Semler Scientific is Setting Up for Bruising

Semler Scientific: From Niche Medtech to Bitcoin Bet

Semler Scientific (NASDAQ: SMLR), a niche medical technology company, rewarded investors between 2017 and 2021 with a 100x return. Its flagship product, QuantaFlo, is a software-based diagnostic tool for detecting peripheral artery disease (PAD). Designed to aid physicians in early diagnosis and preventive care, QuantaFlo has helped Semler carve out a profitable niche within healthcare diagnostics.

Revenues increased from $6M in 2015 to $68M in 2023, but dropped back a bit in 2024. Margins remain healthy, as does free cash flow, but the latter has shown little growth in recent quarters. Perhaps that is what has encouraged the stock to correct since its 2021 peak.

But its product line, financials, and stock performance are not what have produced much of its media attention in the last year.

Semler’s Bitcoin Pivot

In May 2024, Semler surprised investors with a strategic shift: it announced that it had adopted a Bitcoin treasury strategy, converting a significant portion of its cash holdings into BTC. The company stated that it views Bitcoin as a "reasonable inflation hedge and store of value" in the current macro environment. Semler revealed that it had already purchased 581 BTC using existing cash on its balance sheet, with more potentially to come.

The move seems to be taken from the playbook of Strategy (once known as MicroStrategy), Tesla, and other companies that have put Bitcoin on their balance sheets. Bitcoin Treasuries (https://bitcointreasuries.ne) states that Semler has 4449 Bitcoin today.

A Trend That May Signal a Top

Strategy (MSTR) was the pioneer of the corporate Bitcoin treasury model. Under Michael Saylor’s leadership, the company transformed from a sleepy business intelligence firm with declining core business revenue into a Bitcoin proxy. Strategy filled a warchest with Bitcoin via financing with convertible debt. That warchest is believed to be 589,000 Bitcoin today, worth $116B as of writing.

Since Strategy has enjoyed healthy stock valuation since kicking this strategy off, many other companies have explored the opportunity. Some have started to execute.

Is Bitcoin Near a Top?

I’ve made the case before—most recently in my article, ‘Bitcoin: The Last Opportunity of 2025,’ that Bitcoin is closer to a cyclical top than a low. I previously marked the low in early April near $74,500 and projected a rally to $125,000. And as of today, the market is set to make quick work of that target.

But while price continues higher, sentiment stirs into a frothy head. Pundits say the cycle is just getting going. And more notably, the Bitcoin treasury strategy has become a trendy corporate maneuver. This suggests that one should be cautious when jumping into new positions in companies because of this strategy alone.

The SMLR Short Setup

Technically, Semler's stock has exploded higher on the Bitcoin strategy announcement, doubling in a matter of days. The issue with the company moving to this strategy is that Bitcoin is rolling into a cyclical top. While many pundits argue that more companies moving to the Bitcoin Treasury strategy is how this cycle will extend, I see something very different at work.

Markets top when everyone who will get in, does get in. It makes no difference if ‘everyone’ is retailers en masse, or companies discovering a new shiny, strategic toy, for which they want to deploy vast amounts of capital. The sheer number of companies deploying this strategy of late should bring caution.

Further, when a cycle tops, we can imagine that some of these companies may need to sell Bitcoin during its decline to fund ongoing operations or capital investment. Such sales can create a reflexive feedback loop that leads to more selling by others, perpetuating a bearish move.

Based on the chart, it seems sentiment is turning on SMLR before the Bitcoin cycle. I don’t know if investors do not like the recent decline in operating earnings, although it has been small. Perhaps they are underwhelmed by the deployment of this treasury strategy. Regardless of the answer, the chart is set up for a large decline. I say that, knowing full well that to some, expecting a decline in Bitcoin treasury companies is anathema. But that perspective should be common near a top.

