SPY Bumping Against Resistance

SPY continues to bump against the resistance region in the 448-452s. With the odds shifting at the micro-level to that OMH camp, Bayes is playing that long swing trade as a Notes trade.

Again, for newer members, Notes trades focus on short-duration swing trades, and the BTS focuses on a larger-duration swing trade. So don’t be confused by our positioning with SPY short and Notes trades long IWM. Further, please follow the guide recommendations regarding position sizing and leverage.

As a reminder, BTS trades assume 1x ETFs and/or longer timeframe leverage setups vs. Notes trades being more “friendly” towards leverage setups more immediately. And, as is expected, following these rules has you net net up in your Bayesian portfolios (i.e. both the BTS optimal portfolio is green; as is our Notes portfolio).

From before: Another micro-push higher could be seen; so I will let the BTS machine determine the odds of holding our existing shorts vs. stepping aside and attempting another short attempt in the near future.

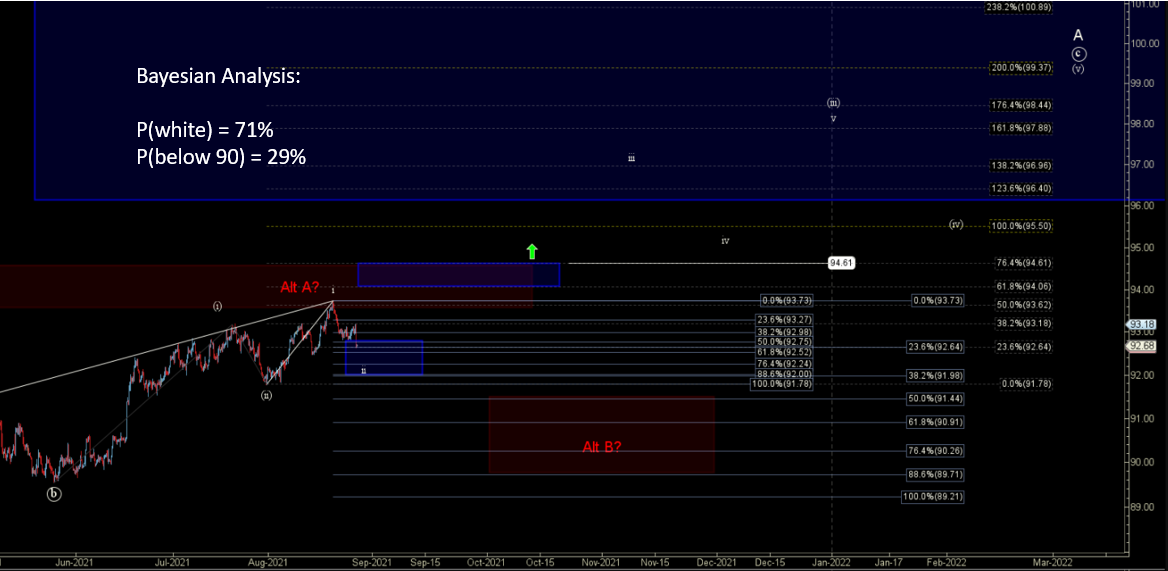

In metals, let's keep in mind what we wrote from last week: “A glimmer of hope for the bulls, as the shorter-duration Notes trades have begun testing the waters for a swing move higher. Will that spill over into a BTS trade too? Stay tuned…."

Well, we got our answer on Friday near the open, as Bayes nailed another tradable path higher. With members sitting on comfortable profits, the discussion now turns to “how long or how much higher do the bulls got in them?"

At the moment there is a vibration window about a week from now and more immediate targets near GDX 35ish. So, that’s what I’ve got and written as succinctly as possible. Now, does that mean GDX 100% hits 35? Nope… we are trading BPs and trade signals are real-time; if you can’t handle those parameters and want absolute certainty then save yourself some stress and put your money in a savings account.