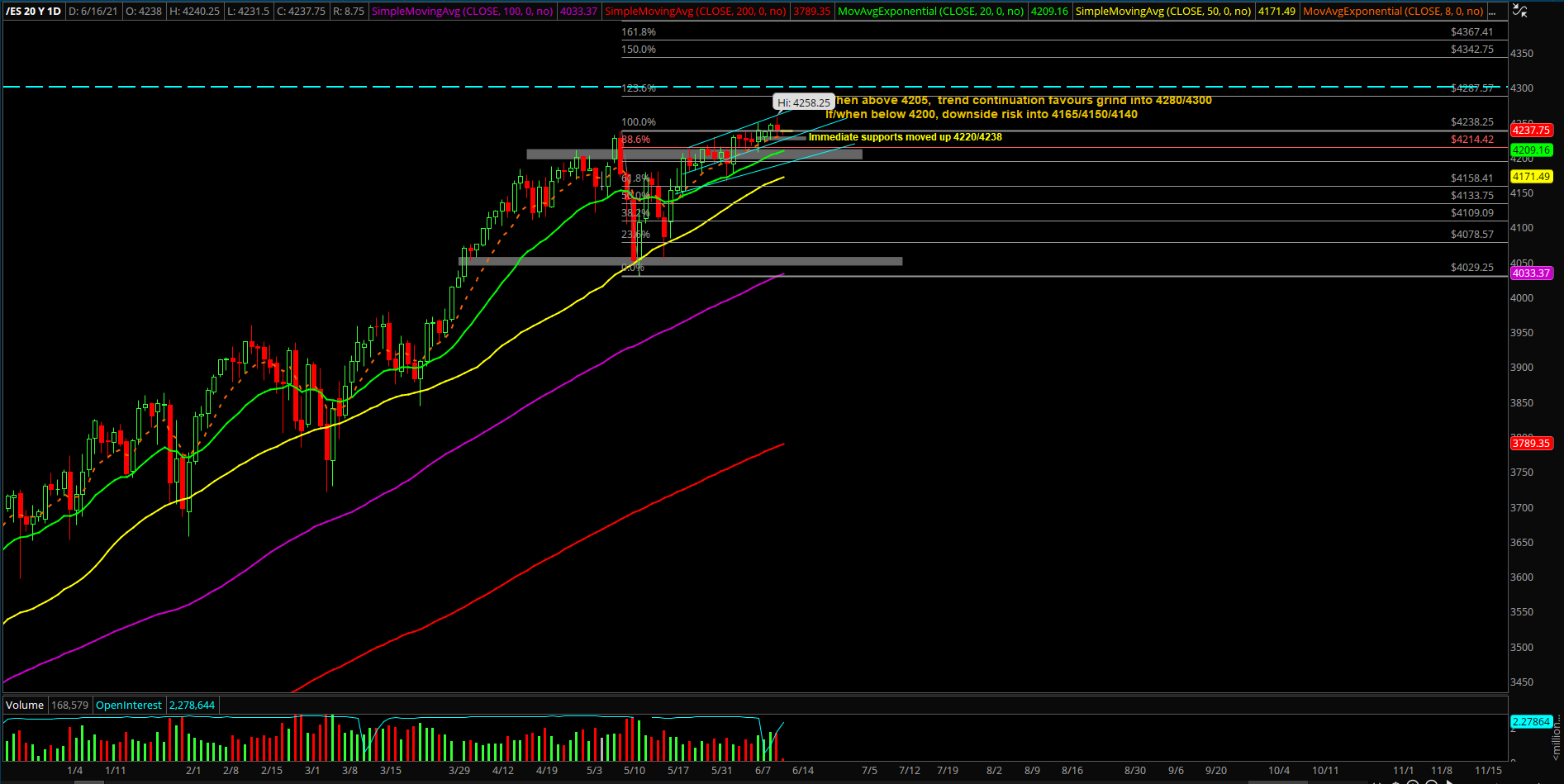

Slow Methodical Grind - Market Analysis for Jun 16th, 2021

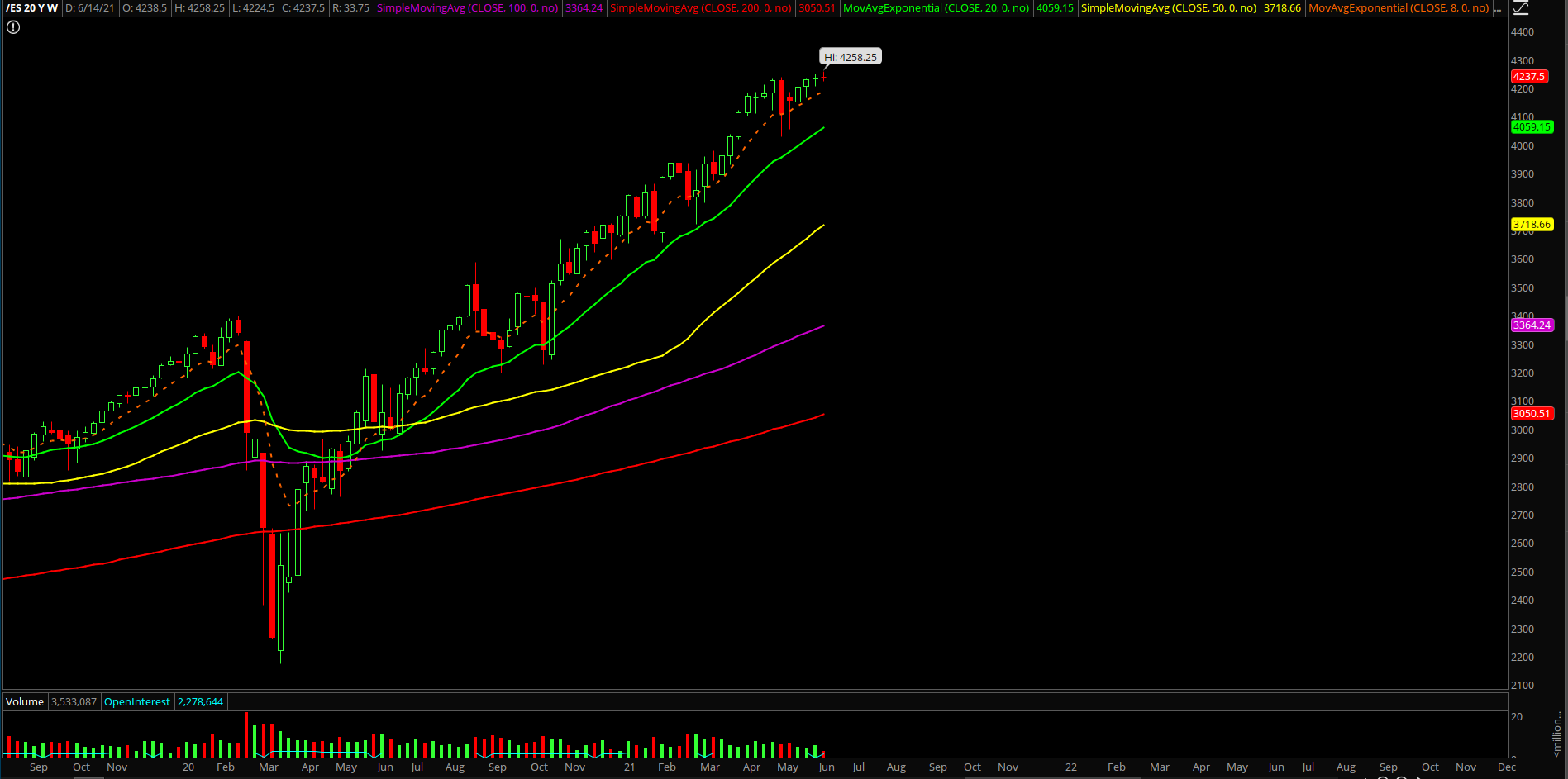