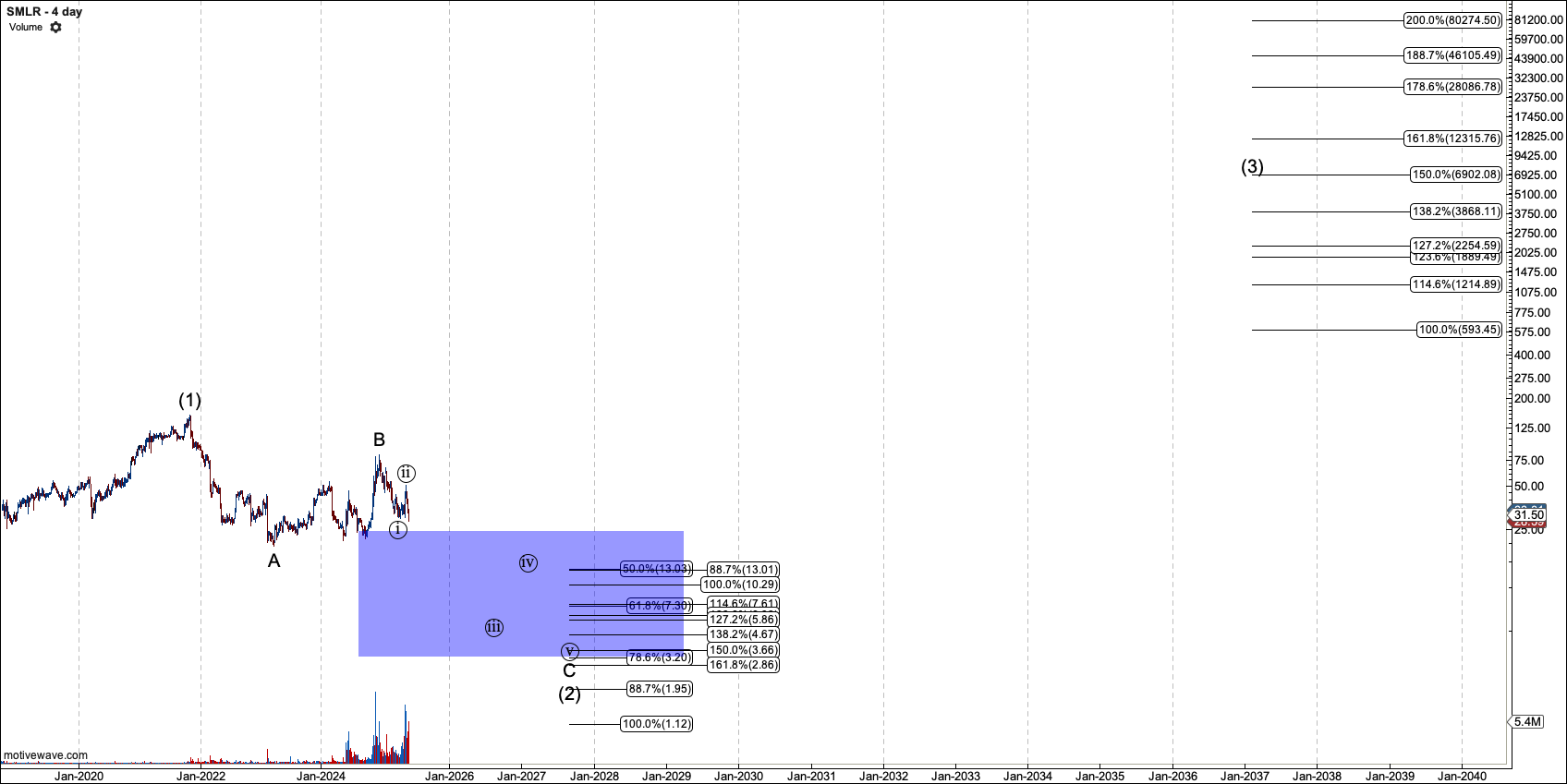

If we zoom out to look at the SMLR chart, with its all-time low at $1.12 in view, we find a clean five-wave structure into its $151 all-time high. Then an 88% decline ensued for over just one year into October 21. Since then it recovered but in a corrective rally, marked ‘B’, which failed with a five-wave move to circle-1.

