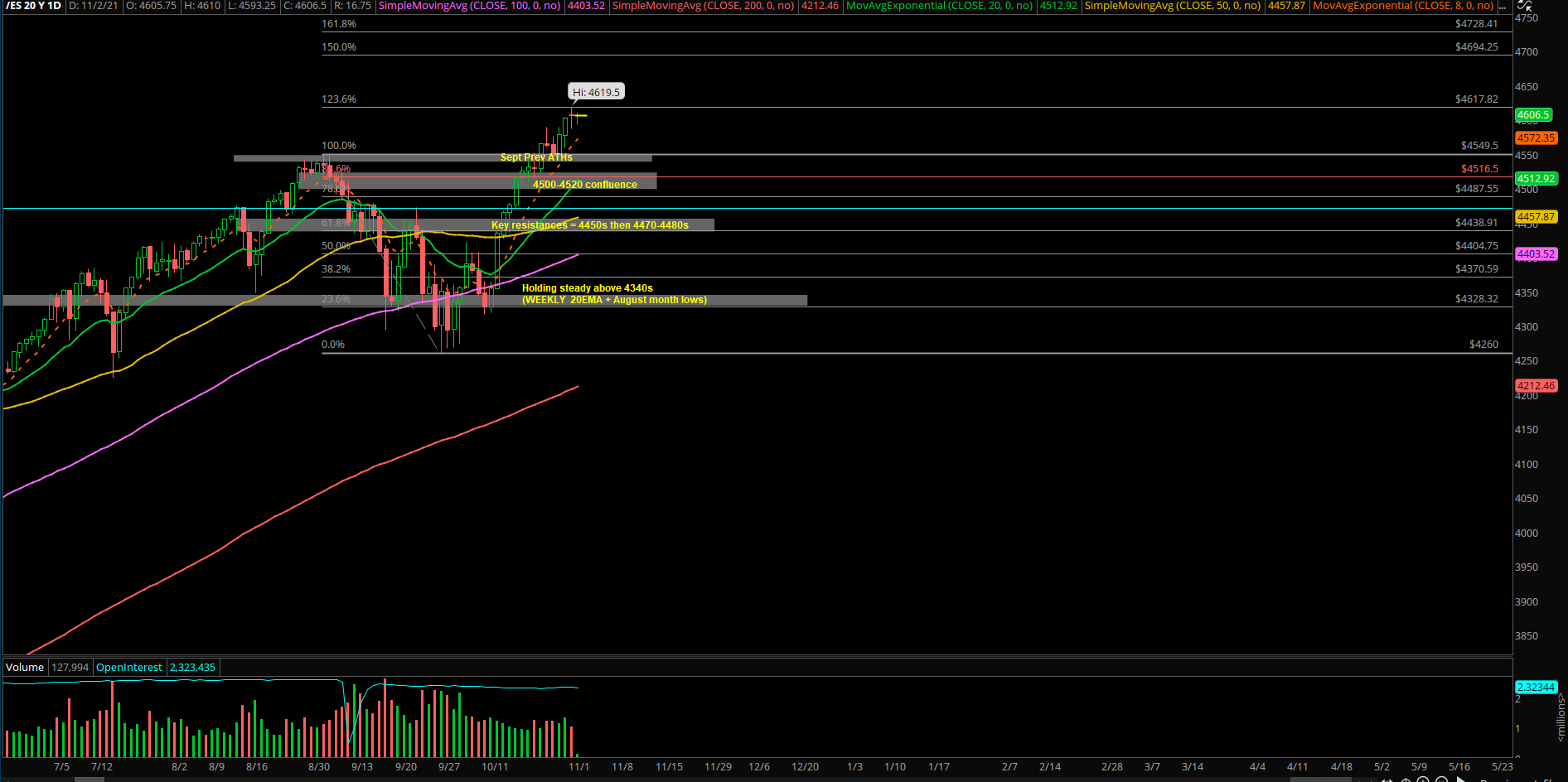

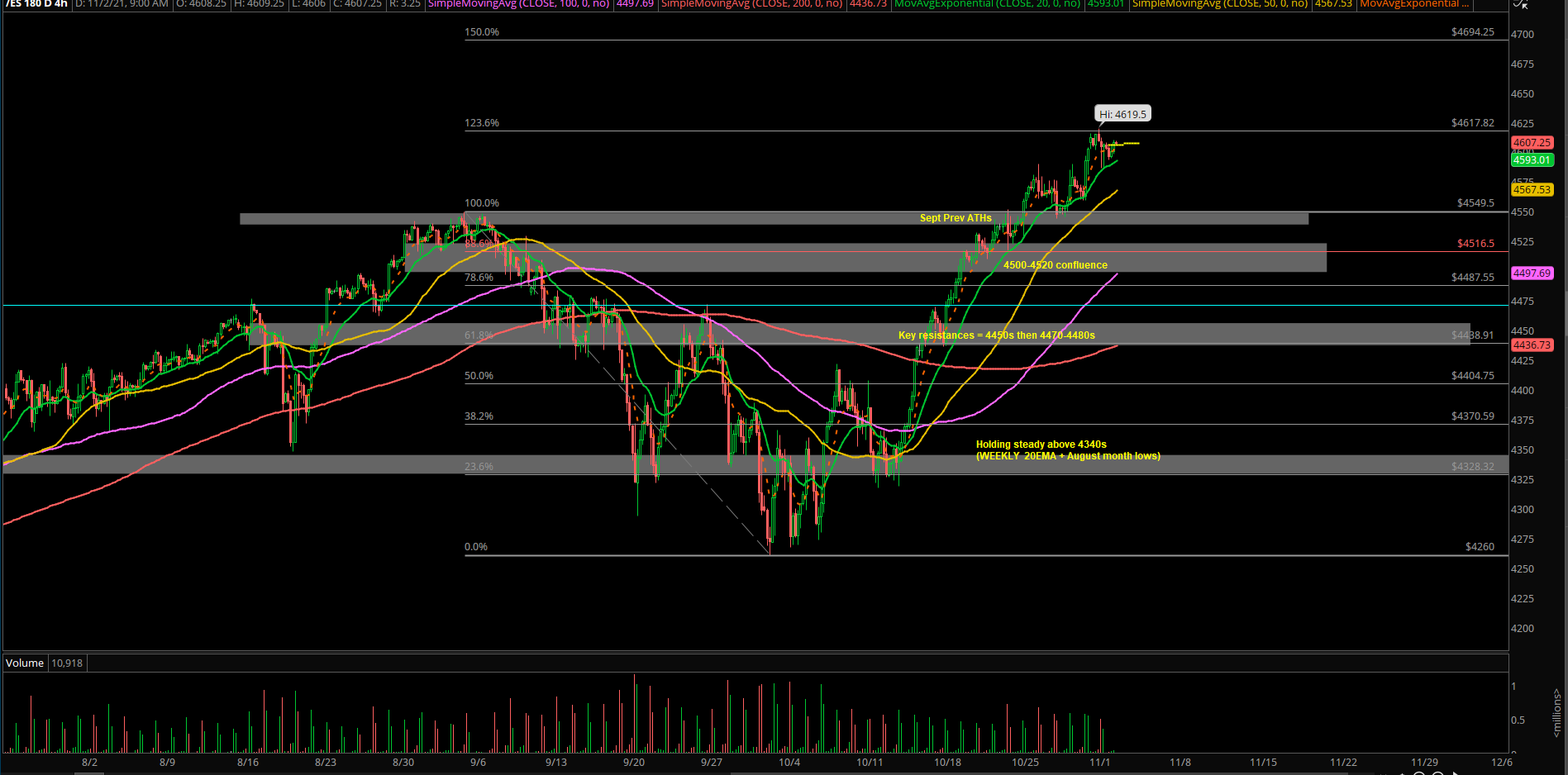

