Seems Lower Lows in Gold & Miners Becoming More Likely

The action we have seen since the weekend is making it more likely that most of the charts will still provide us with a lower low later this year before we complete this two-year long wave ii.

While I was giving GDX the benefit of the doubt over the weekend, I cannot say that I can continue to do so. While it certainly can morph into a leading diagonal off the lows, or even a 1-2, i-ii off the lows, I cannot buy into either of those scenarios at this time purely because the market provided us with a top at the 1.00 extension off the recent lows. That is usually a warning sign to which one should always pay attention.

It would take a break out through the 21.50 region to even consider the bottom as having been struck. For now, I think that the more likely scenario is pointing to a lower low later this year to complete wave ii.

But, that does not mean I think we are heading down immediately to a lower low. Rather, I think the best pattern would still likely see a c-wave rally in the coming week or two to complete a much larger degree 4th wave. And, that would apply to all the charts we are tracking.

That means that the current pullback we are seeing in the GDX and GLD are b-wave pullbacks within the a-b-c structure in the current 4th wave. It is for this reason that I think we can still see a c-wave rally in the coming week or two once this b-wave completes.

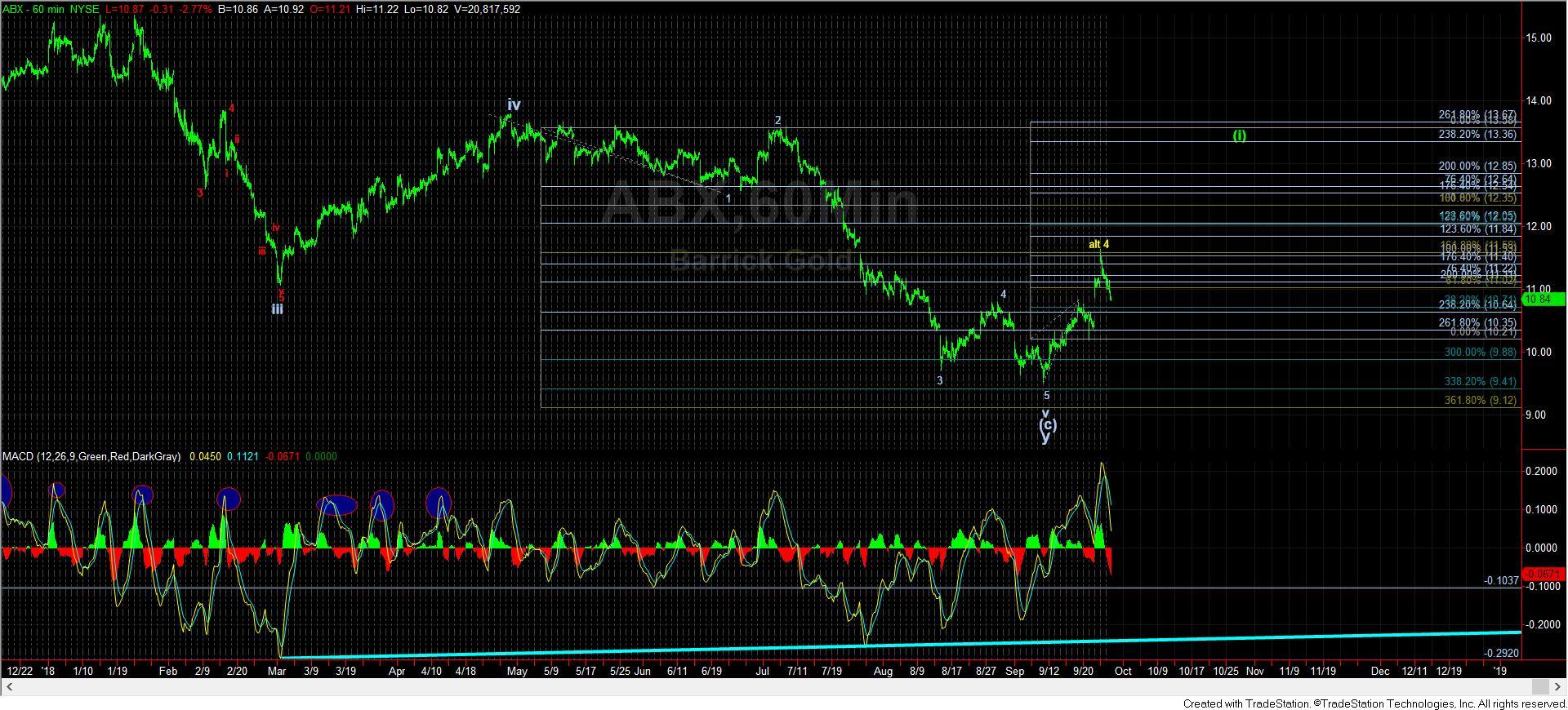

As far as the ABX is concerned, yes, I am still “concerned.” While we have blown through the prior 1.00 extension off the lows, we have just struck a higher degree 1.00 extension off the lows, and have pulled back below the .618 extension in that larger degree structure. That is often a warning signal, as I have outlined in the past. However, as I have mentioned before, the downside structure in the ABX is really “fully cooked,” so I am going to give the ABX a bit more room before I pronounce an expectation for lower lows in ABX. If we can continue higher up towards the 13 region, then I think we can count the downside as likely completed, and look forward to a wave ii pullback while the overall market drops to lower lows.

With regard to the NEM, I still think this has a lower low in its future as well, and nothing has yet changed my expectations. In fact, there is even potential that wave 3 has not yet completed.

Overall, I still think we are stuck within a corrective pattern, which can still take us up again in the coming weeks. But, as long as resistance regions are held, I am looking for a lower low to complete the c-wave of wave ii in the coming months.