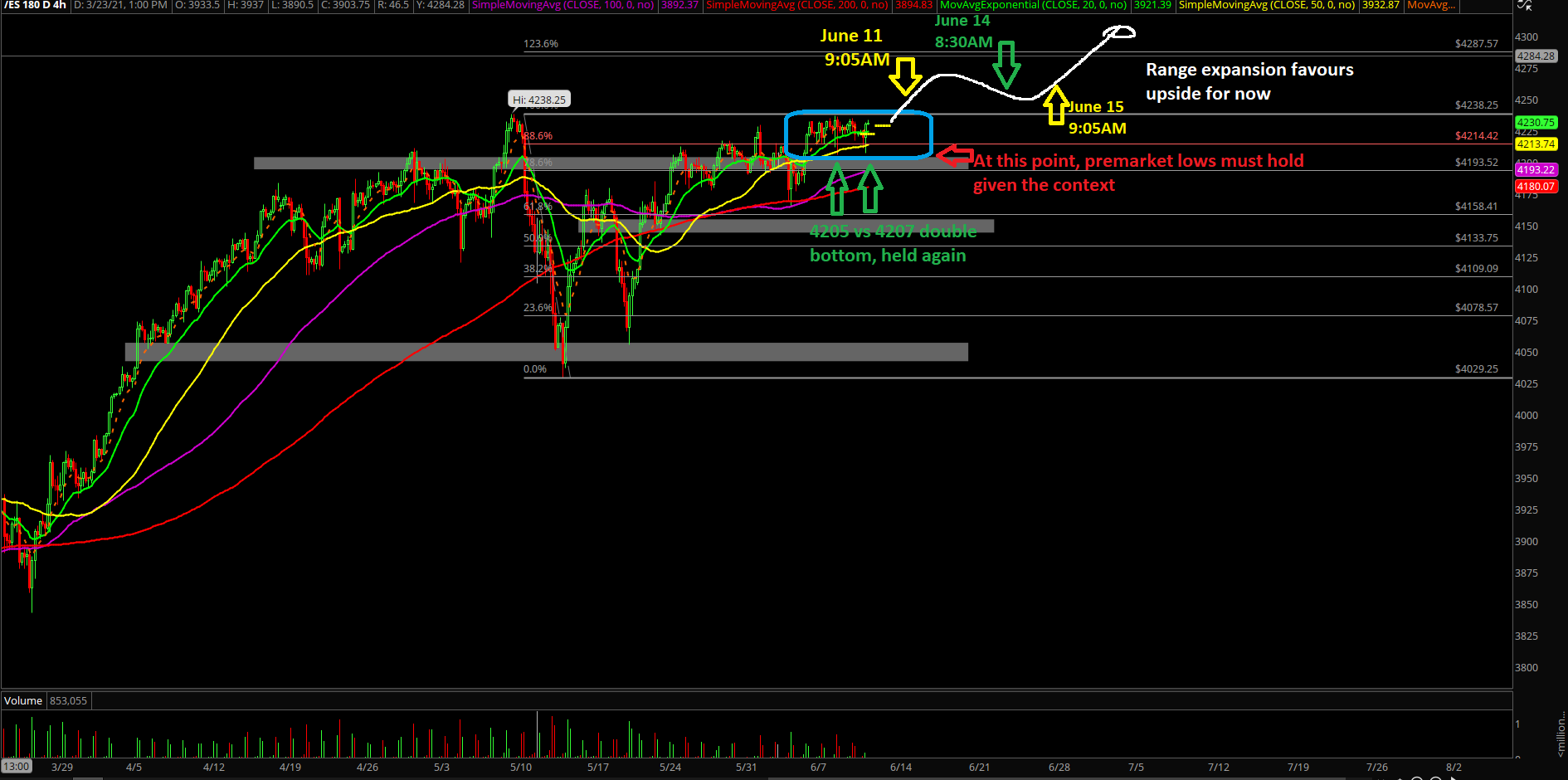

Last week fulfilled our continuation targets at 4238 and 4250 on the Emini S&P 500 (ES), with the slow grind up. Last week also fulfilled our bonus RTY targets at 2320 and 2350, NQ target at 14k.

