Silver Will Never Come Down Again

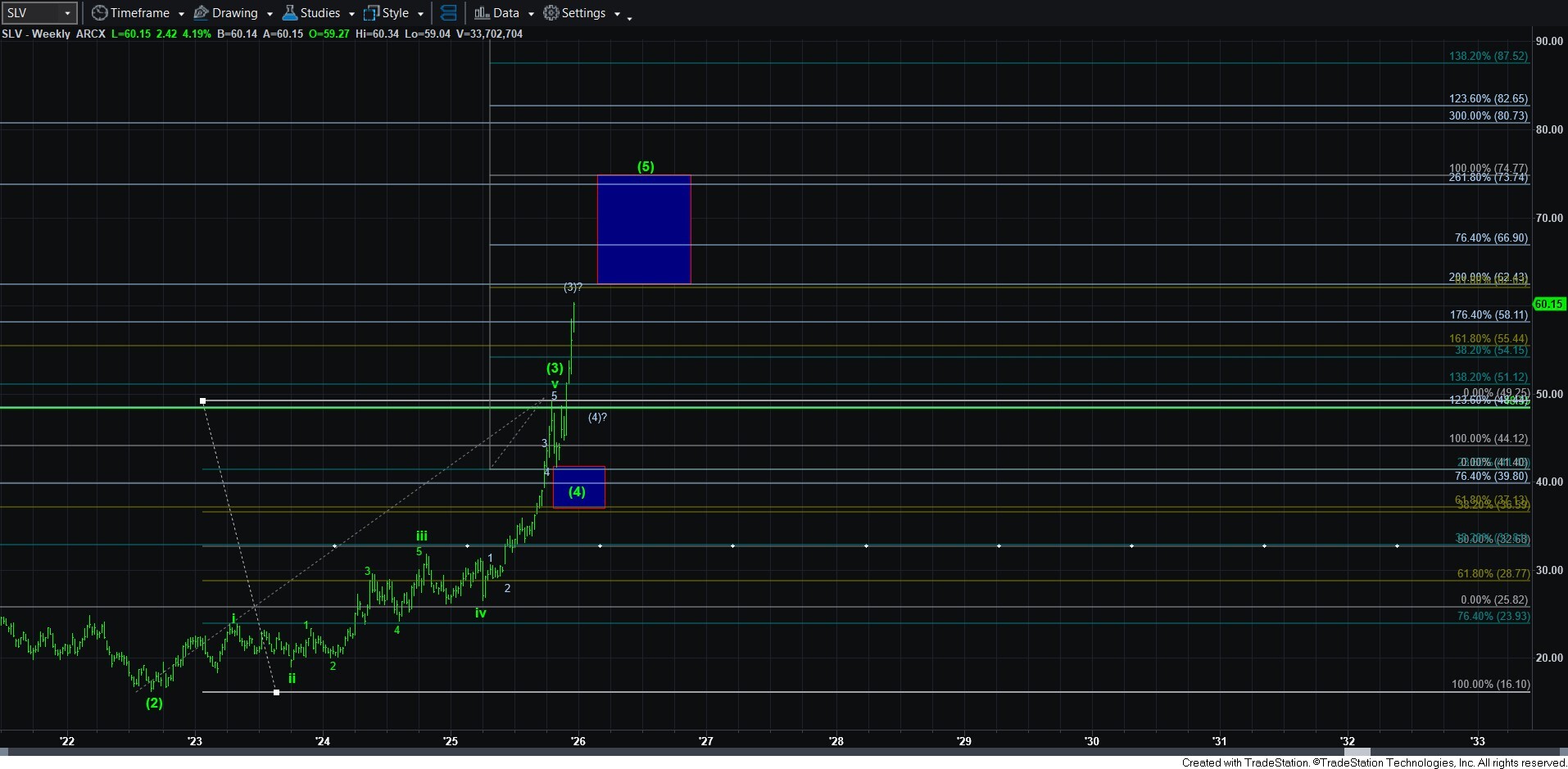

The way the silver rally has extended, it sure feels like it will never come down again, especially as many are now suggesting targets of $200 in the near term for silver. But, needless to say, the wave structure is rather full – and then some – for this segment of the rally. And, I still am expecting one more pullback before the final phase of this rally likely takes hold. Yet, for now, after cashing in some of my shorter dated aggressive long positions, I am still holding my final aggressive longer-dated positions (all bought near the October lows, as announced in the trading room) and will simply add to them on the next pullback.

In the meantime, silver continues to push towards the next major hurdle in the 70 region. In fact, silver is even only a few dollars away from the long-term target we set many months ago for this 5th wave in this long-term rally. And, it should begin to raise some caution for some. While we are not likely at the end of this cycle yet, I believe we are clearly getting closer.

Yet, the question is where are we in the smaller degree wave structure?

I am sorry to say that I still have the difficulties I outlined in my prior detailed analysis of the smaller degree structure. However, I can add that I think the blue count has become less likely as this rally seems way too disproportionate for it to be a 5th wave of wave 1. So, I am looking to the alt 4 in yellow as well as the larger degree (4) as the most likely resolutions for the next and likely final pullback.

