Sentiment Speaks: Is Now The Time To Fight The Fed?

In my last article, I outlined my views of how we have fought the Fed many times in the past and won. My basic premise is that the market changes direction well before the Fed, and the Fed simply follows the market. And, if you look at it from a historic perspective, you will recognize the truth in that statement. In fact, we have been able to use this perspective to "fight the Fed" in the DXY and TLT a number of times over the last decade that I have been writing publicly.

Back in the spring of 2011, I outlined to those that followed me that I was looking for a bottom in the DXY in the 73 region, and expected a multi-year rally to the 103.32 region. That was an expectation for a 40% rally in the DXY, which is an extremely large move in the DXY.

But, what made this market call that much more outlandish at the time was that this was during a period of time when the Fed was engaging in aggressive quantitative easing. If you remember that period of time, the market was absolutely certain that QE was going to make the dollar crash. I was clearly told "you can't fight the Fed" by all those that thought my call to be nothing less than ridiculous.

Well, as we now know, the DXY bottomed at 72.70 in May of 2011, and proceeded to rally over the coming six and half years until it topped at the 103.82 level (50 cents beyond my long-term target), and then went into a 4 year pullback/consolidation, as per our expectations. So, I guess you can fight the Fed.

Another major example of our ability to fight the Fed was seen in November of 2018. At the time, the Fed was engaging in a rate raising program, and was deeply entrenched in its intention. But, as the TLT was approaching the 112/113 region, I outlined to the members of The Market Pinball Wizard that I was going to be a buyer of TLT in the 113 region. Again, I was told that the Fed was still raising rates and that you cannot fight the Fed. Well, as we now know, TLT bottomed at 111.90, and proceeded to rally into 2020 towards the 179 region.

In fact, I even outlined this trade in a blog post I made a month later on Seeking Alpha:

Don't Fight . . . Er . . . I Mean Don't Follow The Fed

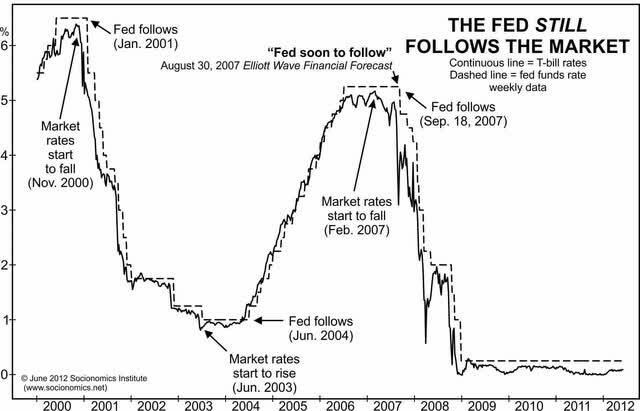

Now, for those of you that think the Fed controls rates, I have another surprise for you: The Fed follows the market. It does not lead it. And, if you don't believe me, maybe you will believe your own eyes:

The Socionomic Institute

So, in my last article, I was outlining that I saw a bottom developing in the TLT. Originally, my target was to bottom in the 100-105 region. But, as we now know, the market broke down below that initial support. Yet, everything I was looking at suggested that we were still in a bottoming formation. So, I sharpened my pencil, and provided a secondary bottoming target for the members of The Market Pinball Wizard in the 90.50-91.65 region. Well, as we now know, the market bottomed at 91.85.

Yet, when the bond market bottomed, almost everyone was convinced that bonds had much further to fall. Everyone was certain the Fed was going to push bonds so much lower. Yet, it seems the market had other ideas. But, take note, the Fed reiterated throughout the rally off the low that it was going to continue to raise rates. Yet, the market did not seem to care as we have now rallied 16.5% off the low in TLT.

If you think my math is off, you can check it yourself. The market has now rallied 16.5% off the lows despite the Fed continually reiterating how it is going to continue to raise rates.

But, I don't think this will be smooth sailing at this point. While I have my next target in the TLT in the 120-125 region, I think that we are due a pullback. As it stands now, support is in the 97.50-101 region. And, corrective pullbacks can be bought, with stops set below support, with our next higher target being the 120-125 region.