Setting Up Another ATH Closing Print For Monthly Candle

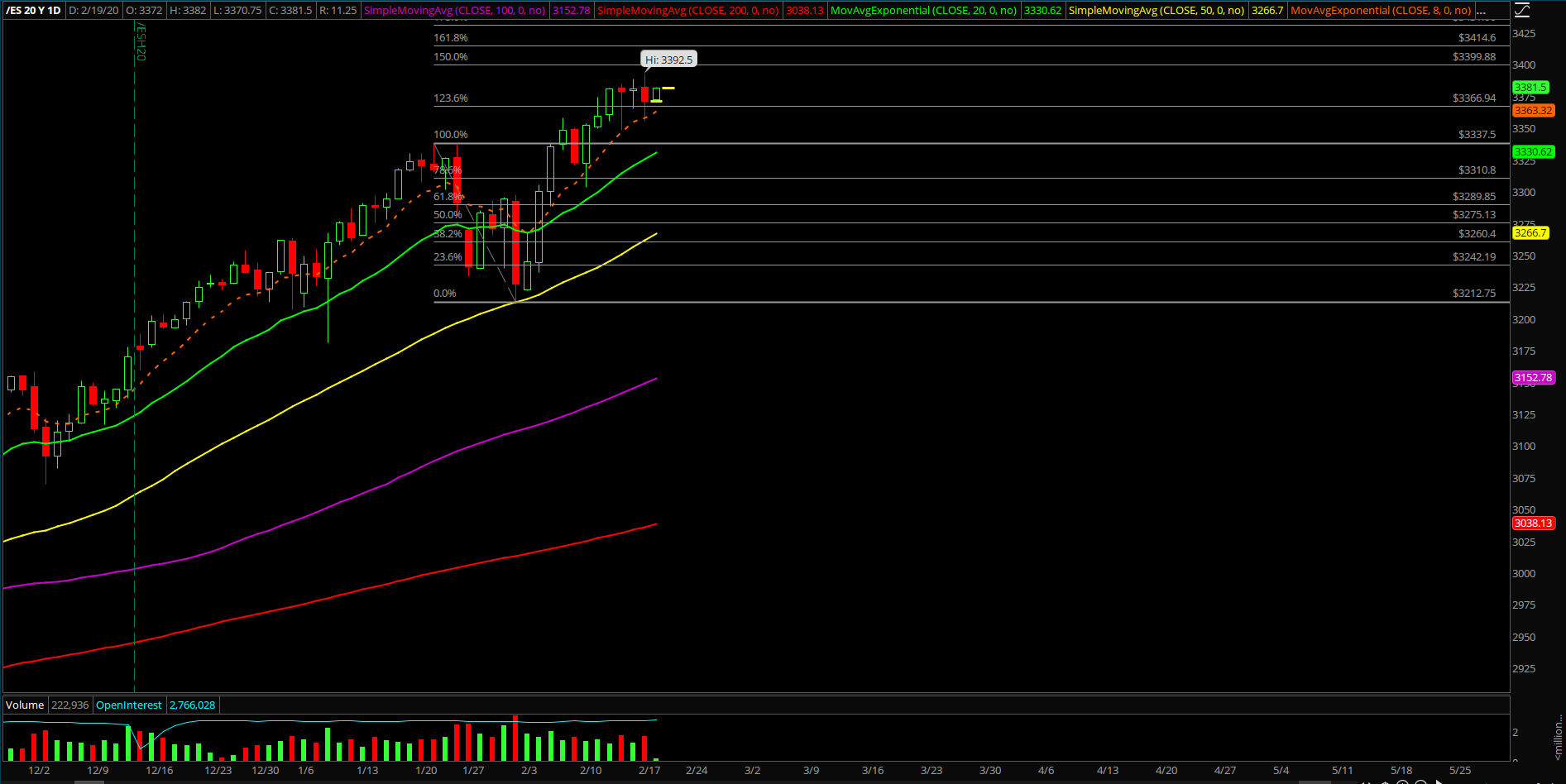

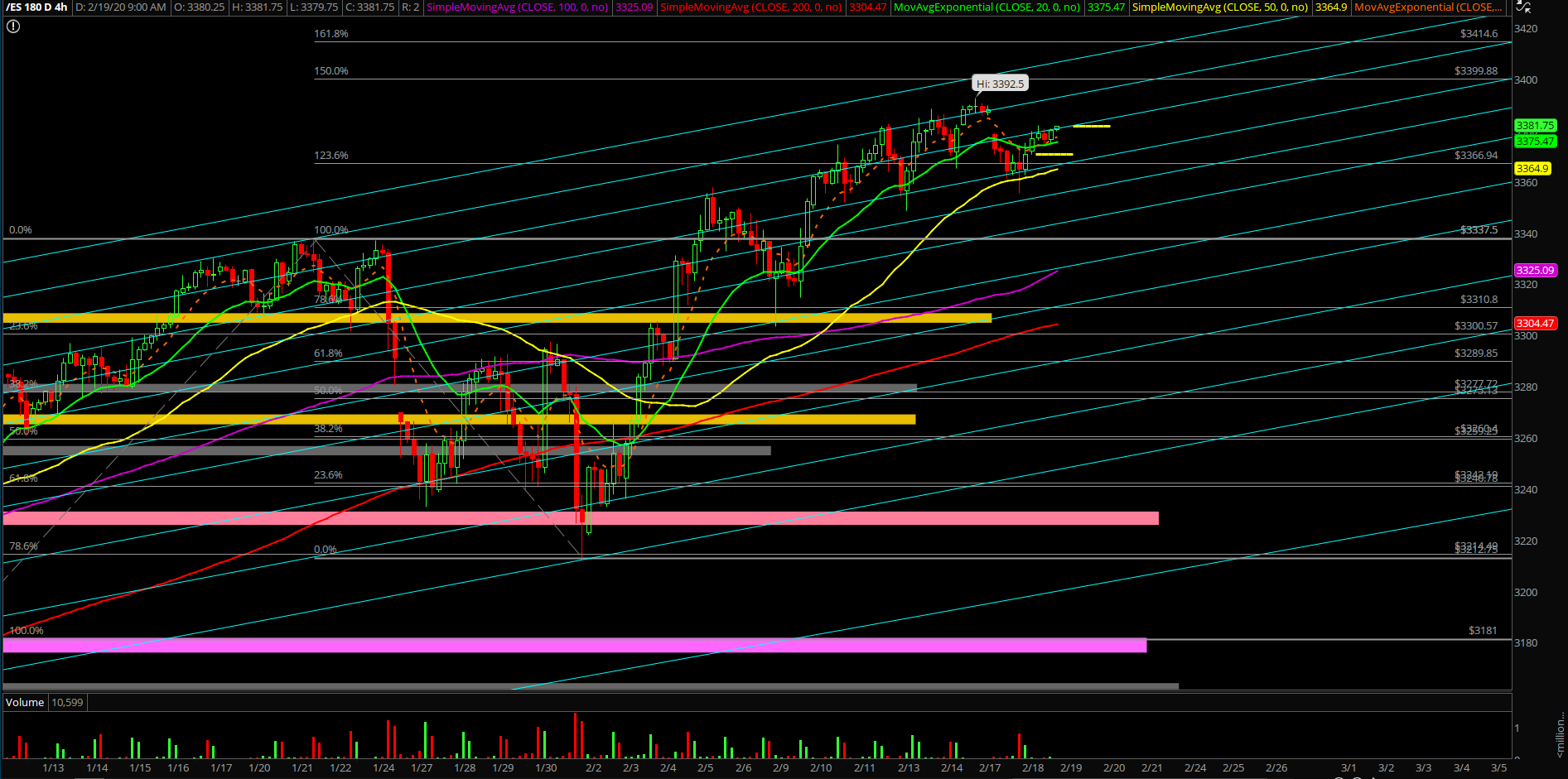

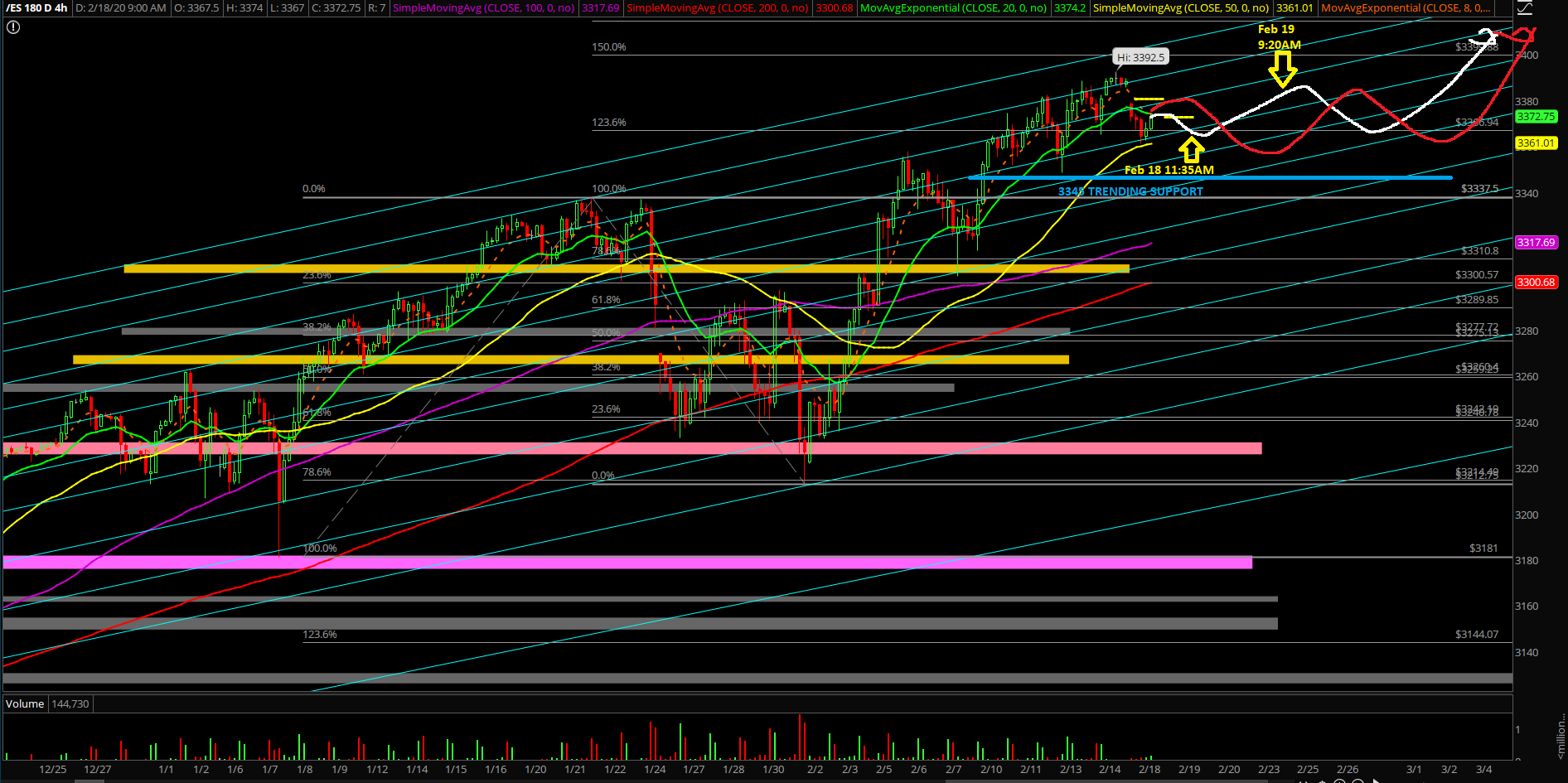

Tuesday’s session was just a typical predetermined range day where the price action dropped into the support zone and rebounded V-shape style. Essentially, it was the same $hit, different day (SSDD) as the key focal point was nailing the usual LOD setup during the morning RTH opening hours. If you recall, the price action just followed our 4hr beloved white line projection.

