Still Searching For A 5th Wave In Metals

We have basically been now going sideways for more than 3 weeks. And, I have to assume the metals are going to have to make a decision even though they have avoided doing so for almost a month.

So, nothing much has really changed since the last update. Right now, gold is at its wave 4 support, and, even though it may get another squiggle or so before we can consider wave 4 complete, we should be seeing a rally begin in the very near term.

Silver may have already begun that rally, or it may still get a lower low to complete an even more protracted wave 4. And, as long as silver remains over 21.90, I can still maintain a reasonable expectation of a 5th wave higher high. However, should we see a break down below that region, then it opens the door for the yellow count in a big way.

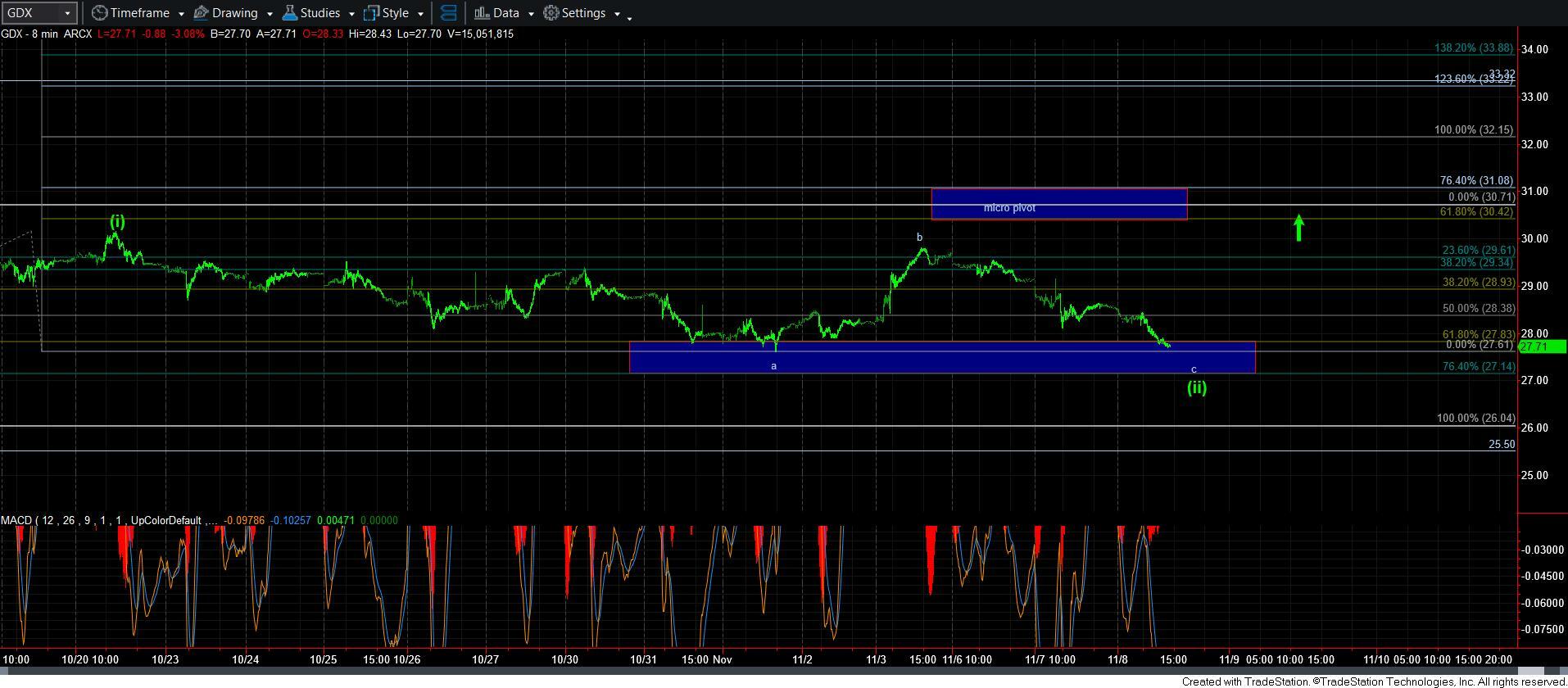

GDX is similar to gold in that it looks like it is complete its c-wave as well, but it would be in a wave [ii], as you can see from the 8-minute chart. So, like with gold, I would like to see a rally begin in the very near term.

