Silver Stretching Its Legs

As I just posted in the trading room as an alert, silver is finally trying to stretch its legs. But, I still think the evidence suggests this is a final move in this rally rather than the start of a new one. As I noted in the live video yesterday morning to the full-time membership, the last consolidation just below us really counts best as a triangle. And, we know that a triangle most commonly takes shape in either a 4th wave or a b-wave. That means that the move out of a triangle is most often the final move in a trending move whether it is a 5th wave or a c-wave. That supports my expectation for this being a final move in this trend for now.

Therefore, while I am not shorting it, I am looking for a reversal signal which would begin with an initial break below 35. But, please keep in mind that the bigger picture still suggests a larger move to the upside has begun. I am just expecting one more pullback in a wave (2) ideally. And, you can see that bigger picture from the older SLV weekly chart I have been presenting. I still expect that major break out which is why I am not shorting it. Yet, I think the evidence suggests one more pullback can be seen before that major move is in progress.

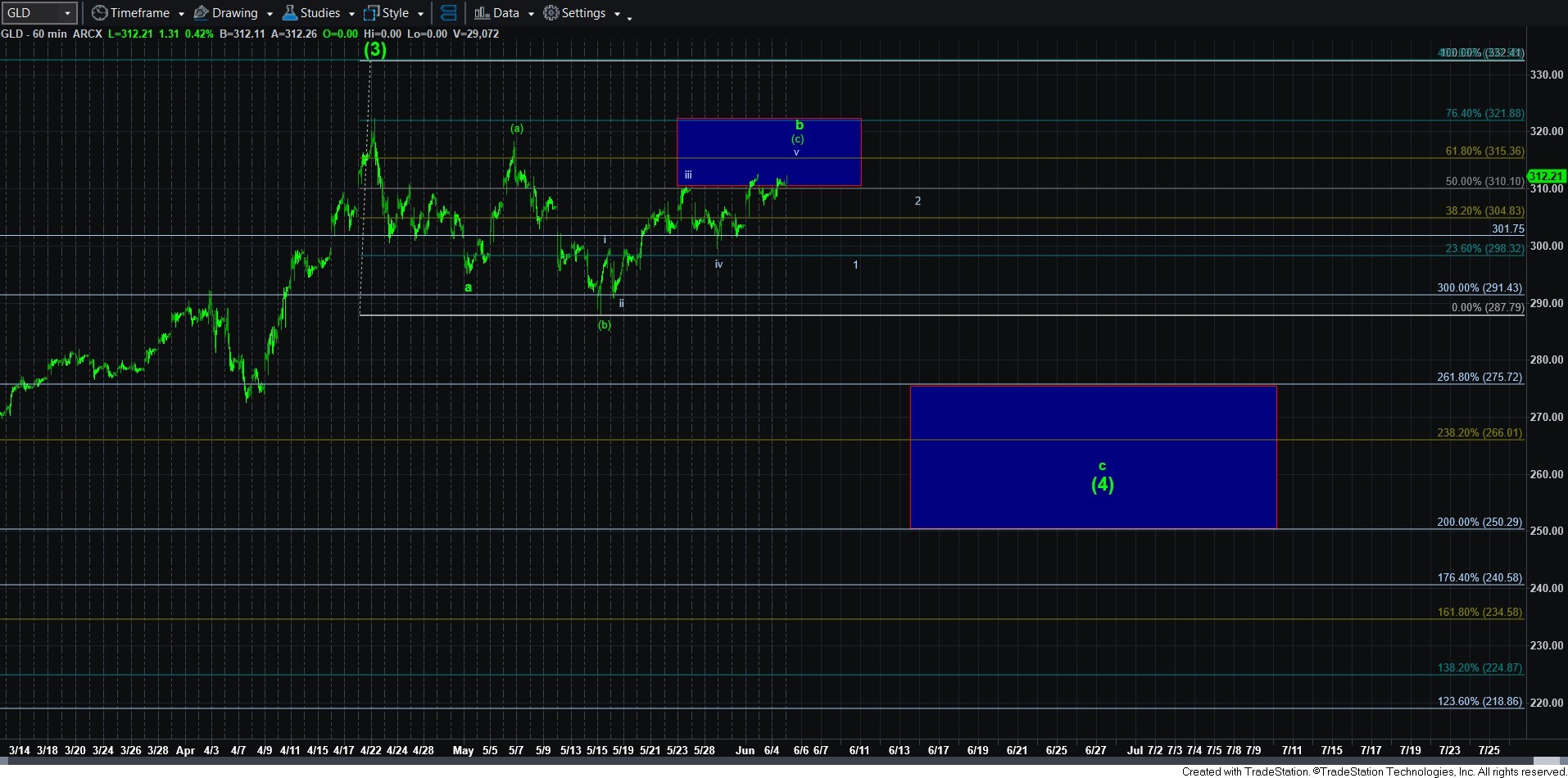

Along the same lines, I think GLD/GC seems to best count as a expanded b-wave structure. However, as I also noted in the live video, I would not be shorting this either until we see a CLEAR 5-wave decline, which would be wave 1 of the c-wave I ideally still expect. The same applies to GDX as well.

While I have been asked if it is “possible” that this is just an extension in the respective 5th of 3rd waves in both GLD and GDX, I still think that it counts best as an ongoing 4th wave for now. And, even if it is such an extension, it still suggests that a larger 4th wave will be seen before the final 5th wave rally is seen in earnest. So, I am personally not trading this aggressively to the upside and using it as an opportunity to reduce risk, especially in mining stocks which are reaching their targets.