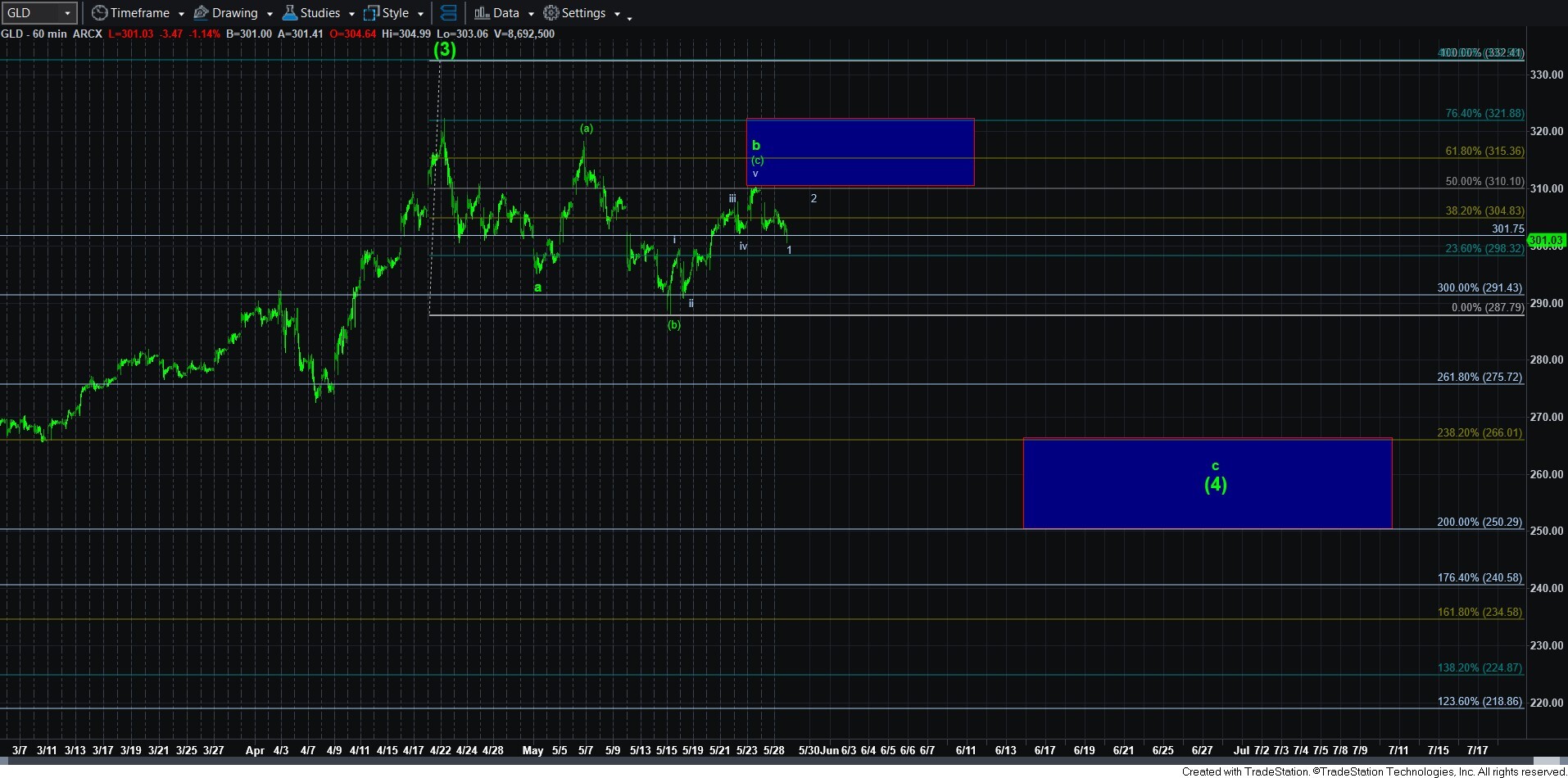

Still Expecting Lower Prices In Metals

Nothing has changed in the bigger picture in my metals analysis. But, the paths to the lower levels is still an open question.

Starting with gold, I can now count 5 waves down in a leading diagonal to begin the c-wave lower. But, we really would need to bounce from the 3285 region in the futures (Aug contract) in order to retain this path. If we see a more direct break down, then it is possible the c-wave itself is taking shape as an ending diagonal – which seems a bit less likely due to the projections to take us down to the c-wave target – or it can be starting a bigger leading diagonal for wave 1, or we may have another twist or turn in this 4th wave.

GDX is pretty similar to GLD, but I cannot say I have a clear 5 waves down in GDX, which means we may make an attempt at a higher high before this corrective rally is done. So, I will be watching this carefully in the coming days to see how the c-wave lower will begin to take shape. Keep in mind that c-waves are 5-wave structures, so wave 1 of that c-wave should also be a 5-wave structure. And, that is the cue I am seeking.

Silver is still very much in limbo still. It refuses to give us a higher high and it refuses to break down. So, I am genuinely unsure how silver is going to give us the next buying opportunity at this time, as the yellow count would clearly be a much better buying opportunity. But, until it gives us the next clue, I cannot be certain as to where that opportunity resides.

Again, I am still expecting lower prices in metals before the next – and potentially final – rally takes hold. The questions now is a matter of path.