Still No Resolution On The US Dollar

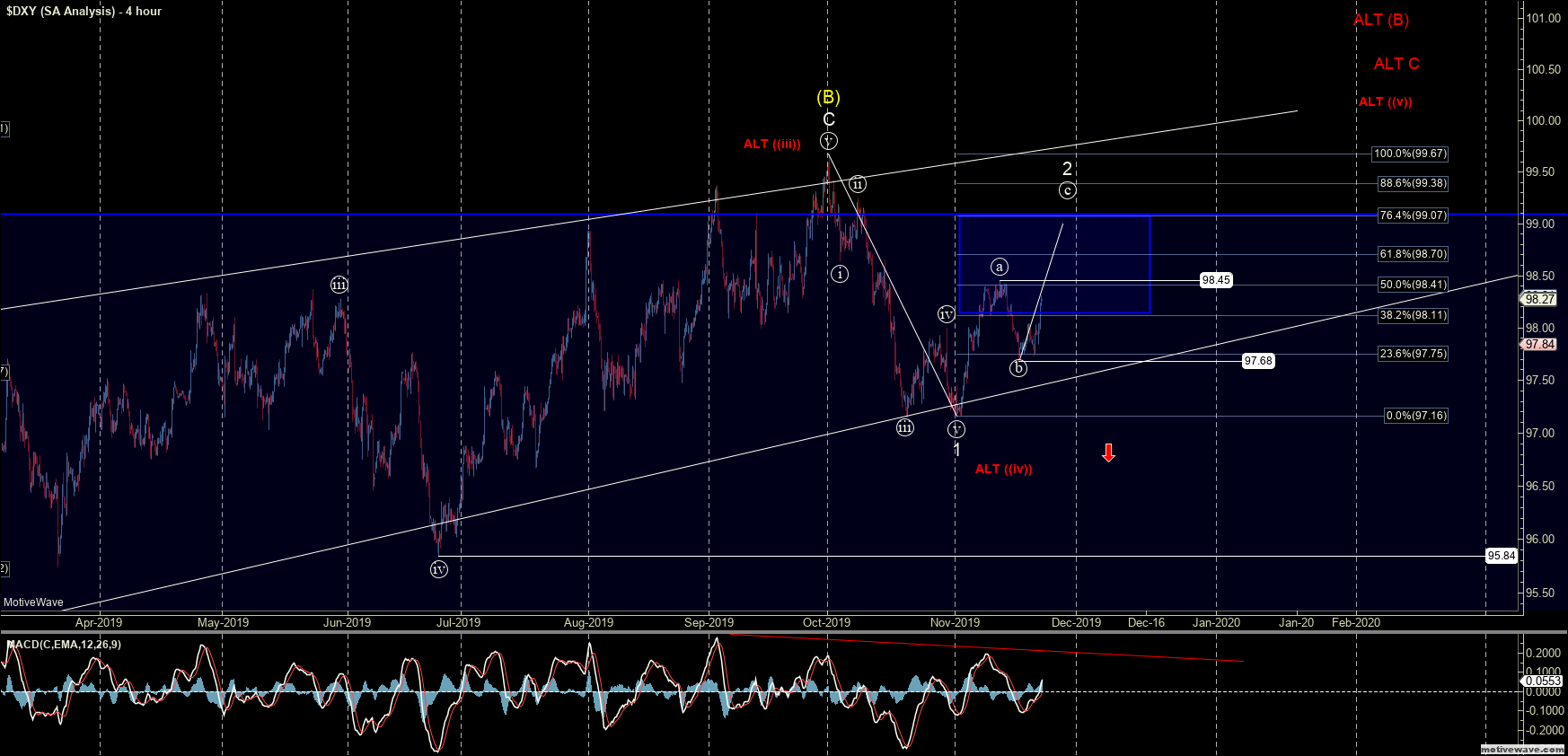

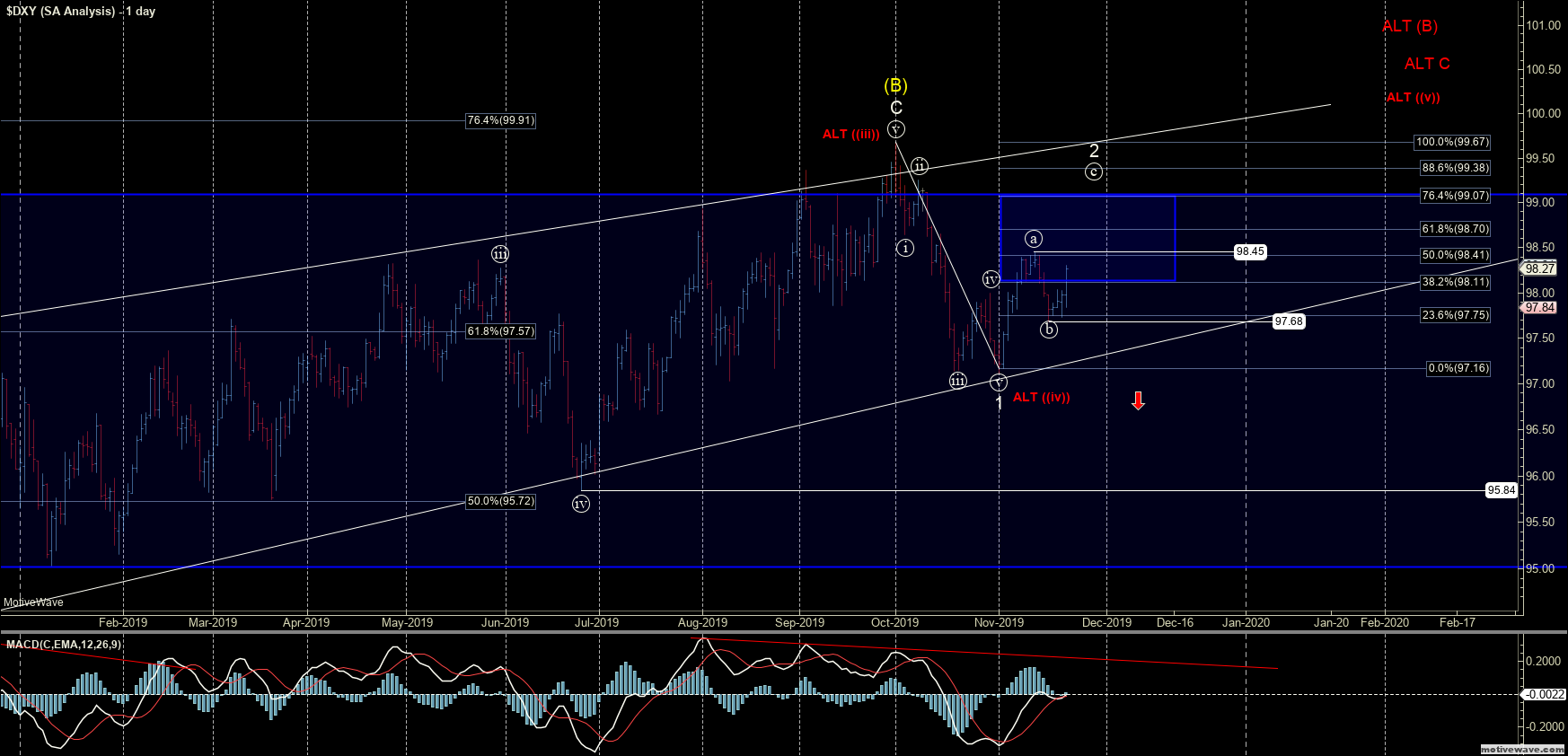

After taking a bit of a breather the previous week, the US Dollar Index (DXY) this past week moved higher once again which has left the door open to still seeing this resolve in multiple different paths. The turn up off of the 9768 low is suggestive that we will see a break of the 98.45 level prior to turning back lower once again. The bigger question, however, is whether this turn higher is still part of a larger wave 2 as shown in white or part of the larger degree wave ((iv)) per the alternate red path.

As noted last week although the smaller degree timeframes are still a bit unclear here bigger picture I am still looking for a larger degree top on the DXY. Because the DXY is likely forming a large Ending Diagonal once this does top I expect to see a sharp move back down towards at least the 93.19 level. This is the origination point of the ending diagonal and therefore the initial target zone upon a reversal out of this pattern. If that 93.19 level gets taken out then we should ultimately see a move back below the 88.25 low to complete the larger degree corrective pattern on the DXY.

As far as the smaller degree timeframes are concerned I now have to give a higher probability to the red path at this point in time. In fact, although I am showing this red path as an alternate I am about 50/50 as far as which will play out due to the inability to make a new low at the 97.18 level. Resistance for the white path comes in at the 98.11-99.07 zone. If we can hold under this zone and then make a new low under the 97.18 level it still sets up that larger degree top were triggering that sharp move back down towards the 93.19 level. Alternatively, if we continue to grind higher breaking those resistance levels we likely will see a grind into the end of the year prior to seeing a significant-top on the DXY. In either case, I still remain cautious to the long side here on the DXY as once this does reverse to the downside the move is likely to be very sharp and strong towards those lower levels.