Some Rain on the Parade

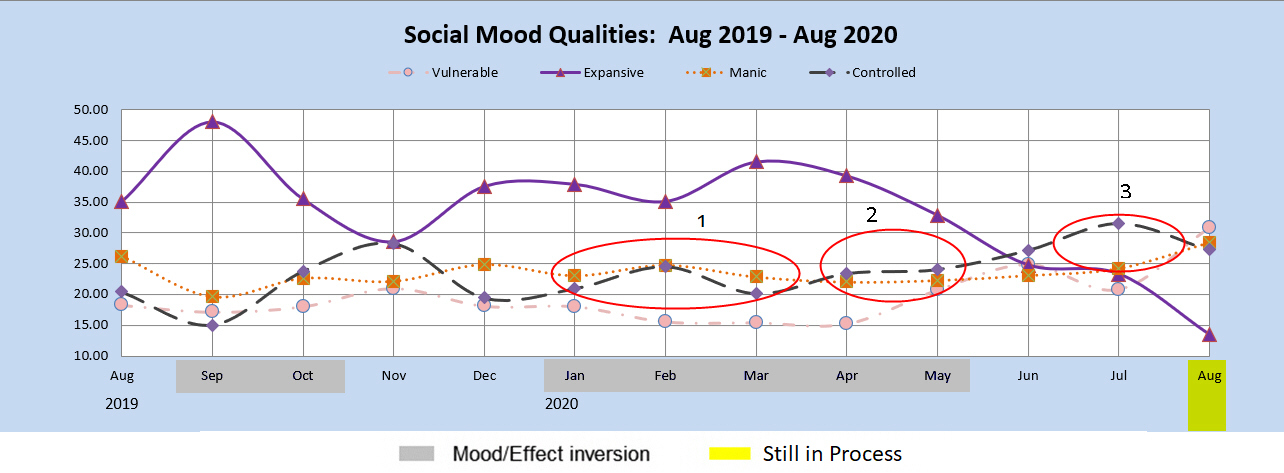

Late last year before anyone had heard of a Corona Virus, the monthly mood pattern gave a heads up to a "global crisis mode" for January-March. In the chart below this is the area marked with a 1. The pattern that identified such a crisis was the Manic (orange) and Controlled (grey) lines in parallel and close together either condition pointing to a crisis, but this was a double whammy of large scale proportions showing on a monthly scale. With the orange and grey lines switching positions for April-May (area 2), that pointed to a "government intervention" mode and we've been watching that happen with social distancing, mega dollar liquidity, market, business, and other interventions. I haven't really been too concerned with the summer as it's been a pattern primarily showing (understandably) people wanting to forget about sickness and dying and serious issues. However, a flip is now showing as a possibility for the month of June which would turn the currently inverted picture right-side up (Controlled or seriousness dominant). The area marked as 3 for June - July, once that reversion to normal were to kick in sometime in June, would point to at best the doldrums of summer, but could easily be pointing to a new surge of serious concerns with the virus, with the government, or something else. While this doesn't have that same "crisis" signature that January - March had, it certainly doesn't look "cheery." The market saying of "sell in May and go away" is probably good advice to be heeded this year.