Sentiment Speaks: Big Bond Rally Is Coming Despite The Fed

The common refrain is that you "can't fight the Fed." Well, excuse me, but I do not agree with this premise. And, neither do the facts of market history. I think the better conclusion is that the Fed cannot fight the market, as the market is much more powerful than the Fed.

I can cite many examples throughout the years wherein we have fought the Fed and have won. I can cite examples using the US Dollar, the bond market, and the stock market. And, if you are interested in our successes in fighting the Fed (when most at the time told us we were crazy), you can feel free to read my articles from the past, and this is just one example:

Sentiment Speaks: I Fought The Fed... And I Won

In my last article on bonds, I was looking for the 135-support region to hold and provide us with another larger rally. However, as I outlined, if the 135-region did not hold, then it was a strong signal that the bond market had likely struck a long-term top, and we had begun a long-term bear market in the bond market. In fact, as I said to my members of ElliottWaveTrader, even if we did hold the 135 support, this was not a long trade I had any intention of doing since it was way too speculative. And, as we know, 135 did not hold as support, and the bottom fell out thereafter.

So, what does that really mean to us at this time?

Personally, I have no horse in this race. In fact, the last time I entered the bond market was when I bought TLT around 113 back in November of 2018, expecting a sizeable rally. As we know, the market rallied all the way to just under the 180 level before the market topped out. I have not been long in this market since we were approaching the top of that rally.

But, now that the market has seen a sizeable decline, I am seeing the bond market bottoming out and setting up a major rally over the coming year or so. While I do not yet believe we have struck "the bottom" to this decline, and that there is still potential that we drop down to the 106-109 region on the TLT, I believe that any further weakness will likely set up our final bottom in 2022 in the bond market. (But, please do consider that my primary view is that the next rally is likely going to be a corrective rally and will not likely exceed the highs struck in 2020.)

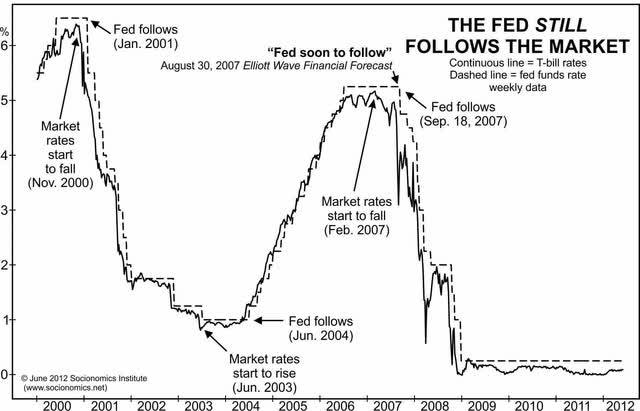

Of course, many will be viewing this analysis in light of the fact that the Fed is still continuing to raise rates. But, consider I put out a similar expectation back in November of 2018 when the Fed was also still intending on raising rates at that time. Yet, amazingly, after the market bottomed within pennies of our bottoming target back in November 2018 and then started its larger rally towards 180, the Fed changed its intentions several months later. So, you see, the bond market led the Fed, and not the other way around. And, if you look closely at history, you will see this is exactly how the bond market and Fed work. The bond market leads the Fed.

The Socionomic Institute

Therefore, the TLT chart is telling me that either the market does not care about the Fed's intentions, or the Fed is actually going to be changing its intentions over the coming months.

So, in conclusion, I am seeing a bottoming structure developing in the TLT, with our next support in the 106-109 region. And, when we break out through the 127 region, we should be on our way to the 150+ region over the coming 12-18 months.