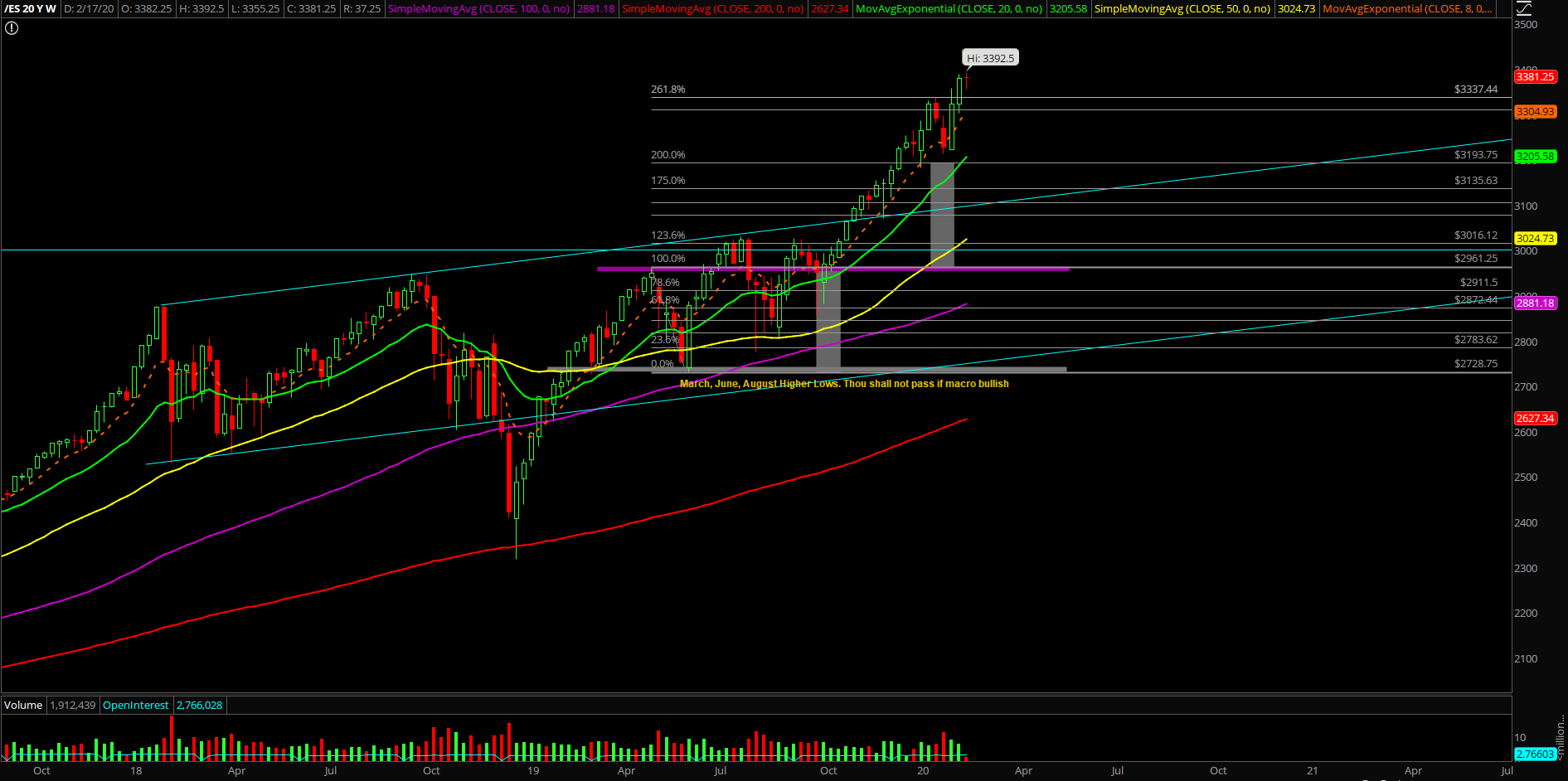

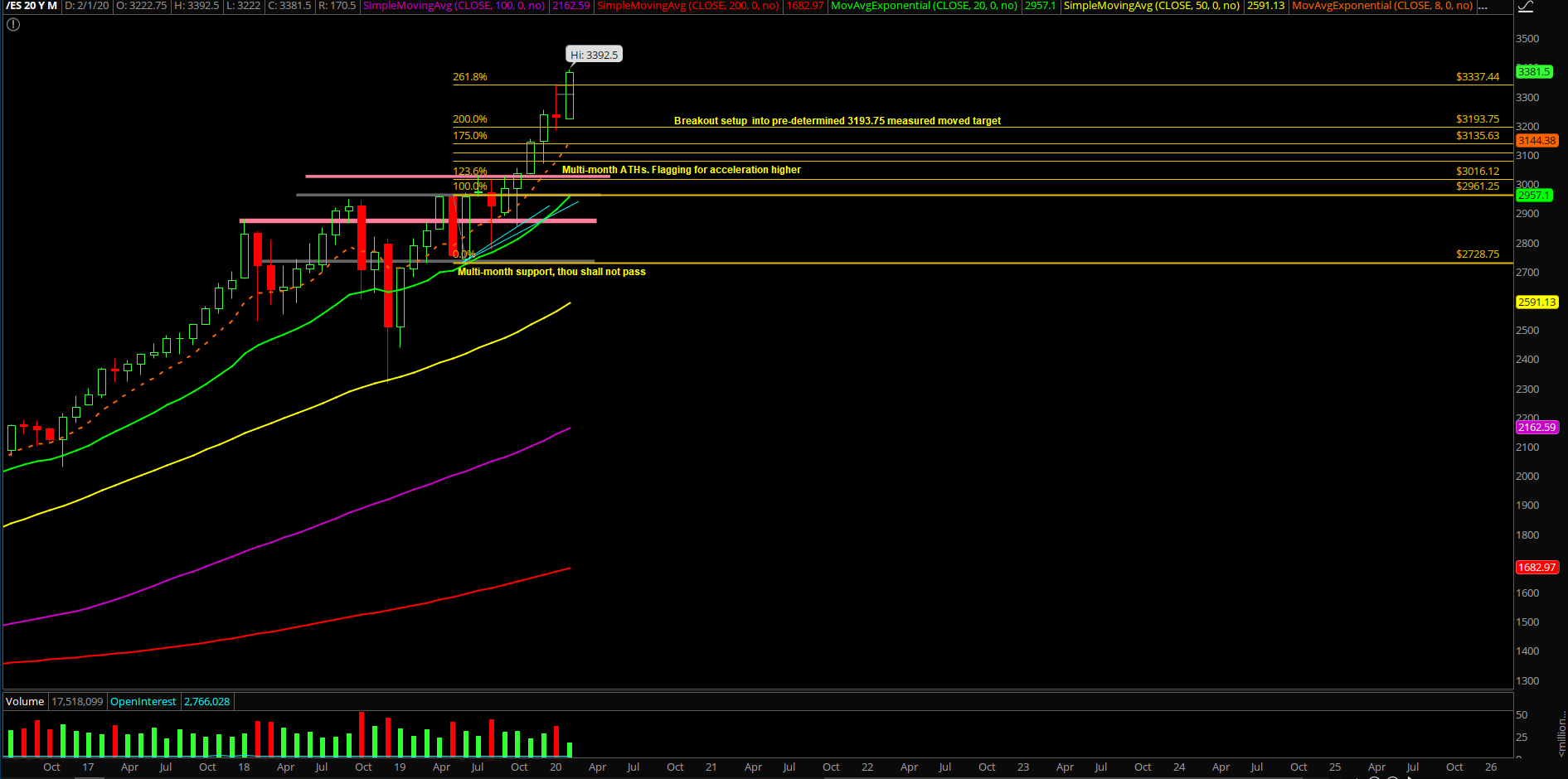

The current holiday/shortened week will likely be focused on stabilizing in a high-level consolidation the gains made from last week as we head into this Friday’s monthly OPEX closing print. Barring any big surprises this week by actually breaking support, it would likely set up for another all-time highs closing print for the monthly candle next Friday.

What’s next?

Tuesday closed at 3770.75 on the Emini S&P 500 (ES) and its low was sticksaved/held at 3355.25, the trending daily 8EMA support. (Not a coincidence given our ongoing short-term must-hold support level of 3345 derived a week ago Monday.) Traders should prime themselves and get ready for the monthly closing print in 2 weeks if price action remains this stable by grinding higher lows and higher highs every single day/week. The goal lines are crystal clear for the month-end print again for both sides given the context of the trending market. (Bulls want to wrap up at dead highs again and bears want to force a rejection setup/breakdown.)

Traders should take advantage of the daily 8/20EMA momentum when applicable due to the nature of leveraging the trend/bull train.

Here's our game plan:

- The market is following our beloved 4hr white line projection perfectly and it remains king until we see price action deviating from it or until the odds start to change. Note: the bull train can also go straight up (3400 and beyond) instead of forming another higher lows.

