Seemingly Too Small - Market Analysis for Jun 2nd, 2021

If you listened to my video update this morning, you will likely know what I am about to say about the metals complex.

As I have outlined many times before, if there is an immediate bullish interpretation when it comes to the metals, I will often adopt it as my primary analysis during a bull market move, as the metals love leaving people at the station waiting for the train.

In this case, the train is an appropriate 2nd wave pullback. And, to be honest, I really do not see a clear one in the GDX or GLD at this time. Rather, my “preference” would to still see more of a 2nd wave pullback over the coming weeks. Yet, when the metals get moving to the upside, they often surprise.

So, I am still abiding by the pivots I have outlined of late. The only changes to the pivots come on the 144-minute silver chart, which I slightly adjusted upward due to the potential that the recent consolidation was large enough to be a 2nd wave. And, should we rally through the pivot, then I will fully adopt us being in wave 3, with a minimum target of the 35.50, but with a more likely target in the 37-40 region.

As far as the GDX is concerned, I really have such a hard time buying into the pullback in early May as being the 2nd wave off the low. And, the fact that the current consolidation is even bigger than that one really puts this into question for me. Ideally, I would much prefer to see the current consolidation as a 4th wave within wave i off the lows, as that would fit a much nicer count, as shown on the daily GDX chart. And, it would suggest one more push higher would complete wave i.

However, if I continue to maintain the i-ii, [i][ii] more aggressive count I have been tracking of late, it would suggest that a break out through the top of the pivot in the 42.15 region would suggest that wave [iii] is already upon us. And, that would then make the 41 region our new support, as we begin the move to much higher levels towards the target box overhead on the daily chart.

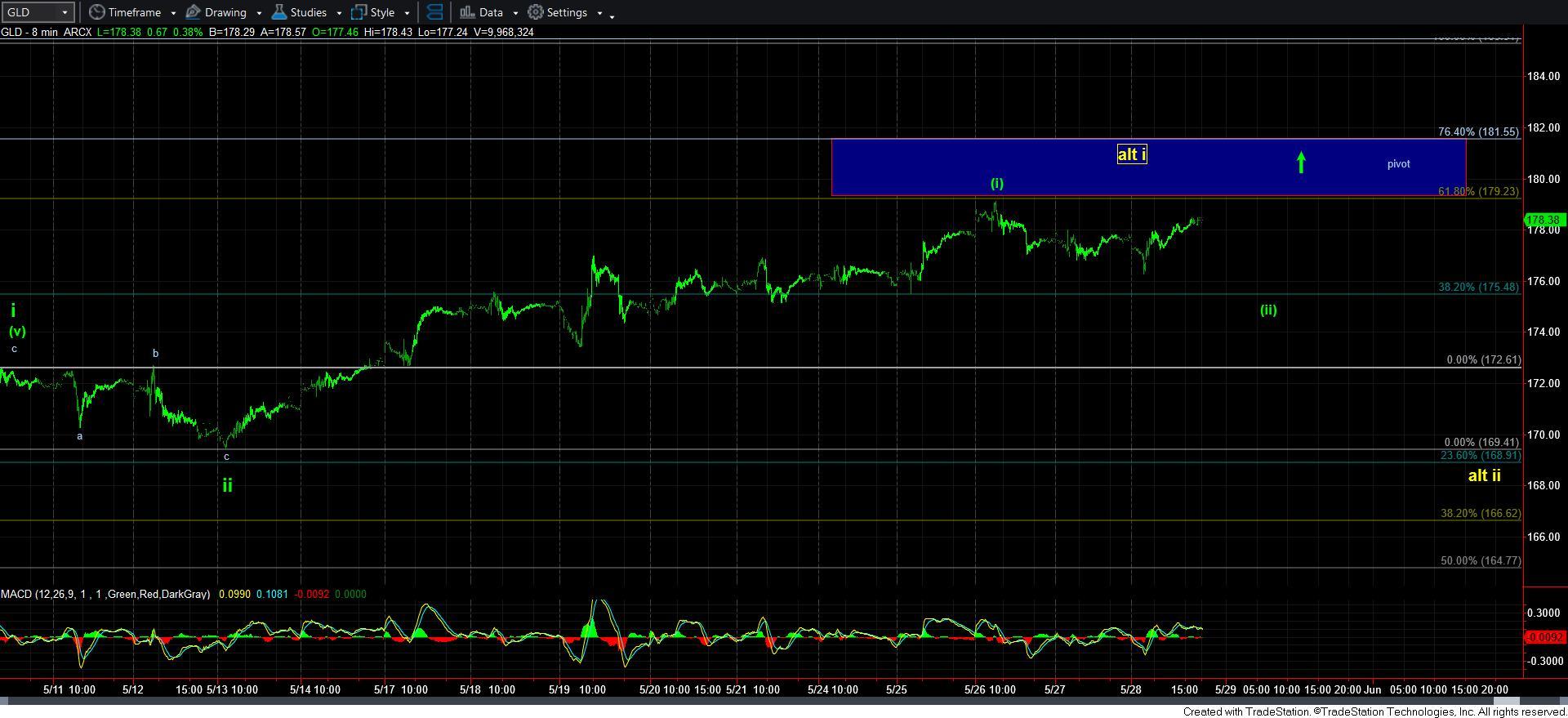

GLD is presenting even more bullishly in its micro structure, as it is already at its respective pivot.

In summary, while I have been and certainly remain quite bullish this complex as we look out towards later this year and into 2022, I am still struggling without an appropriate 2nd wave upon which I can hang my hat. Remember, it is the 1-2 structure which allows us to set our targets for waves 3, 4 and 5 in a high probability fashion. But, without a clearly appropriate wave 2, it does make us struggle a bit.

For now, I am going to be watching the pivots on GDX and silver more so than GLD. Should we see both silver and GDX break out over their respective pivots, then I have to proclaim us being in the heart of a 3rd wave in the metals complex. At this point, I am still somewhat uncomfortable with that, again due to the lack of an appropriate 2nd wave. But, I will let price set our perspective. And, since this is a bullish market now, I am giving the bulls the benefit of the doubt for now, even though I would prefer the bears to make a showing for an appropriate 2nd wave.

Lastly, I have noted many times that I would trade a 3rd wave aggressively in this complex. However, that is only assuming we have an appropriately reliable 1st and 2nd wave in place. So, at this point, I am still just riding my standard long positions, and have not done anything aggressive yet, at least not until I get the set-up I want to see for a lower-risk more aggressive long trade. If the market follows through on the more aggressively bullish wave count, I may miss that opportunity. We will see. But, the market has certainly taught me the common lesson - bulls get fat, bears get fat, and pigs get slaughtered. I really try to avoid being a pig.