Silver’s Time To Shine

While silver is pushing into the minimum expected target region we set a while ago, I cannot say that this changes much in the analysis. I am still uncertain as to which of the paths silver is going to take higher, as this is just a 5th wave in all the potential paths I have posted. And, yes, I still expect a pullback. But, as the analysis presented over the last week noted, I am still not sure how deep that pullback will be. And, based upon the depth of the pullback, we will have a much better idea as to how high silver can travel in its larger 5th wave.

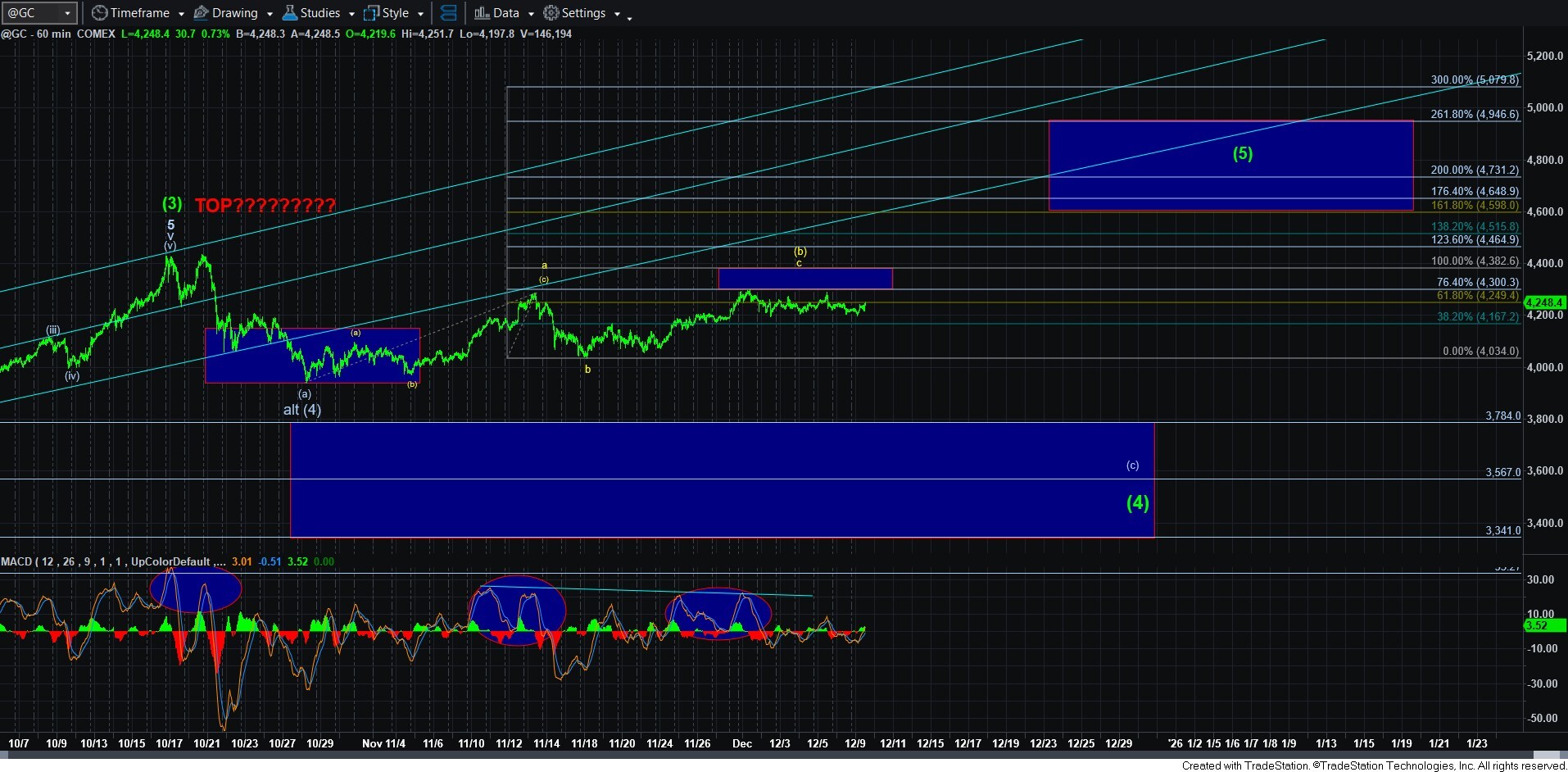

Interestingly, both GDX and gold still maintain below the recent highs. But, there is still a reasonable interpretation that can push GDX back to the 86 region unless we see a clearly impulsive break down below yesterday’s low. There is still also a reasonable interpretation that can push gold into its resistance box for the alt 5 as well, until we see a clearly impulsive break down below yesterday’s low as well.

So, overall, not much has really changed in the picture, other than silver pushing a bit higher within this current wave degree.

But, I want to reiterate something I have said soooooo many times since before this bull market in metals began. The best way to ride a metals bull market is with a core position and trading around that core position. And, by no means, should anyone be shorting silver. Yet, I am seeing some people posting about how they are losing money shorting silver. And, it just makes me scratch my head. Yes, there will be pullbacks in silver, but they are buying opportunities, not ones to short. I am not sure how many more times I can state this.

And, if you feel the need to add hedges to your portfolio, you usually focus on the weakest of the charts, which as I have noted a number of times as well is the gold chart. As long as gold does not exceed its resistance box on the 60-minute chart, I full expect a (c) wave decline.

As for me, I have sold all my SLV aggressive positions that I bought during the July dip other than the September 2026 dated calls. I will likely hold those and simply add on the next pullback, and I will likely add in stages for the yellow 4, the blue 2, and if we get it, the green (4) even more.