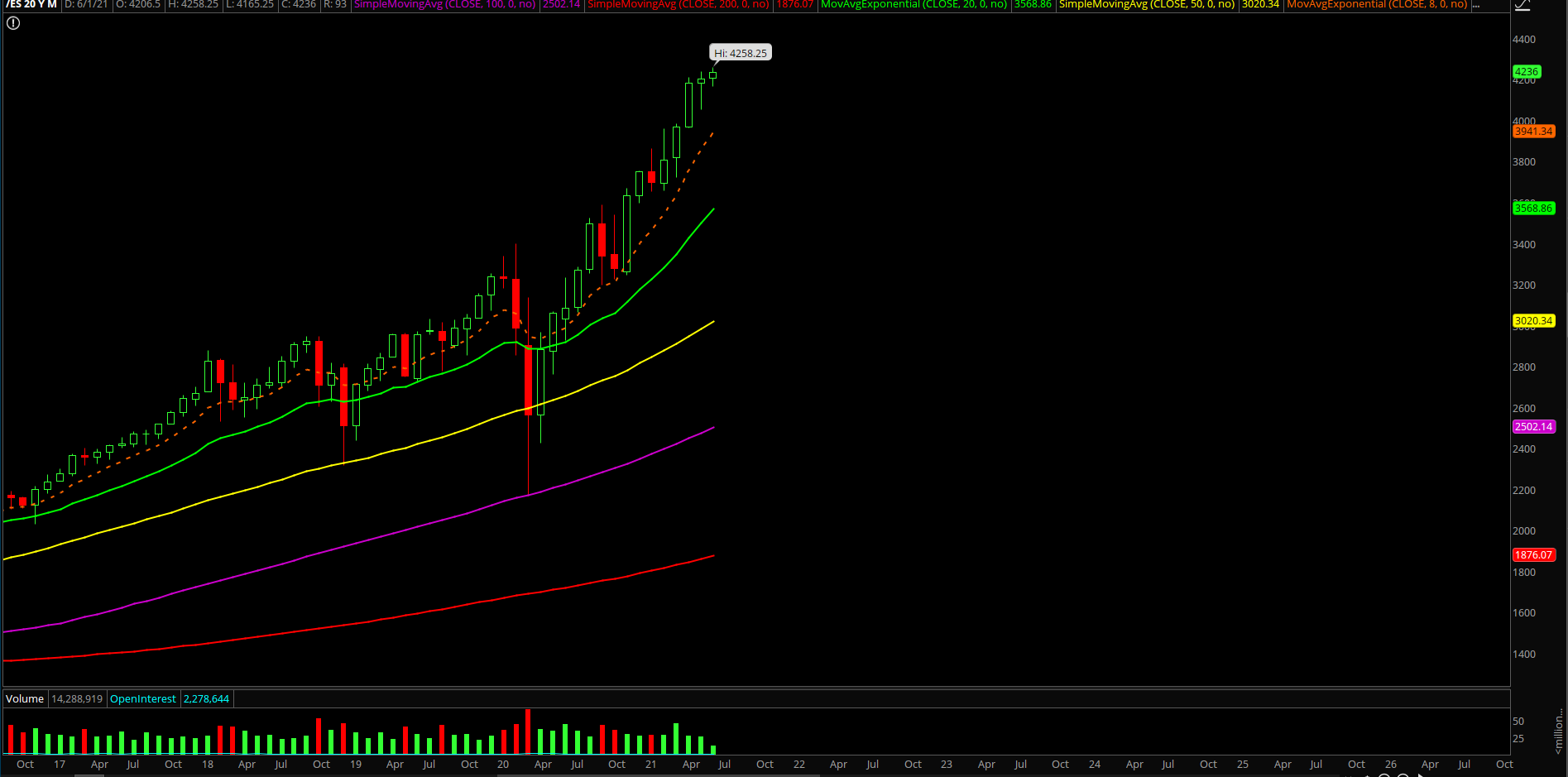

We’re expecting more of the same slow methodical grind this week as the price action and volatility dried up until price action proves otherwise. We still need to be mindful of mid June-late June weak seasonality as sentiment could change in an instance by price action confirmation/reversal.