S&P 500 Fulfills Our 4600 Target ... Dips Buyable

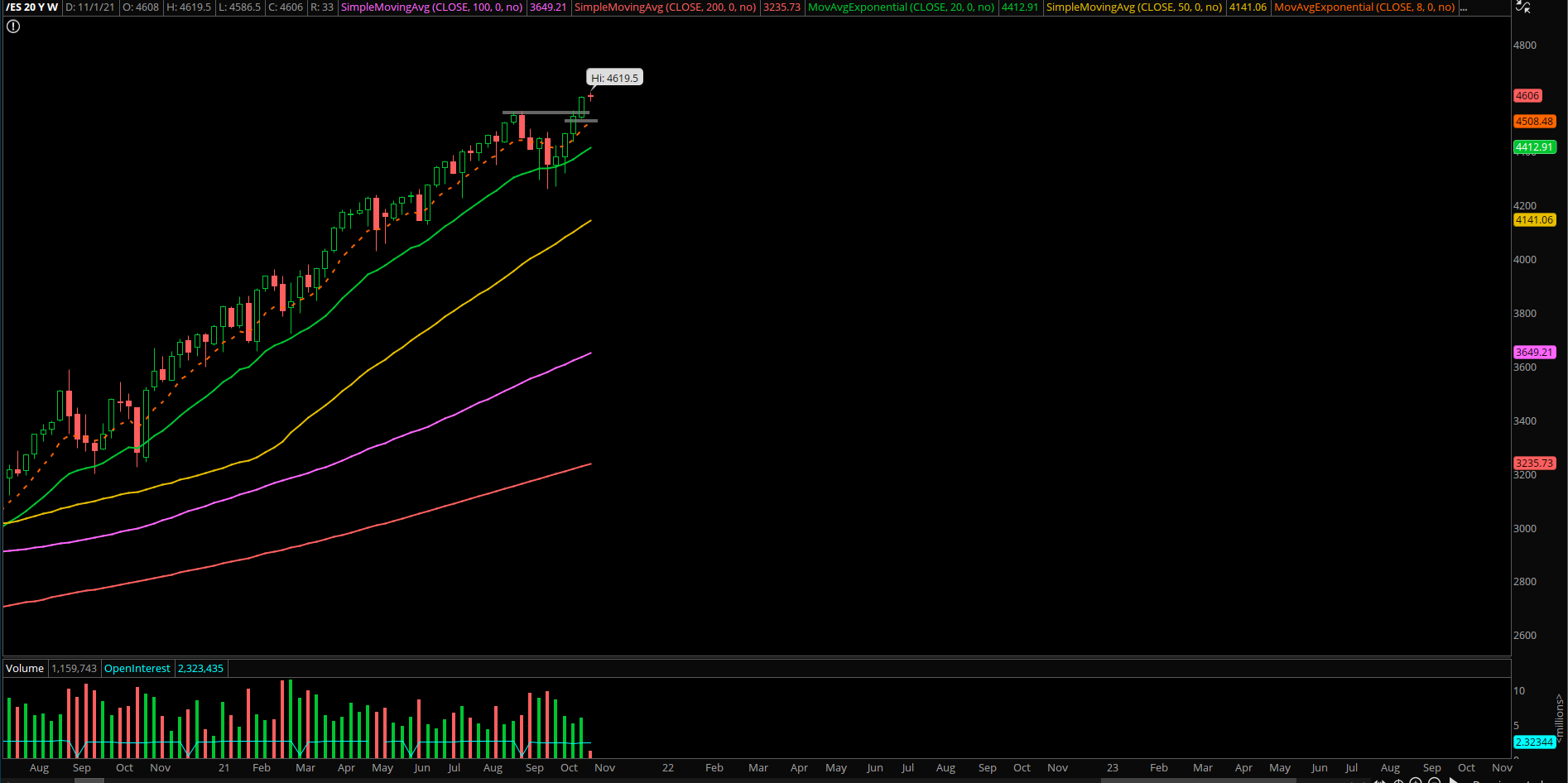

