SPY Could See 300 In Path Lower

As of pre-market on 9/3, the SPDR S&P 500 (SPY) remained in the resistance band of 350-356s (with a spike higher and reversal on 9/2). Thus, this region in probability terms "should be" the last extension higher, coincidentally aligning with Avi Gilburt’s counts as well.

The large divergences in nearly all breadth, volume, volatility, etc. continue, but any improvement in these metrics could spell trouble for bears, as laggards catch up to leaders. Just something to keep an eye on.

Above this region and 380-400+ come more directly into focus; remaining below it keeps a move back down to at least 290-300 on deck. Here are the paths: (1) [P=75%] SPY begins a sustainable path lower from the 350-356s to at least 300, and (2) [P=25%] SPY continues a sustainable bullish path targeting 360+.

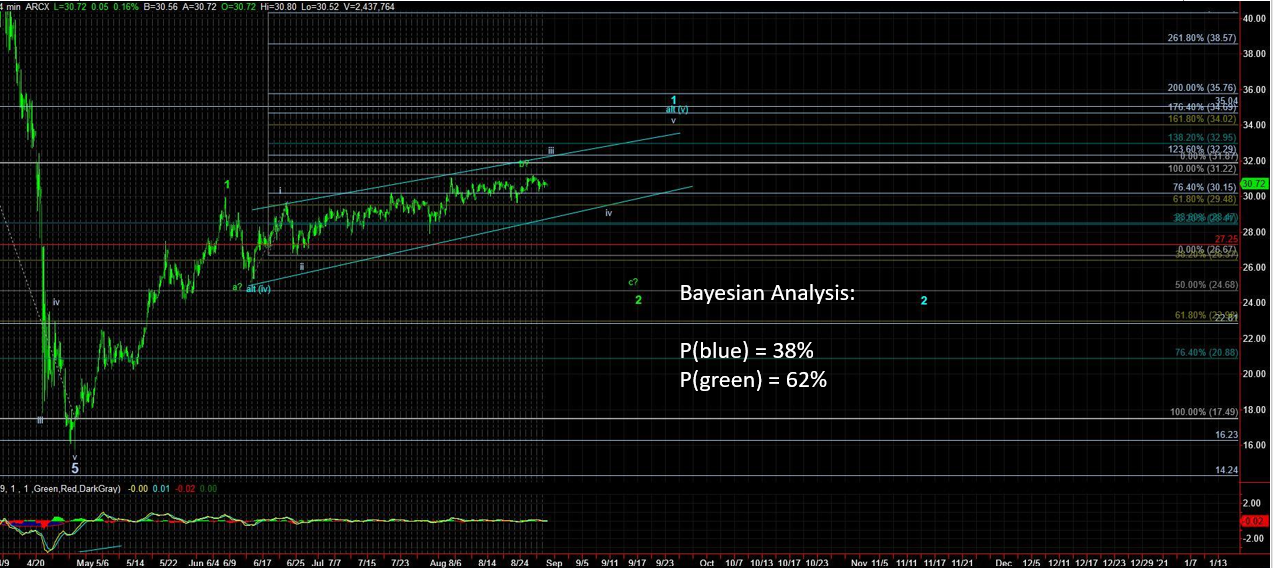

In metals, the GDX gold mining ETF continues to struggle in the 41-42s resistance band and still has targets below 39 – most notably near 35 or 30. Further, the 150s in the SPDR Gold Shares (GLD) has a tradable shot of being seen again before the next sustainable uptrend is seen in metals.

Here are the paths: (1) [P=78%] GDX visits below 39; and 35 or 30 can’t be ruled out, and (2) [P=22%] GDX continues its bullish advance sustainably above the 45s.

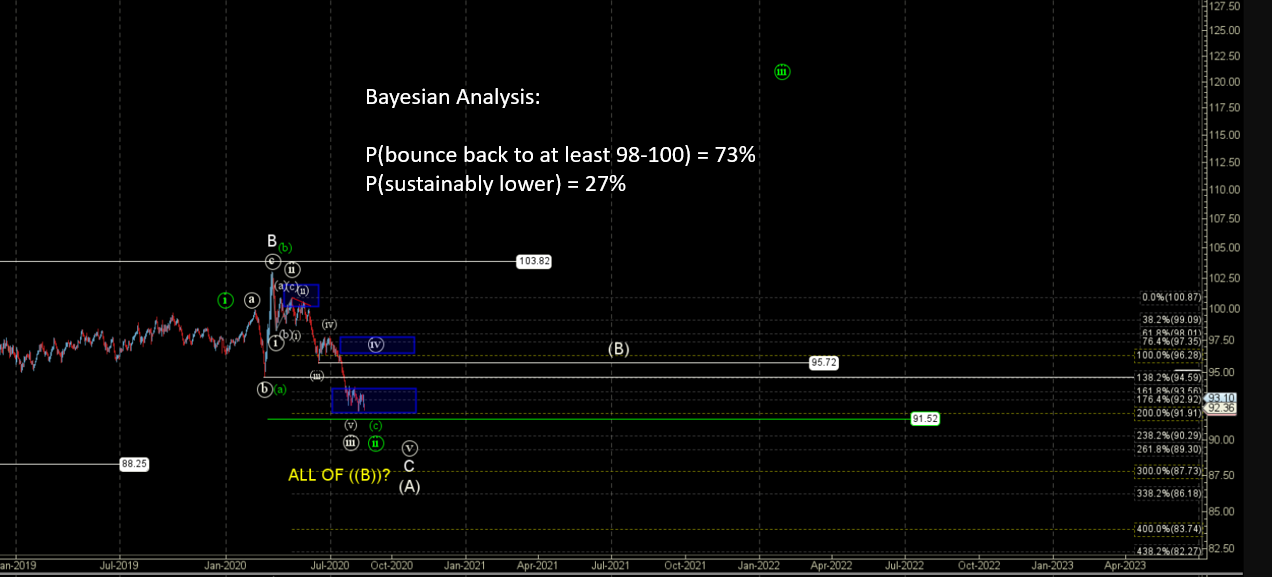

In oil, with the US Oil Fund (USO) remaining in a tight range near 29-30 for weeks, there isn’t much to trade. Possibly a push to 32 is on the immediate horizon, however, not worth the risk on the long side. If anything, a modest bump higher could be worth a short. If and when a real time signal triggers, then you’ll get the notification.

In the dollar, the UUP is basing near 25ish. Back above 25.1 and a run to at least 26.5 is most likely on deck. Breaking 25 sets off another bearish leg lower. The Bayesian Timing System still leans towards a "surprise" bounce back up to at least 26.5-27 before this is over.