Still Just a Four?

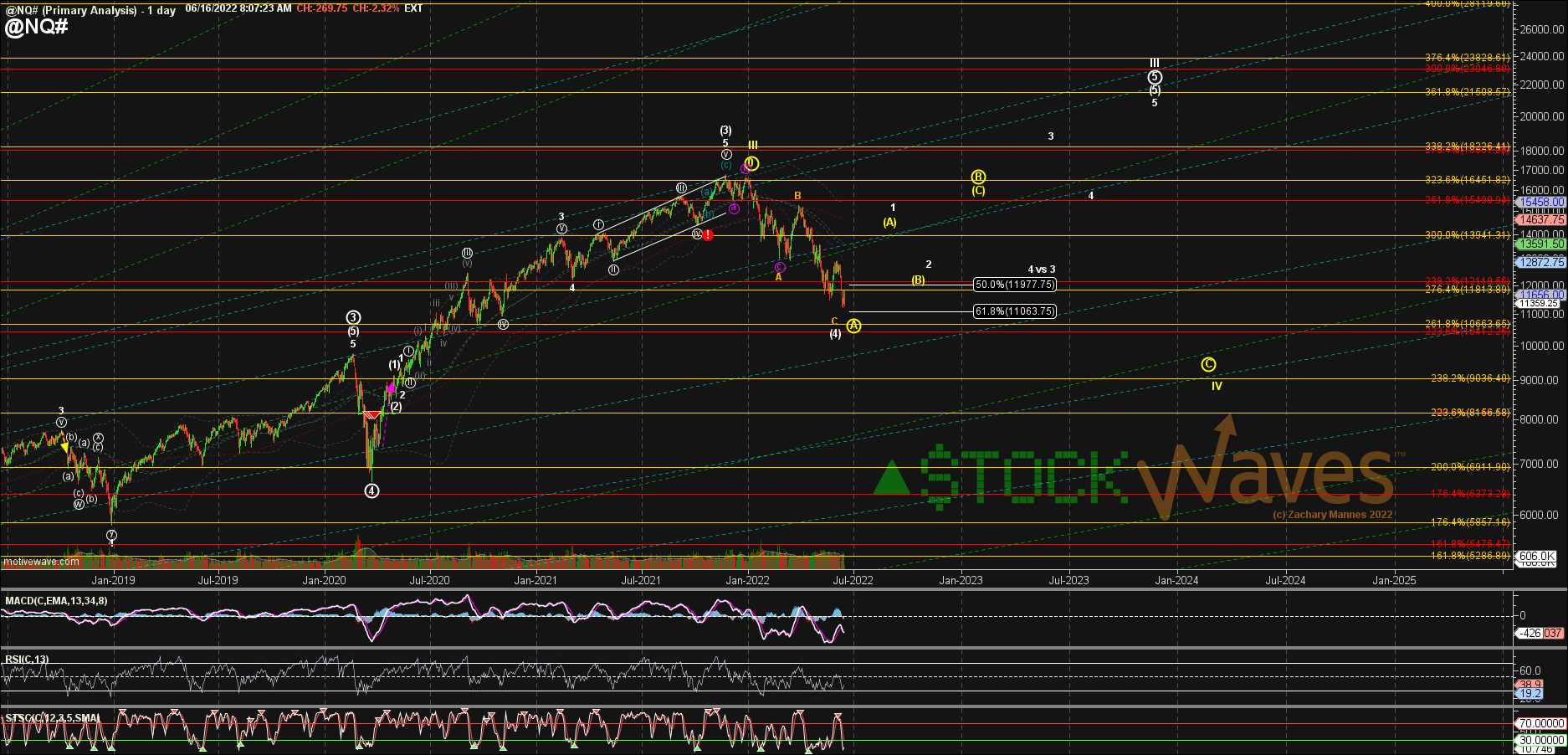

For me SPX has to be the (4) now rather than only 4 of (3) even though RSP still argues strongly for the latter. Even that is getting deeper than ideal, but we still have a corrective move off the Jan high and many charts and sectors still supporting at least OMH. EW looks for the most probable path extensions can happen in either direction but cannot be relied upon. I do think we are getting a glimpse of what might be an underlying root cause of the bigger declines to come. I think the exacerbating decline in SPX/ES vs the RSP is not only a warning of the overweighting of certain segments of the market but also the prolific replication and magnification of that overweighting by countless other products (ETFs, MFs, annuity allocations, etc). Many folks do not realize just how leveraged the entire system is.

We do our EW analysis at different degrees, we look for subwave confirmation of the larger degree counts. We talk all the time about needing 5up3down. While we might have something that can count complete as a corrective fourth and start tracking the potential for 5up off that low the small degree subwaves give us levels that need to hold for things to remain constructively bullish. Failing to hold a smaller degree support level along the way is a good early warning and should be used as part of risk management. But failing to maintain a pure impulse off a low does not automatically create a reliable new specific downside target. Off the Feb low April 7 low needed to hold for a (iv) of i, April 26 needed to hold for an alt (ii) of an LD. Off the May low we needed 4070 region to hold as a small fourth. Off yesterday post Fed we only have 3up.

I do not try to track every extension, I want to prepare you for the next bigger move and make sure you understand the risk skew. I do not know if you remember the amount of HATE I got back in Nov/Dec/Jan for being a "perma-bear" and unkind calls for me to throw in the towel and flip my analysis to match what many wanted to see. That is not how I work. I see a corrective decline that while stretched deeper than I expected and deeper than normal, is still within guidelines for a fourth in EW. I still see many charts and sectors arguing for a rally to start to a new ATH. Even if the P.5 has topped we still have a corrective ABC trying to complete and should expect a "bounce" that could easily try for the cluster of MovingAvgs and BBs in the 4300s-4400s region.

I am heading to a preK graduation, back ~11.

"Best to your trading."