SPY Pointing Toward 320

The Bayesian Probabilities cluster in the 340-343 region proved too much for SPDR S&P 500 ETF (SPY), and a rug-pull of sorts has begun from that region, as indicated in our daily write-up for a week now.

If this path proves out, then a swift move to the low 320s is on deck and then price action should dictate next steps. Keeping with the theme of the 330ish level holding on the next move lower: (1) [P=34%] SPY holds above 330ish, (2) [P=66%] SPY targets more directly 320ish before next steps.

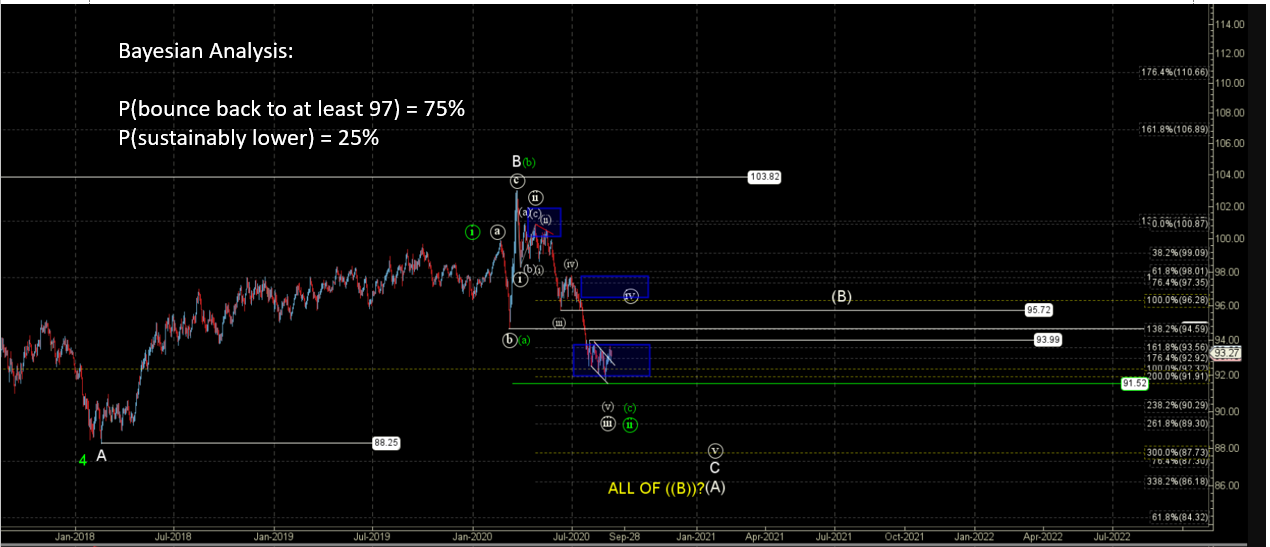

In the metals, there is very little to add, with at least one more down leg on deck and a vibration window appearing for mid-next week. A Bayesian vibration window is a moment in time that serves as resistance or support in price, usually manifesting as a relative high or low in price. With GDX continuing in its month-long trading range, action continues to present bearishly into month end.

Other than that, here are the paths: (1) [P=75%] GDX visits below 39; and 35 or 30 can’t be ruled out, and (2) [P=25%] GDX continues its bullish advance sustainably above the 45s.

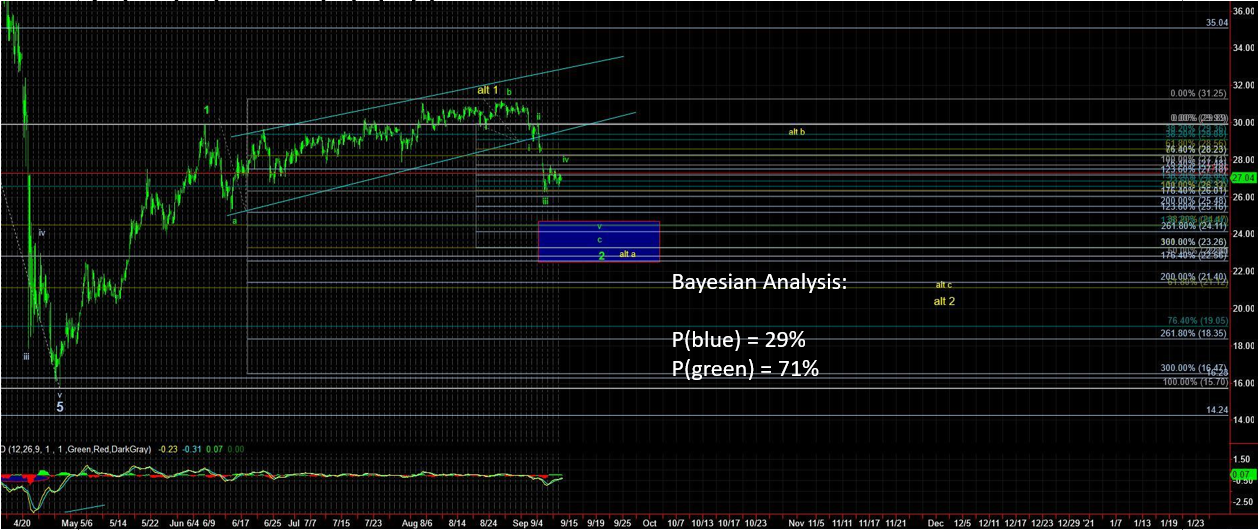

In oil, the USO has broken down and now a vibration window has appeared for later this week. This could be an important multi-week/month low setting up, so be on the lookout for a signal change to long.

In the dollar, the UUP is basing near 25ish. UUP is backtesting the important 25-25.1 support region and thus far has held. Holding it could produce a swift move upward – should know more on this very soon. The BTS still leans towards a “surprise” bounce back up to at least 26.5-27 before this is over.