Short Term Topping Potential

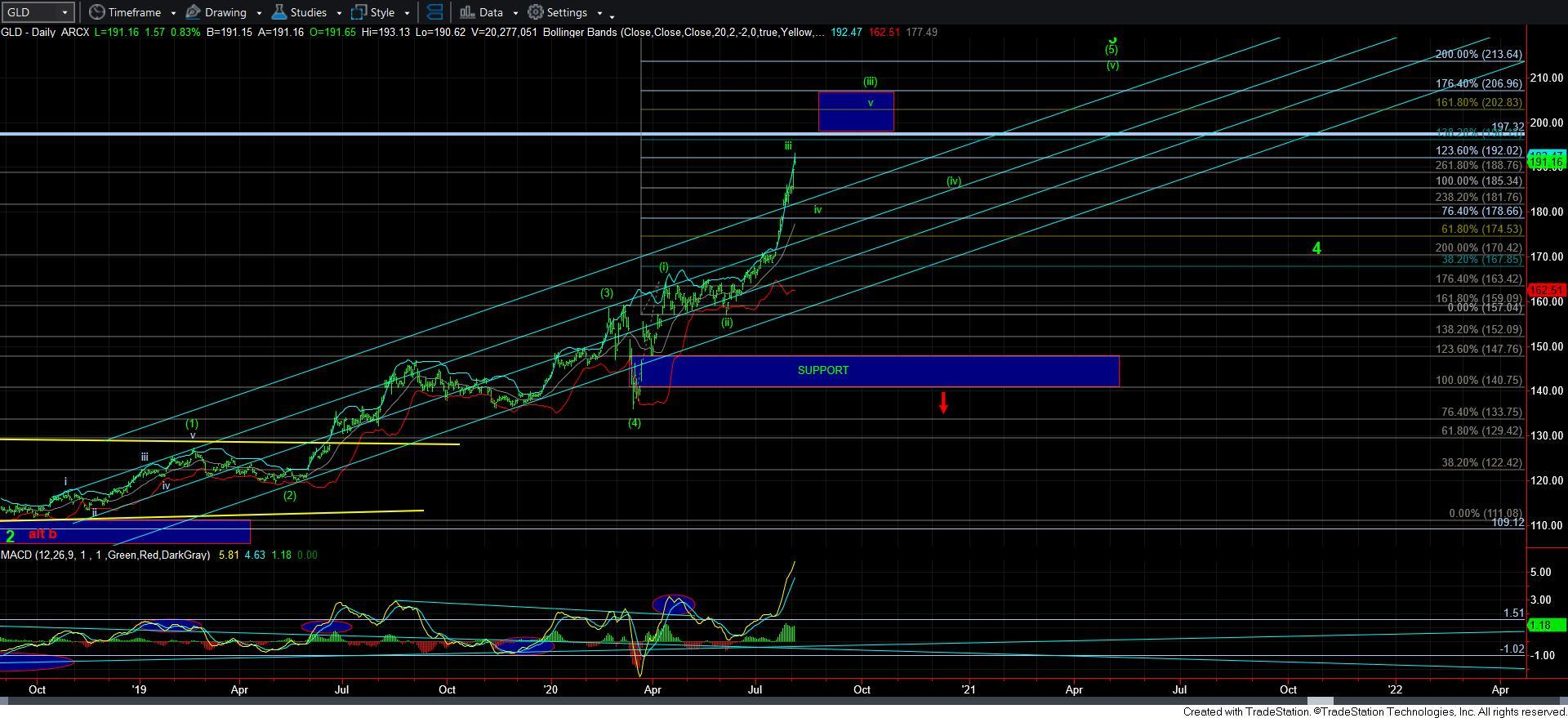

With GLD now moving into our next target region, which is for wave 5 of iii of [iii] in wave [5] of 3 off the December 2015 low, I am beginning to look for the next 4th wave pullback.

As you may recall, once the market proved that we were in the heart of wave iii of [3] earlier than I expected, we begin to set our upside target for wave iii for at least 192, with the potential to extend as high as 197. Today, we struck a higher in the 193 region, and I think there is one more push higher still to come before we begin the next pullback in wave iv of [iii].

Micro support for GLD is in the 190 region, and as long as we hold over that support, then I will look for that one more push higher to complete wave 5 of iii. However, a break down below 190 will begin to suggest we have begun wave iv.

The target for wave iv is in the 178/180 region for GLD. This will be your next buying opportunity in the GLD for a trade to at least the 202 region, but with strong potential to well exceed that target in the coming months.

As far as silver is concerned, while I expected a nice b-wave rally, we are really pushing the top for a possible b-wave in wave iv, as I have been counting it. While I can certainly be wrong about the micro count (which is why I have strongly urged that no one even consider shorting silver), that b-wave count really fits best with everything I am seeing, so I am going to still retain it even if we see just one more marginally higher high in the coming day or two. What would force me to adopt a count of being in a higher wave degree – wave v of [3] – is if the market actually heads up to the wave v of [3] target region of at least 27.80. But, in all honesty, this really still counts best as a b-wave within wave iv, as I have been presenting it thus far.

At the end of the day, the difference between these two counts is what the next pullback will represent in a buying opportunity. Ideally, I would prefer the next drop to be a c-wave in wave iv, as that would provide us with a nice entry point for the next rally in a completed a-b-c structure for wave iv. Otherwise, it would mean that the spike down we got afterhours in silver is all of the iv we got, and while I would not be surprised, it certainly did not offer an ideal buying opportunity. And, unless I get an ideal set up, I really do not move into leveraged long positions. Yet, anyone who has been following our analysis which has been looking for much higher levels in the complex certainly cannot complain if they were long “regular” stock positions.

Lastly, with regard to GDX, I have been having issues in identifying the appropriate micro structure, especially when reviewing the underlying miner charts which are at varying degrees of trend. So, after much consideration, I think I am going to have to view GDX as potentially topping out in wave [3] of 3. In fact, this count would align well with the deeper retracement I expect in GLD in the coming month or two, which also aligns well with the weakness I expect to see in the equity market for wave [ii]. While it certainly does not have to align, it would not surprise me if they all pulled back in unison.

In conclusion, I am expecting that we can top out near term in the various charts we are tracking, and I view the ensuing pullback as presenting us with our next short term buying opportunity for the next phase of the metals rally in the coming months. But, the one thing that sticks out to me is that I think the next rally in the complex will offer some incredible opportunities in some individual mining stocks, especially the ones which have not yet had a major 3rd wave take hold. Those will likely outperform as we look towards 2021. And, those are likely the ones that Zac and Garrett will likely be focusing upon in the coming months in our Mining Service.