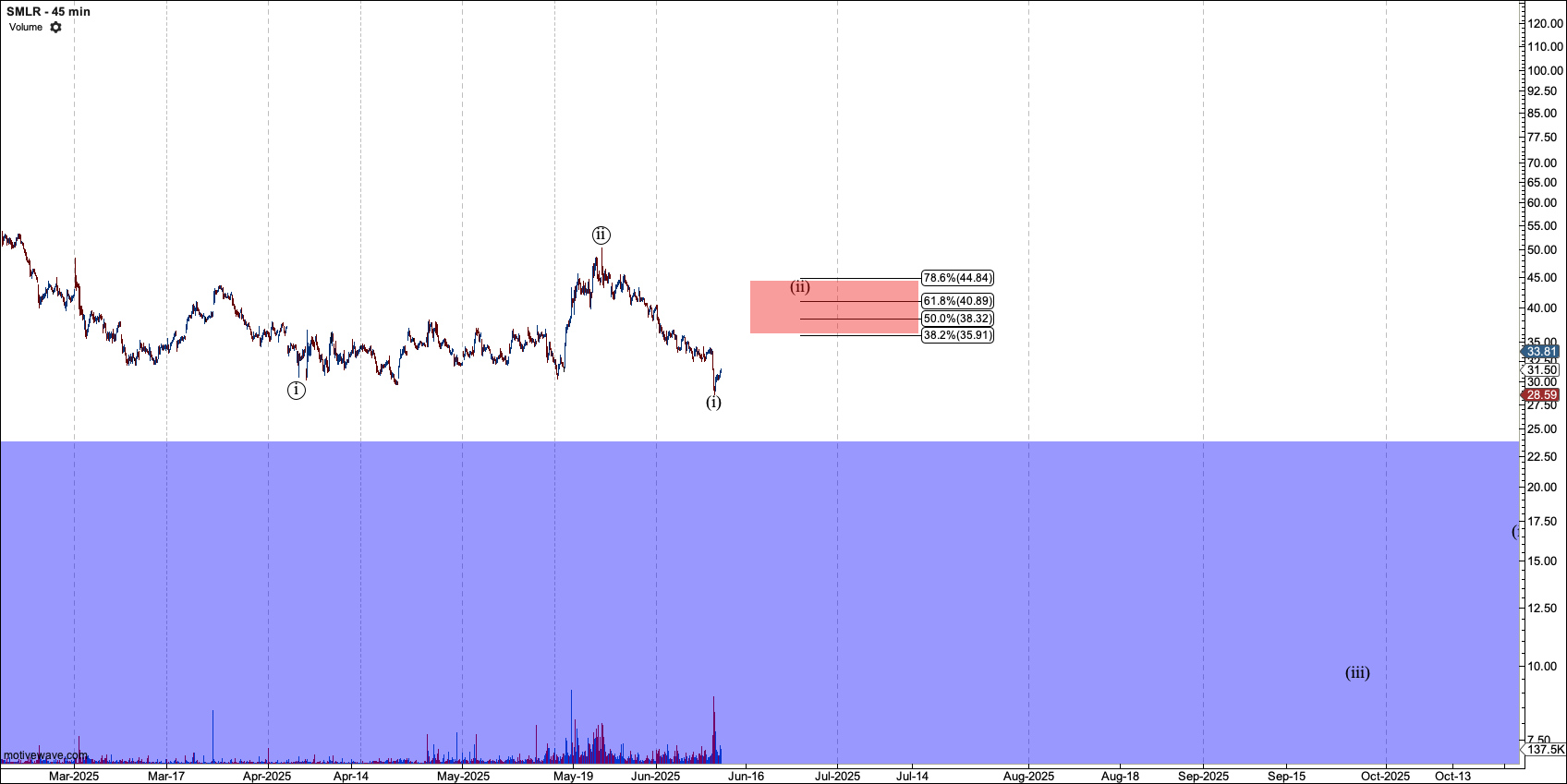

Then an even weaker rally took $50.44 before the recent low in wave-(i). I am now looking for a smaller corrective rally in (ii) which should not overtake $50. That will be our setup. If it breaks over $50, I will wait for another small serup to form. Regardless, over the next year or two, SMLR should fall to between $10, and $3.

Ultimately, the chart suggests the future is bright for SMLR. Its original five-wave structure into $151, portends, provided the company stays healthy, that it can eventually reach four or even five figures. However, that is far off and is not expected until after SMLR investors have experienced significant pain. And, if they continue to bet on Bitcoin during a bear market, it should bruise the chart.

Despite my view, I am not short now. I want to catch the short in the $38 to $50 region. $50.44 is my stop, so I want to minimize risk with the position.

Conclusion

Semler Scientific may be a solid medtech firm, but its pivot to Bitcoin smells more like trend-chasing than strategic clarity. The enthusiasm around corporate Bitcoin holdings has coincided with overheated crypto sentiment and a likely peak in this cycle. While Bitcoin still has some upside left, the conditions are ripe to start selling charts that are seemingly fading early.

SMLR is one of those opportunities as it has formed a clear short setup with risk-to-reward. It is also not a crowded trade as most crypto pundits expect newly formed Bitcoin treasuries to power Bitcoin higher, along with the companies that deploy the strategy.