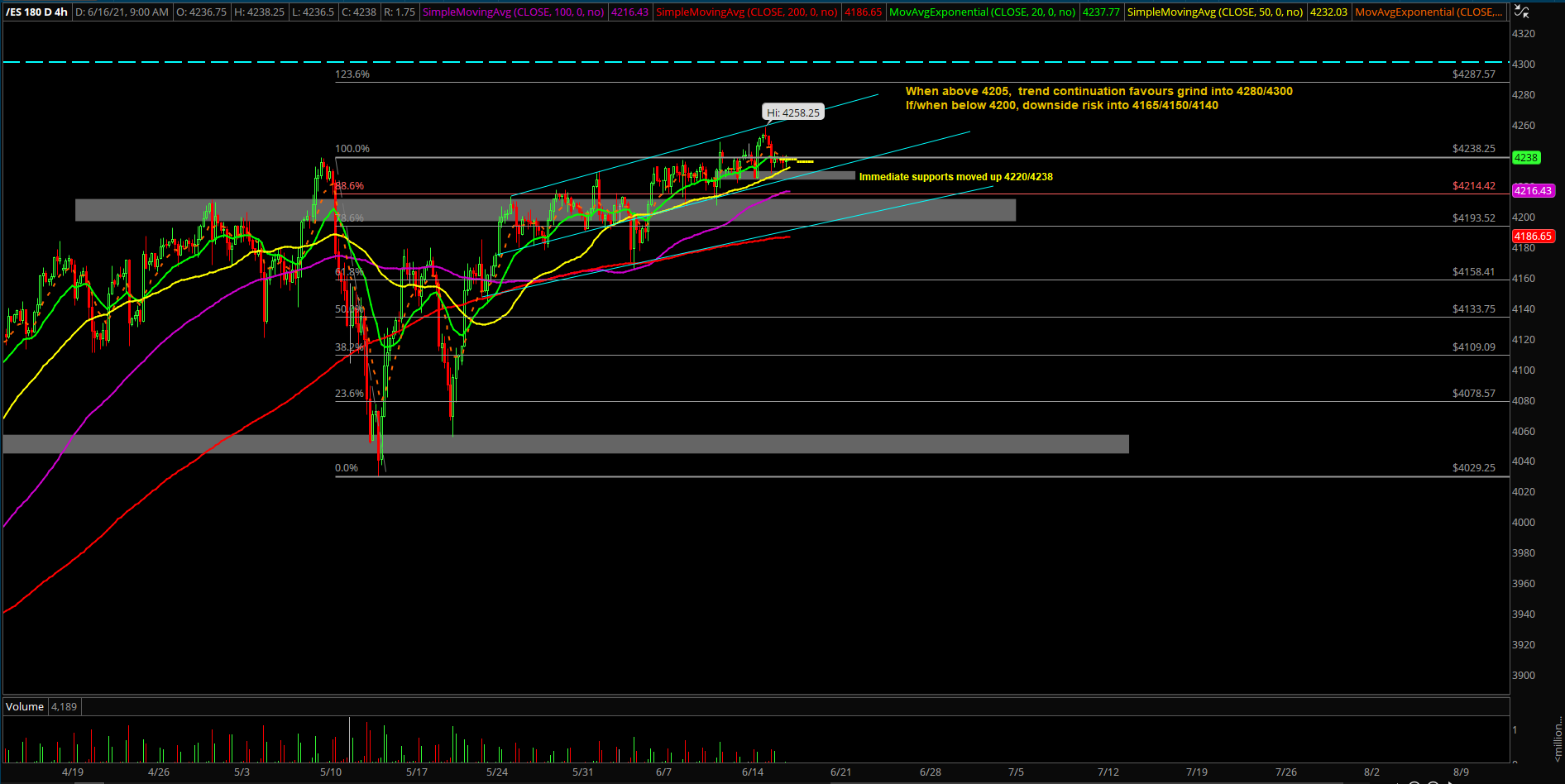

Going into this week, our parameters were that when above ES 4205, the grind favors 4280/4300. When below 4205, downside opens up 4165/4150/4140. At this point, immediate supports have moved up to 4225/4238 given the early week movement+existing context.

If/when below 4225 would be your first confirmation of weakness, adapt accordingly. For now, last week’s 4hr white line projection remains valid as grind up continues toward around 4300.

Today is FOMC day so expect head fakes.

Bonus: keep close eyes on RTY as it could outperform as it gets out of its multi-day bull flag.