Silver Is Still An Issue

Yea, I know the market has been pushing through resistances of late. And, my account is rather happy as I have been net long for quite some time. But, that does not mean I am ready just yet to throw caution to the wind. There still are a few issues I need resolved before I am willing to jump on the bandwagon without my caution.

First, silver still remains in a bearish potential path. And, it is running out to time to catch up. I am really going to need to see some major upside break out action in the coming days to confirm the move in other parts of the complex.

Second, GLD is now at its pivot. And, as I said earlier today, I need to see us break out over the pivot, which would be a strong indication that we can be targeting the 220-230 region in the coming year or so. Once we take out the pivot, then the bottom of the pivot will become our support for an expected continuation higher. But, we will have one more test on the pullback after the break out to assure ourselves of the rally to 220-230.

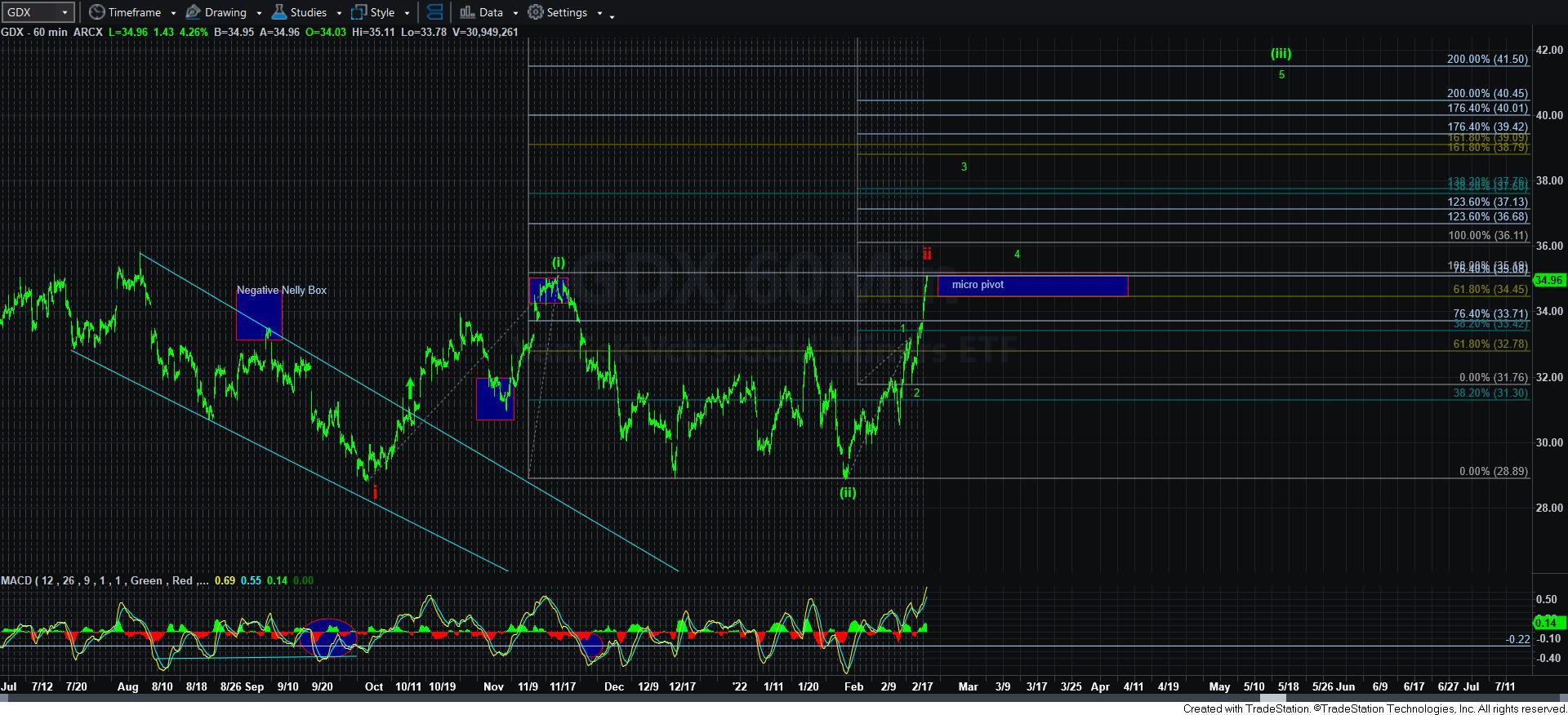

Third, GDX is now at its resistance. So, I will want to see GDX take out its resistance and then hold its pivot for a successful corrective pullback. It will then have me back into the bullish phase, even though I do not have a confident enough structure to play this in a leveraged manner. Sometimes, you just have to be happy with regular profits.

So, for now, we are on the cusp of confirming a major continuation rally. But, we have seen efforts before fail. I do not want to have this one fail as well. I want it to prove itself. And, once it does, I will avoid attempting to hedge my positions further more. The last two times have been a bust after many successful attempts over the last year and a half.