Still Looking For A Deeper Pullback To Confirm The Five Up

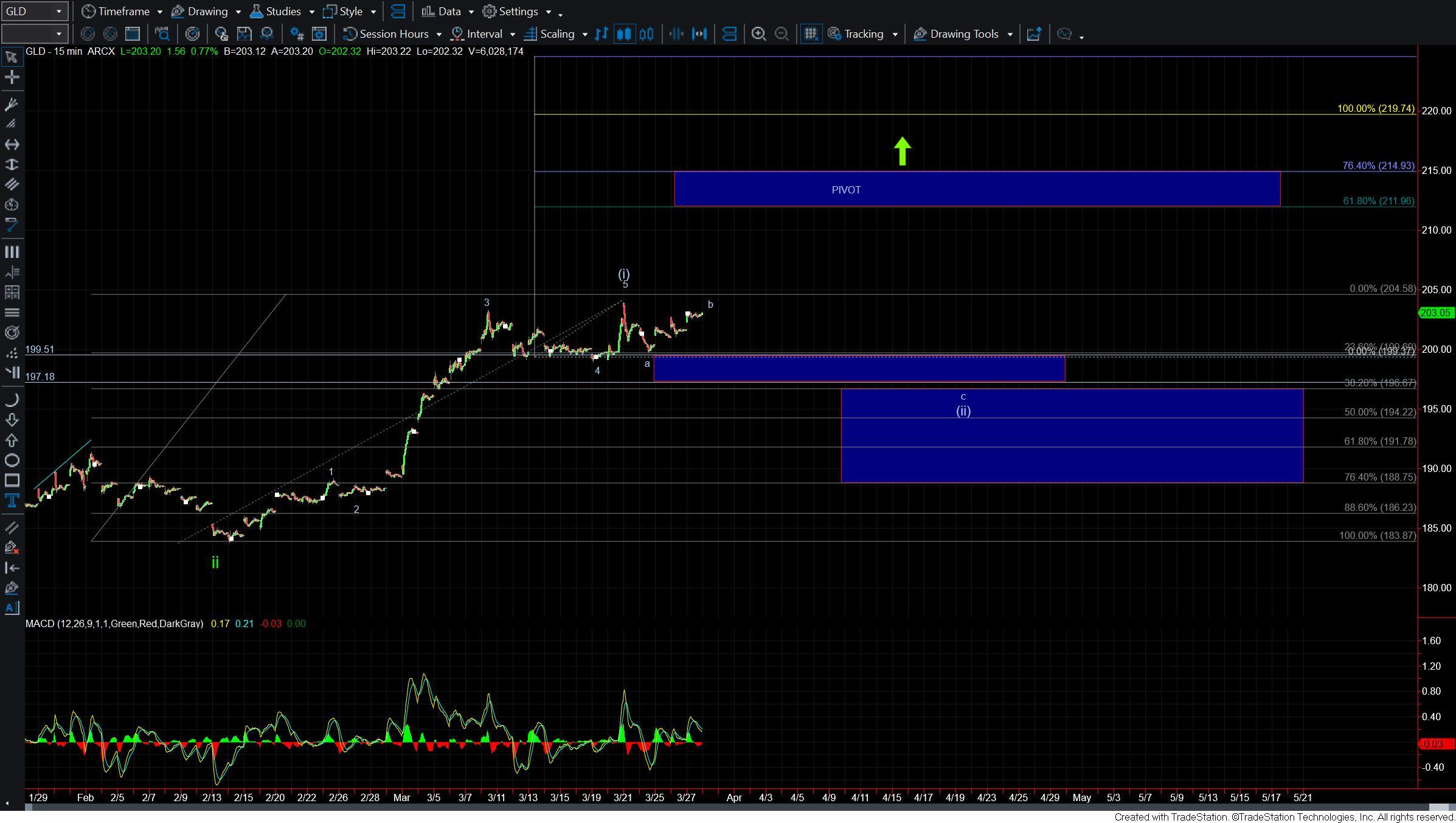

This past week we saw what can count as five up on Silver, Gold and GDX. The pattern is so far fairly clear in regards to that potential five-up. As Avi noted in the last update while we do have a fairly clean potential five up we still need to see a corrective retrace lower followed by a break back over the previous high to confirm that we are ready to begin the larger degree third wave up.

So far we have a bit of divergence in regard to this pullback with Silver pulling back the furthest while GDX has actually exceeded the previous high. Gold in the meantime is higher into the end of the day but is still trading under the high that was stuck on March 21st.

Even though the GDX has exceeded the previous high given the stance on Silver and Gold I am still going to give the benefit of the doubt that we will still see a deeper pullback across all three of the charts. If we begin to see Gold and GDX start to break out through their respective pivot levels then it would open the door for metals to already be in the heart of their third waves. For now, however, I will continue to give the benefit of the doubt that we will indeed see a deeper pullback before that occurs.