Silver May Be Telling A Different Story Than GDX and Gold

Earlier this week, I outlined my support for silver in a potential wave [4] pullback at 24.75. Today, the market saw a small spike down to 24.72 and reversed quite strongly from there. Off that low, I can count a reasonable 5-wave move. Therefore, based upon only the silver chart, as long as today’s low holds, we seem to be setting up a rally projecting over 27. Yet, it would not surprise me at all if we extended through 28 on the next rally.

What we need to now see is silver complete a small wave ii pullback, and then break back over the high of wave [3] to suggest we are rallying to 27+ to complete wave [5] of [iii] of 3 of [3]. And, I think we would begin to see some larger than standard extensions once we break out over the high of wave [3].

Clearly, breaking below 24.72 opens the door to a more protracted 2nd wave pullback before the heart of the 3rd wave begins in earnest.

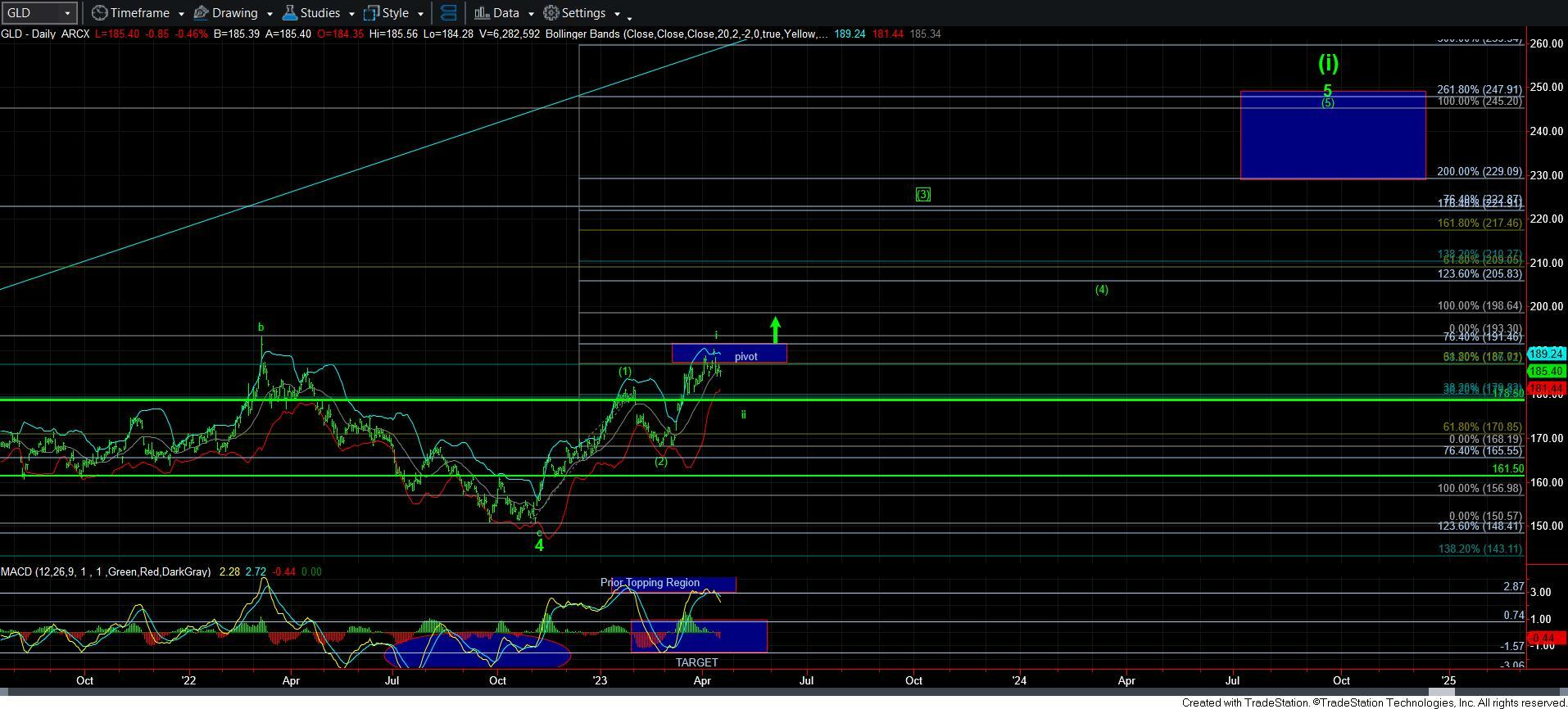

Yet, when I look at GDX and GLD, both those charts suggest that we can see more of a deeper 2nd wave pullback in the coming weeks. In fact, as I have been noting with GLD, the MACD struck its topping target and has now rolled over. Ideally, we should see more of a 2nd wave pullback as the MACD resets back to the target zone again.

So, clearly, we have a battle of charts going on now. And, I will say this . . . should GC take out the recent high and rally through its pivot, and should GDX break back over its recent high, then I have to abandon thoughts of any deeper pullback for their respective 2nd waves, and assume that we are already in the 3rd wave. But, for now, I am still retaining the potential for more of a pullback in at least the GDX and gold charts.