- Absolutely no changes to our thesis and overall game plan so repeat: still viewing this week as consolidation mode Tuesday-Wednesday and price action to attempt to at the per usual Friday highs when above support for the monthly OPEX print.

- Traders should utilize 3345 as the ongoing must hold short-term level alongside with 3360~ as the O/N reference point in order to buy dips against if/when applicable. Adapt if fails.

- As discussed previously, we trimmed a lot of short-term profits into the 3385/3400 continuation targets as our algo demonstrated its effectiveness during Feb 13’s predetermined 3350-3360 backtest support zone. Not much has changed; we still remain fully hedged for short-term purposes given the grind into 2 standard deviation highs and prior warnings in regards to the overall uber bullish portfolio approach as insurance is dirt cheap.

- Again, for portfolio approach, we’re staying hedged as of last Wednesday’s discussion vs. the highs by leveraging the asymmetric returns on lotto options across the board because insurance is fairly cheap. The structure/pattern/context is very similar to the Jan 20s week where we got paid heavily for our efforts(4x and 8x). Essentially, hedging when 2 standard deviation into resistance is definitely worth it if you’re in the same shoes as us managing an uber bullish portfolio

- Immediate continuation targets remain the same up at 3385 and 3400 and this is valid only when above 3345 which is near last Monday’s trending support

- A break below 3345 would be the first warning sign for short-term intraday pressure as it opens up a trend day down possibility in order to find more significant support levels

- Zooming out, the must hold daily closing print for the next few sessions is 3303.5 as the Feb 9th Sunday night low will act as the ongoing daily+weekly timeframe low for the foreseeable future. A daily closing price that breaks below that is a key warning sign as daily 20EMA has grinded enough upside (currently 3320s) to warrant caution across the board

- We must be aware that the first week of Feb’s low at 3222 that we’ve been using as a key reference point for momentum could very well be the month’s low already just like the previous 4 months doing the same structure. Same $hit, different day (SSDD)

- Absolutely, no naked shorting is allowed in full effect again, except if just hedging the uber bullish portfolio with lottos like a couple weeks ago when we mentioned. Reasonable hedging vs highs is perfectly fine if you’re in similar shoes like us since the start of Q2 2019 like us because throwaway lottos at key points do more good than harm.