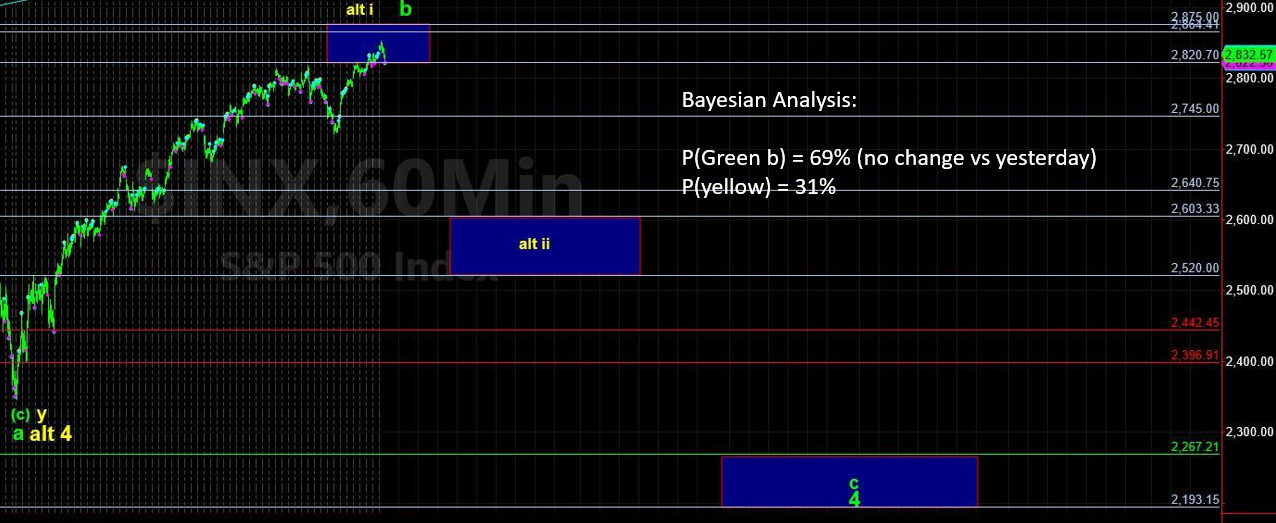

SPY Looking Lower - Market Analysis for Mar 20th, 2019

Examining the Bayesian probability paths, the SPDR S&P 500 ETF (SPY) has a 68% probability of a reaction lower off the 282-284 target range reached on Mar 19. There's a 32% chance the bulls directly power up beyond 282-ish to above 286.

Of further note consider these observations: (a) The most bearish micro path would be one more attempt at higher as high as 283s (hit on 3/19 with a reaction lower), which would trigger a stronger reversal lower into next week. (b) A jump event has been detected for this week – for those new to Bayes, a jump event is a strong move detected. Since first featured on EWT, Bayes has picked up about a handful of jumps and has thus far batted 100% on the “strong” move materializing – and Bayes has gotten 80% correct in terms of the expected direction of the move. This jump is looking for a strong move lower. The intraday move on 3/19 shows a jump event potential is near, even though 3/19 didn’t quite qualify as one.

In metals, as expected, the vibration window identified for last week halted the mini-rally off the 3/4 low. Given this path continues to play out, a retest of the early March lows will most likely occur before the next decision is made. Not much to trade in this current back and forth; but when this resolves a nice sustainable trend higher should emerge….patience.

Other observations: SPDR Gold Shares (GLD) has the highest probability of not breaking the 3/5 low and bottoming before Gold Miners ETF (GDX) or iShares Silver Trust (SLV) -- with a 66% chance of bottoming before the end of March. SLV has the highest probability of breaking its 3/7 low bottoming after GDX or GLD (and extending its bottoming process into mid-April).