Still In A Bottoming Structure

I know this has been a very long bottoming structure, but it does not change my view that we are in a bottoming structure. While this correction has now been VERY long in the tooth, I am still viewing us as feeling for a bottom in the charts we track.

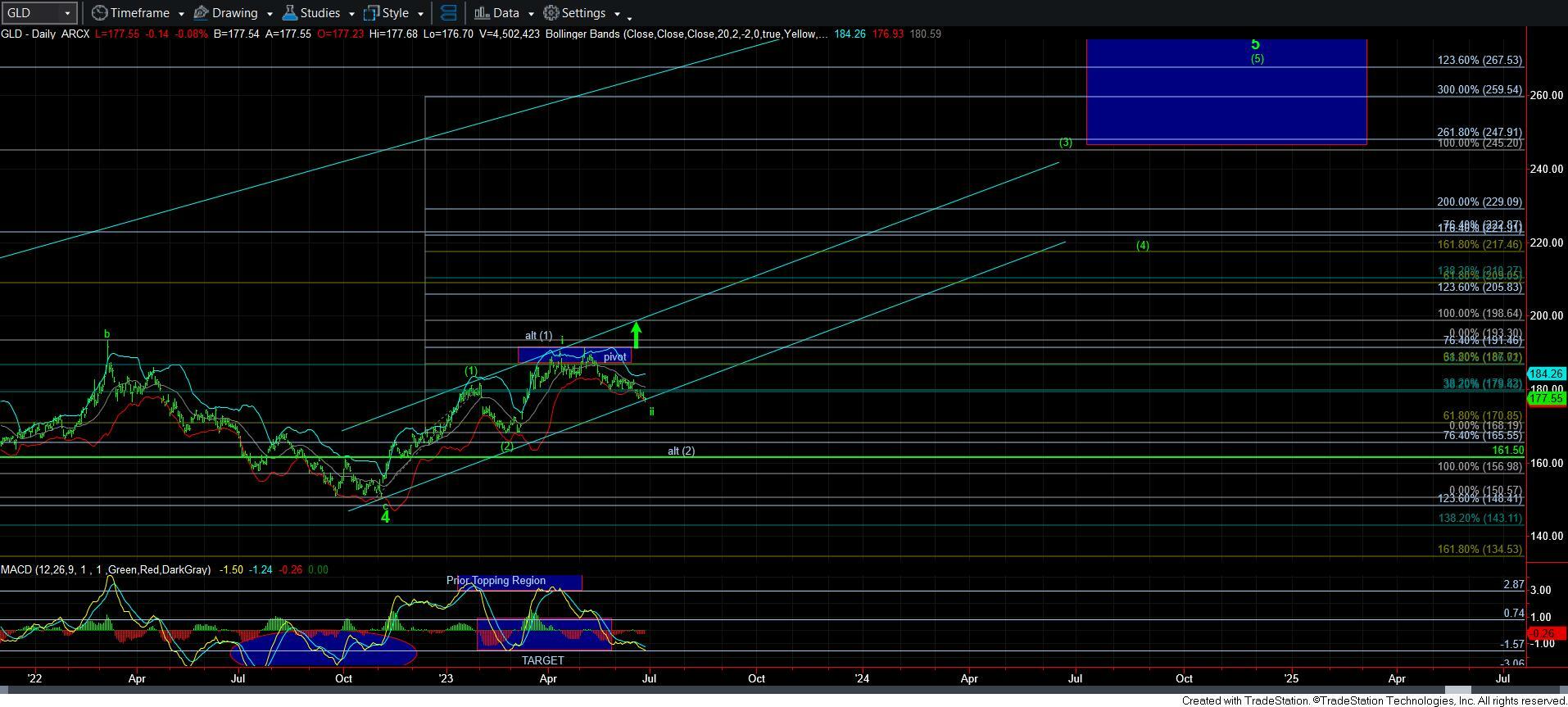

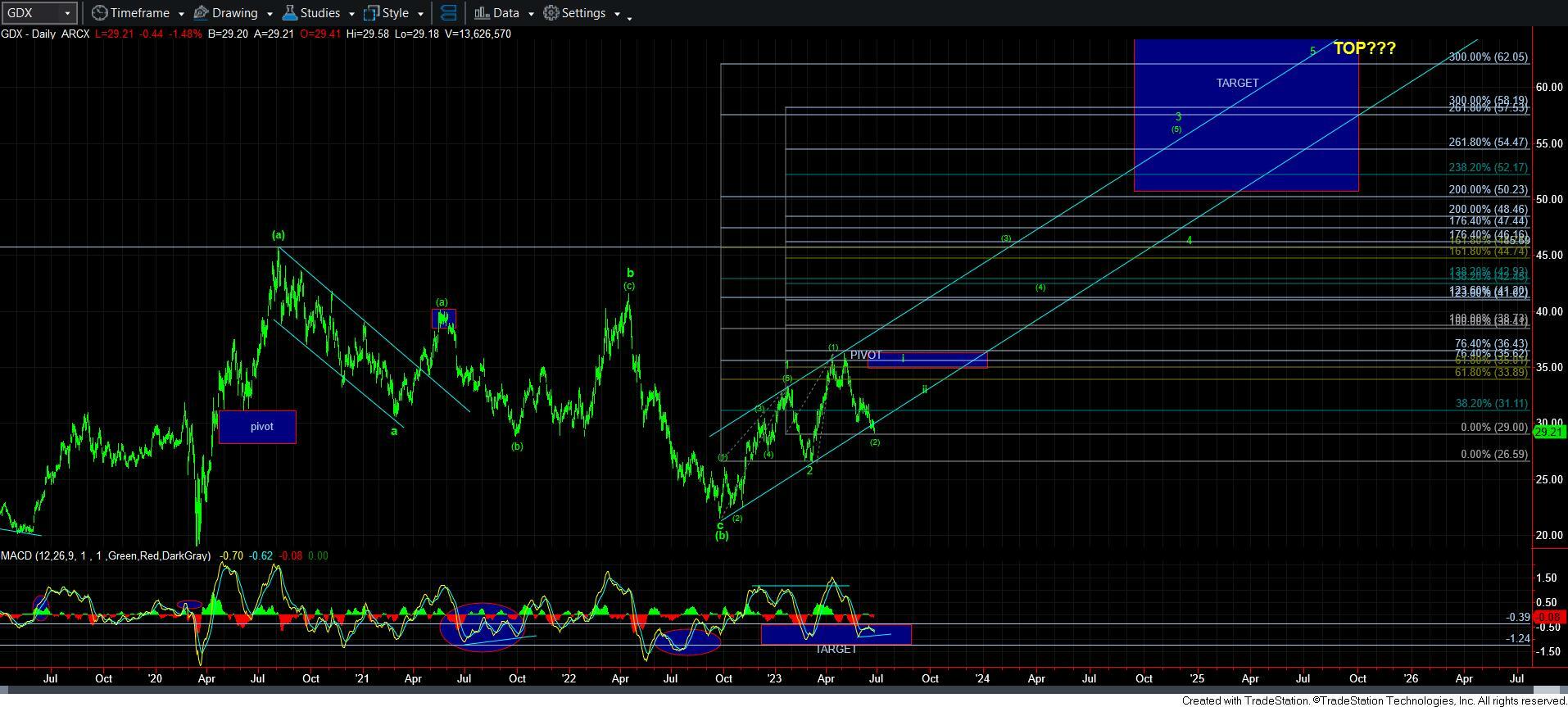

Of course, as an alternative, I have to now consider a larger 2nd wave in my thinking, as I am showing on the GLD chart. But, to be brutally honest, I just cannot see this potential in the GDX. But, I will admit there is the potential for this to be seen in gold and silver.

You see, the high that we hit back in April could have been a 5th wave off the low struck in 2022 in both silver and in gold. But, that is really my alternative at this time, as the primary count I have been tracking really makes the most sense at this point in time.

What would make me consider that alternative a bit more seriously is if gold sees a sustained break of the 1900 region. Otherwise, I am maintaining my primary count presented on all the charts as a series of 1’s and

From a technical standpoint, both the GDX and silver are presenting us with some nice positive divergences on this drop. In fact, there is potential that silver may have even bottomed, as there is a colorable argument to suggest that we have a leading diagonal off the low struck this week. While it is not something I am going to rely upon until we are able to break out over the high struck this week, I do have to note the potential.

When I look at the 60-minute GC chart, I have to note the positive divergences that are evident for over a month now. The great majority of the time, this suggests that we are setting up a strong reversal.

I have also attached an 8-minute chart which shows the potential leading diagonal in silver off the low struck this past week. But, I have to again stress that I need to see a break out over this week’s high to consider this potential more strongly. But, thus far, the decline off this week’s high is looking rather corrective.

GDX has a very nice bottoming set up, with the MACD on the daily chart providing us with a really nice positive divergence bottoming structure.

So, overall, I cannot say that I am terribly swayed by the alternative I have been forced to put on the chart due to the depth of this pullback. Zac often says that when I am forced to place an alternative on a chart, it often marks the point at which the primary count takes hold. And, in GDX, it is hard to adopt any other count other than that which is outlined on the chart currently.

Therefore, I am trying to be patient to allow the market to provide us with our next 5-wave rally before I get more aggressive with the complex.