I am also taking the same step by step approach to adding to my long positions, starting at the yellow wave 4 box. But, in order to see that pullback as likely taking shape, we will need to break down below the 62 region.

GDX still looks best as only a (b) wave rally. So, I am going to be watching for a clear 5-wave decline structure in the coming days. And, until I see that signal, I am leaving the alternative in blue on the chart. But, keep in mind that it is still likely that a larger 4th wave is going to be seen before the 5th wave takes hold.

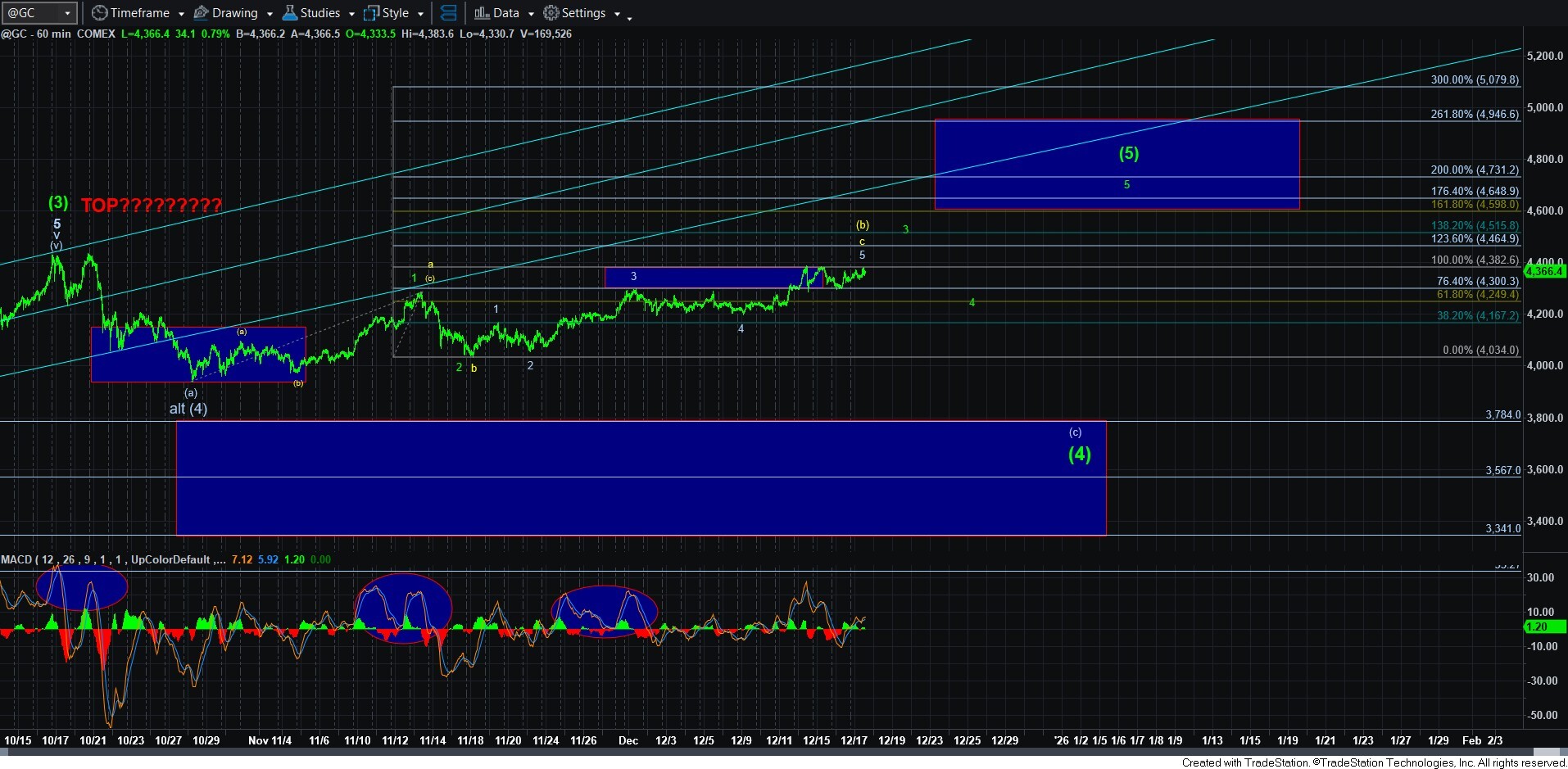

Gold is still struggling at resistance. And, I can still view us as attempting to complete its (b) wave and am seeking a 5-wave decline to suggest that the (c) wave down has begun. But, as I noted, should we see a break out towards the 4460+ region in the coming days, then the resolution of the count will depend on the nature of the decline from that higher region. Should that decline be impulsive in nature, then I can still assume a higher (b) wave top with a (c) wave having begun. However, if that decline is clearly corrective, then I will have to adopt the green count presenting as an ending diagonal for wave (5) in gold.

Recently, I did an interview on KITCO, much of which I said should be no surprise to any of you following my analysis for some time. But, it may give you a refresher on the broader perspective.