, it was needed and necessary in order to pop into new all-time highs during the globex overnight session last night to fulfill two of the immediate upside targets at 3345/3350.

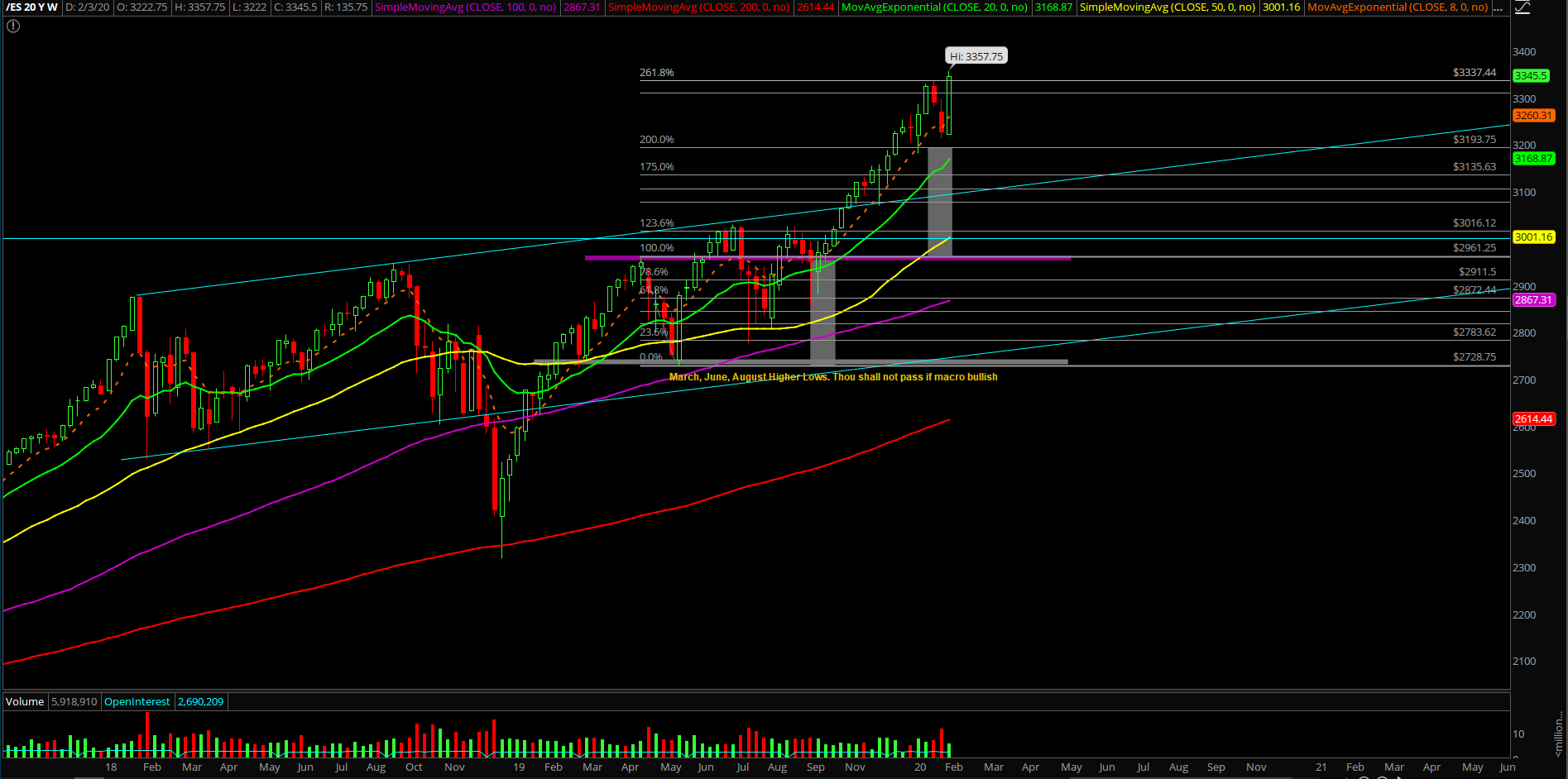

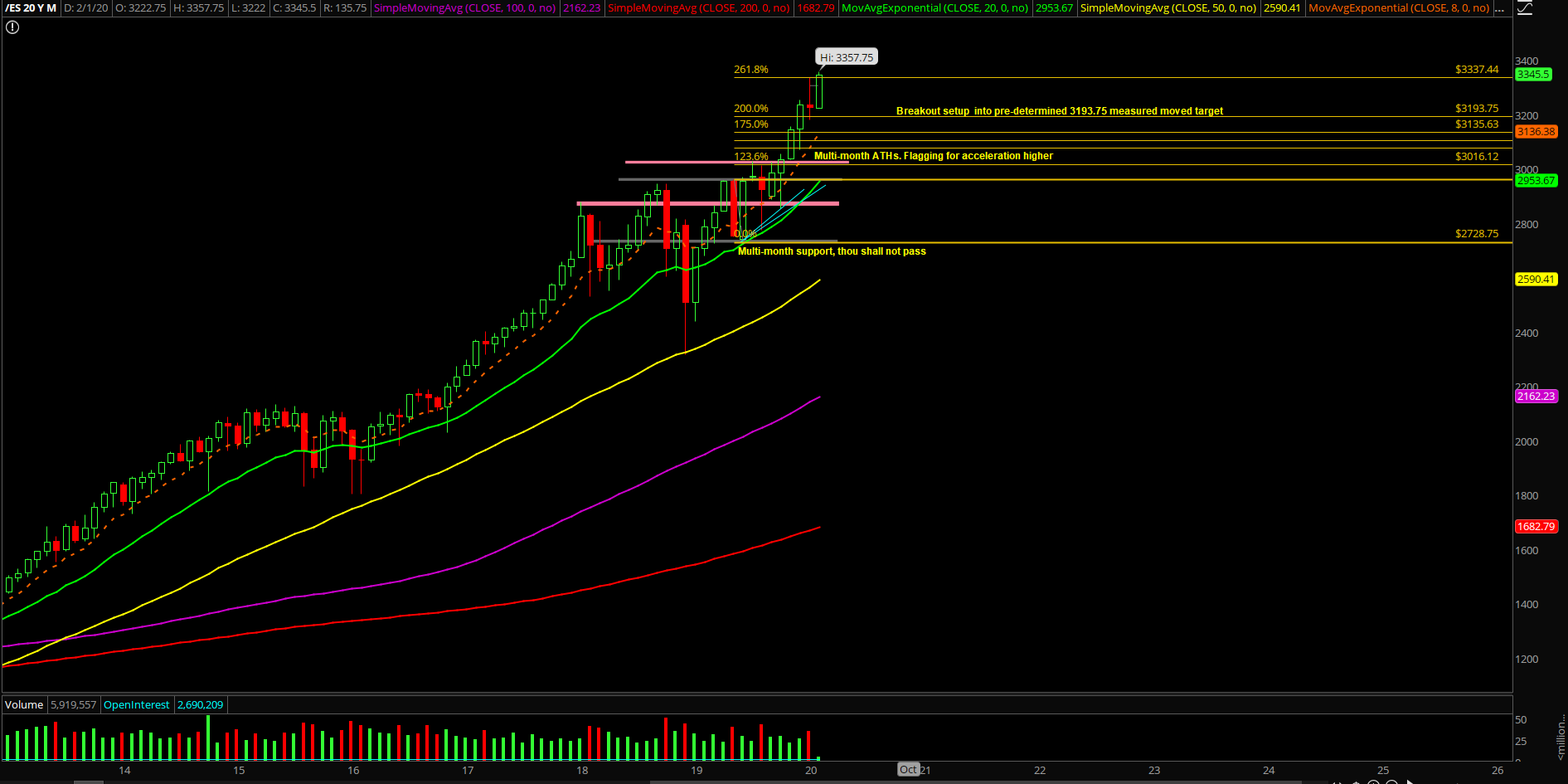

The main takeaway is that the week’s low of 3322 is still being treated as in since Monday. If the bulls close strongly this week, then it would enhance the odds that the February monthly lows could be in as well given the previous structures of the recent months doing the same structure. Technically, it’s still an inside month for the time being, so it’s just a shake and bake/consolidation and offers traders the opportunities to hedge when appropriate like this morning vs the ATHs.

What’s next?

Wednesday closed at 3335.5 on the ES at the high of the session and also just a hair below the Jan monthly high of 3337.50, indicating the usual higher lows and higher highs pattern into ATHs attempt. As noted, we got the expected new ATHs print as the bull train did a decent job during the overnight globex session.

From our game-plan report:

- For now, when trending above 3265, all short-term dips on the daily timeframe are considered buying opportunities and not a threat. Zoom in, intraday needs to hold the 3310/3300 lows for immediate trending purposes for micro micro. Note: a daily closing print below 3300 would be a warning shot though, not intraday.

- Revised the 4hr white/red line projections due to the nature of the bullishness and likelihood of new ATHs and the ongoing momentum towards 3345/3350/3367 (two targets have been fulfilled already)

- We must be aware that this week’s low of 3222 that we’ve been using as a key reference pont for momentum could very well be the month’s low already just like the previous 4 months doing the same structure. Same $hit, different day (SSDD)

- Absolutely no naked shorting is allowed now in effect again, except if just hedging the uber bullish portfolio with lottos like a couple weeks ago when we mentioned. Reasonable hedging vs highs is perfectly fine if you’ve been uber bullish since the start of Q2 2019 like us because throwaway lottos at key points do more good than harm.