Silver Concern - Market Analysis for Sep 13th, 2024

I know everyone is getting excited about silver right now. And I do understand. But, with this extension in what we are counting as wave 3 in this rally, it has brought a concern to the forefront, of which you must be aware now.

I know I have not been a fan of the alternative count for that lower lower in wave 2, which I have presented in yellow, but with this extension, we are seemingly going to approach a potential (a)=(c) off the recent lows. While silver can still provide us with a (1) which is at the 1.00 extension of waves (i)(ii), if we top EXACTLY at that point, it should be a STRONG concern that it is the alt b wave in yellow, pointing us down towards the 27 region for the bigger wave 2.

Again, this has not been my preference and I have kept it as an alternative - and correctly - to date, but should we top at 31.73 ((a)=(c) level), and turn down in a micro 5 wave structure, I will likely be playing this for a larger c-wave down.

I just wanted to give you a heads up about this scenario for you to prepare emotionally for this potential should it develop.

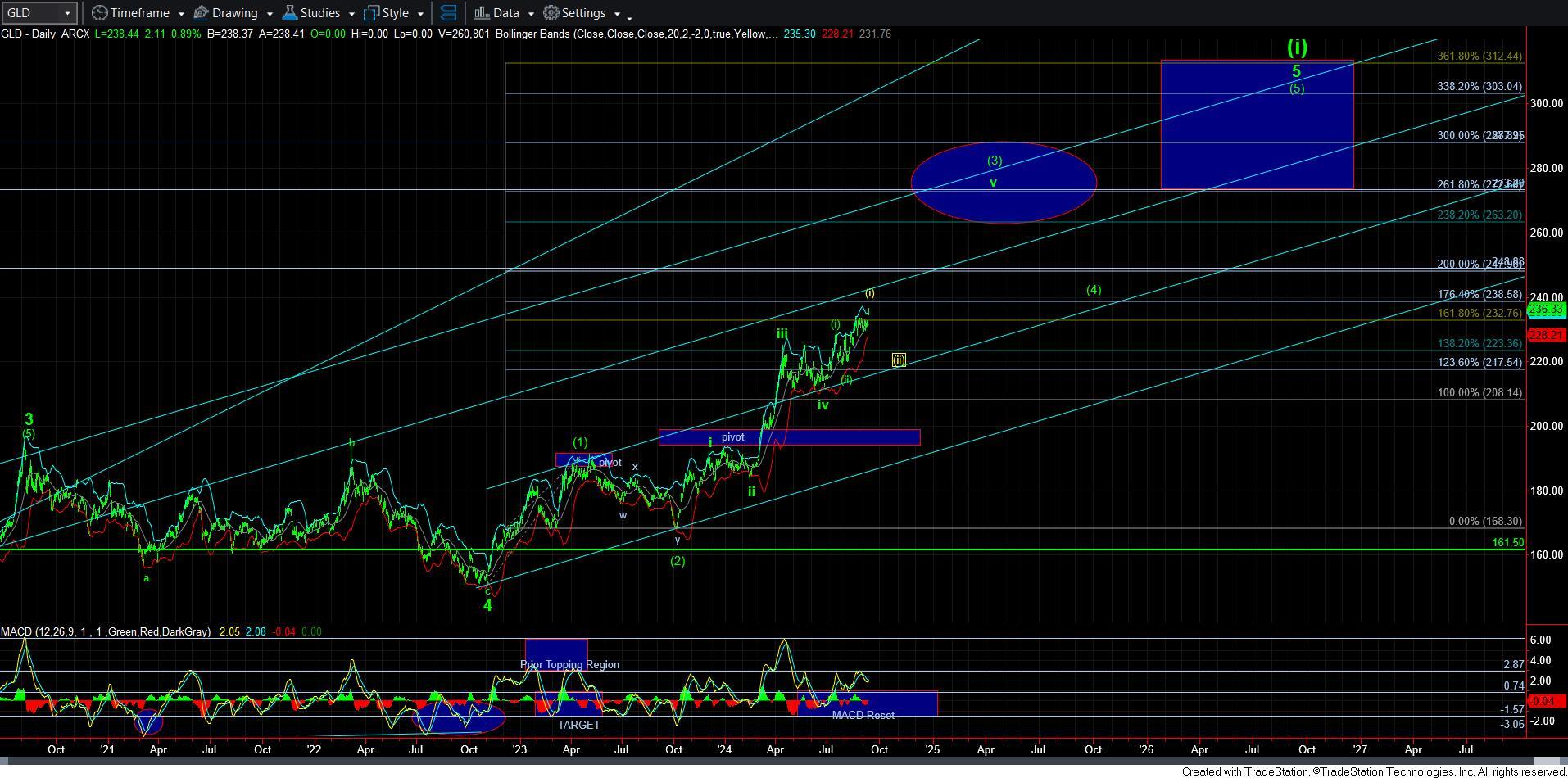

This would align with a yellow count in GLD, which would be a (i)(ii) in an ending diagonal scenario, and the c-wave of wave (ii) in NEM.

Of course, if we blow through 31.73, then we may actually be in wave (iii) of 3 already, and we are on our way to 37+. So, this will be a BIG test in the coming week or two in the metals, and will determine if there is one more pullback before the "fun" begins.

As of right now, I am not doing anything - and letting my longs run. But, depending on how the day progresses, I may be inclined to try some OTM protective puts just one more time.