Still No Pullback - Market Analysis for Feb 8th, 2017

Everyone seems to still be looking for a pullback. But, the metals have not exactly been compliant, as I warned they may not for several weeks.

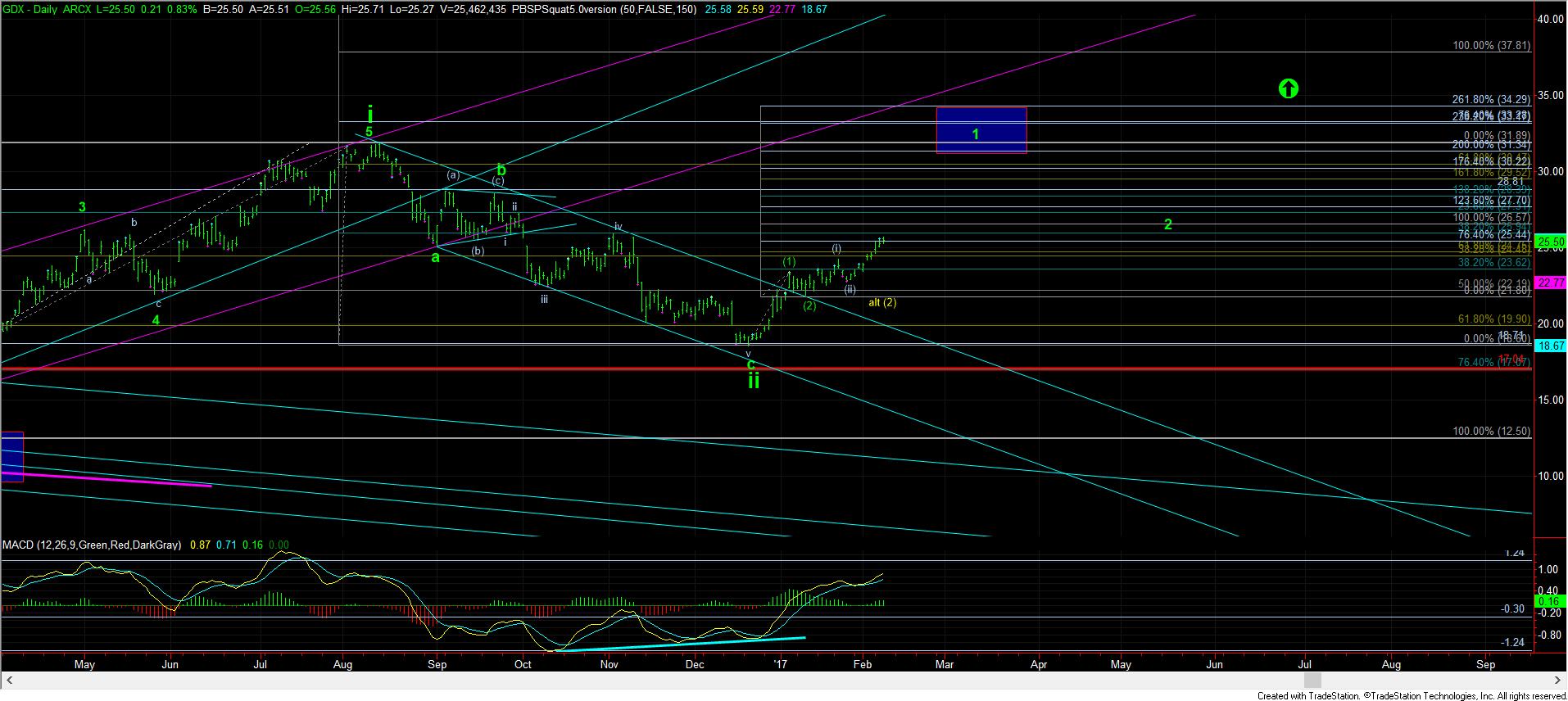

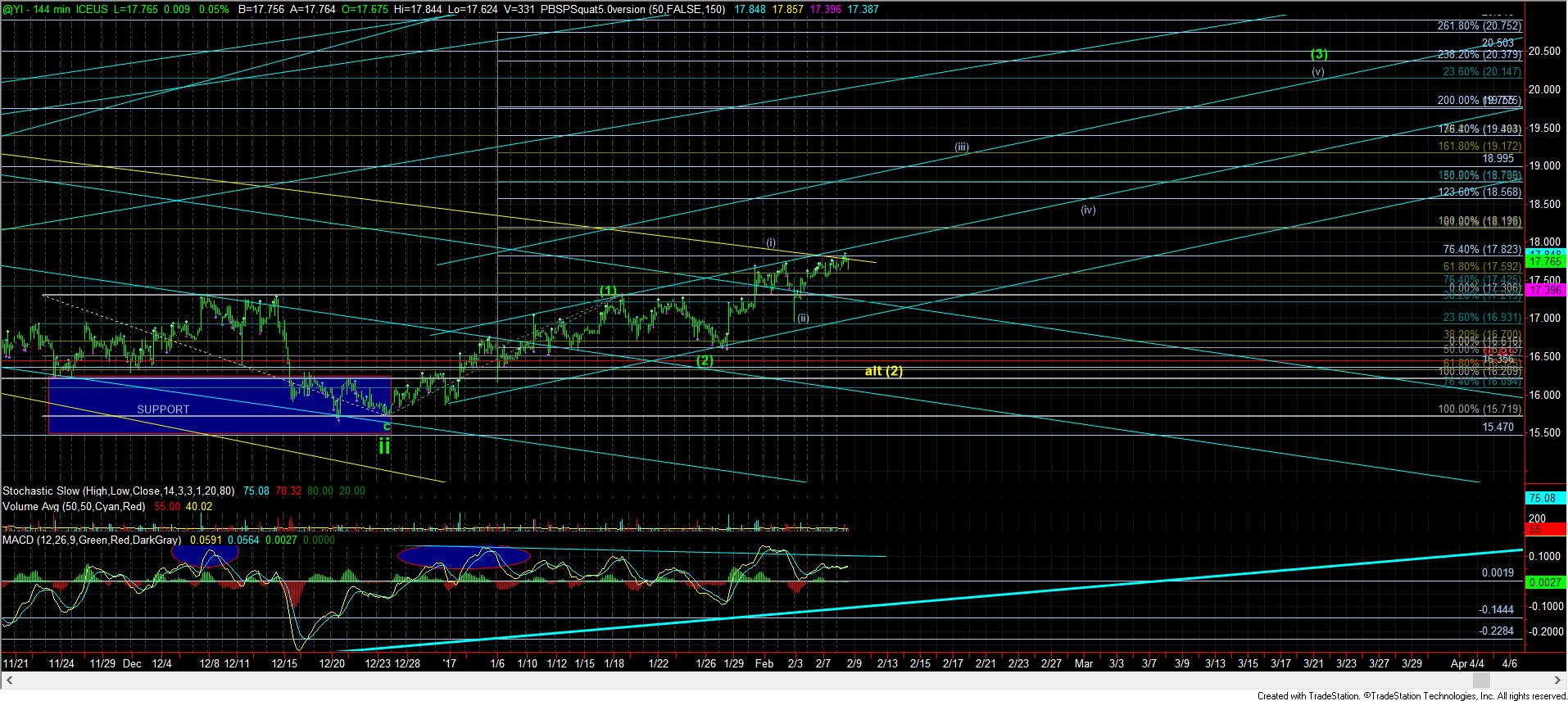

As it stands as I write this right now, both the GDX and silver are sitting right below their respective .764 extensions off the recent lows, which, if broken through, should solidly confirm the heart of a wave (iii) of (3) in wave 1 of iii. And, remember, wave 1 of iii is likely targeting he highs of August of 2016, if not even a little higher.

The only question right now is if we see one more minor pullback before the break out. And, as I have been saying for quite some time now, 17.85 in silver will likely be the dividing line between these two potentials. Thus far, we have held below 17.85, yet still developing a high level consolidation. And, as long as silver remains over 17.50, the market is setting up in a short term break out posture. We are looking for a high volume spike through the 17.85 level, with follow through over 18.20 to point us to the 19 region for wave (iii) of (3).

In GDX, the .764 extension resides at 25.76, with support below residing between 23.75-24.90.

As I have said so many times, when the metals turn bullish, they rarely offer a “gentleman’s” entry, and if they do, it is often via a spike down which scares people from buying. So, just stay on your toes, as either possibilities still remain as long as we do not see silver’s break out signal as noted above. Once we do break out, I will be looking for GLD, GDX and silver to be heading back towards their August highs for wave 1 of iii, which will likely complete over the next two months, setting up a wave 2 pullback into the late spring or summer. That means the real fireworks for the complex may not be seen until later this year.

As for the shorter term, I noted in the Trading Room that if one would be so inclined to hedge their long positions in the complex, you may want to go with a long position in the USD as your hedge. You see, the DXY is set up for a c-wave higher, but there is clearly no guarantee that the metals will not rally alongside the DXY at this time. If you have noticed, they have both been rising together now for about a week. So, this is just an idea for those that want to have a hedge at this inflection point.