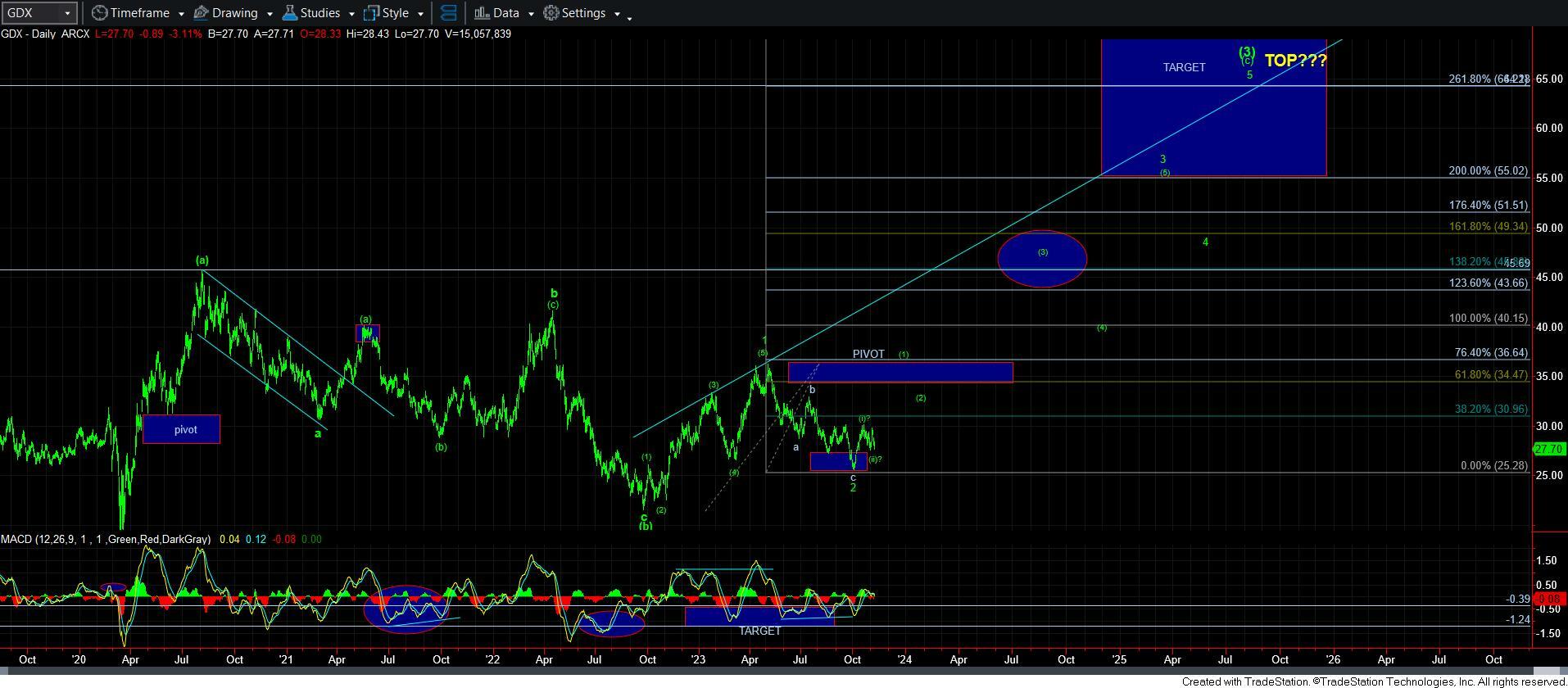

You must have a lot of patience to be able to trade in the metals market. And, we have been patiently awaiting the market to provide us with the “break-out-setup” I have been outlining on the various charts. In order for that set up to really begin developing, silver and gold need their respective 5th waves, and GDX must see a larger rally to complete its wave [1], as can be seen on its daily chart. So, as it stands right now, I cannot say that the market is ripe for a melt-up phase I expect to take us into 2024. We still need a bit more patience for that set up to develop.