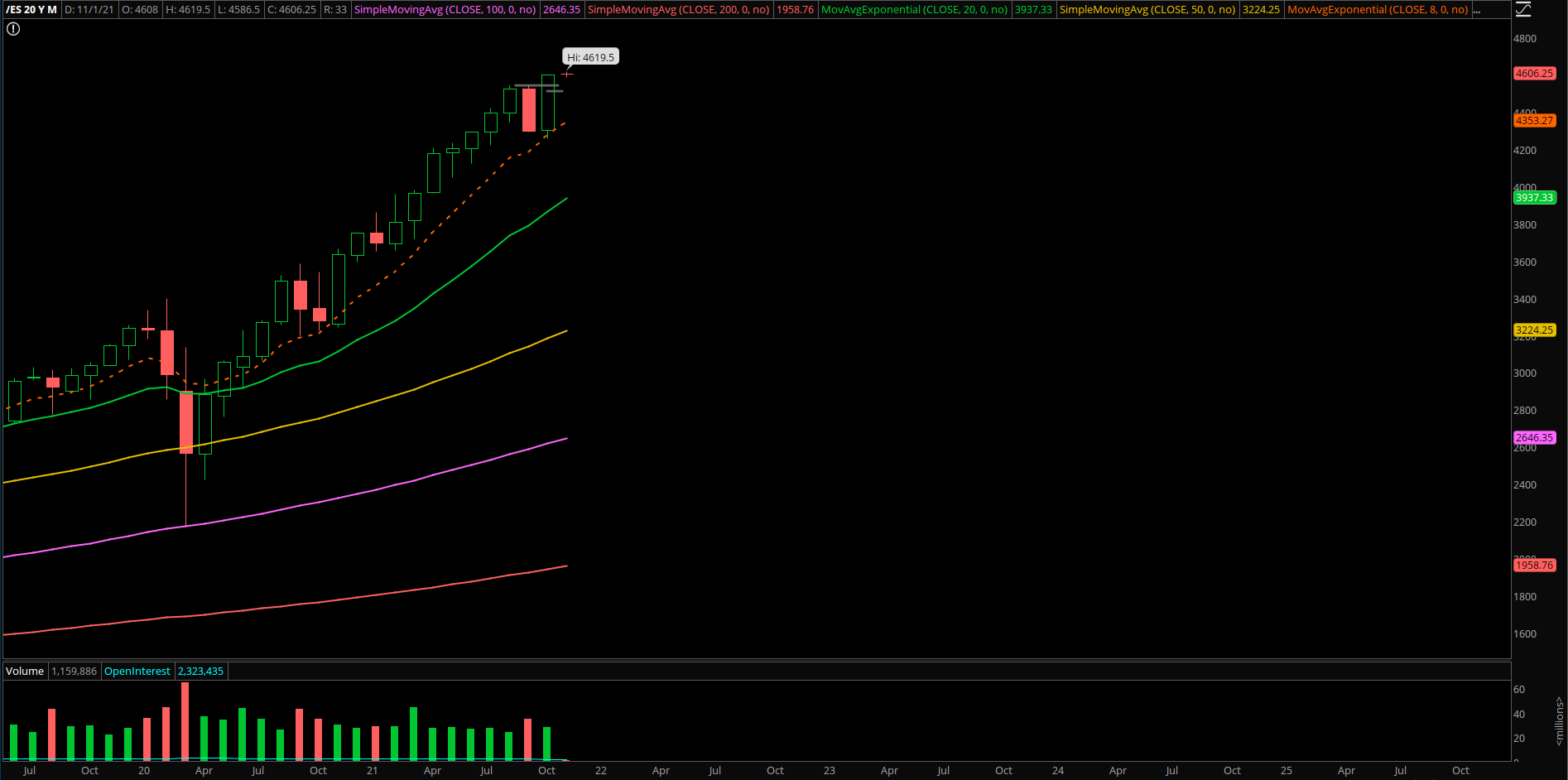

October closed at the highs for the monthly closing print as expected as the market fulfilled our 4600 round number target on the S&P 500. Strong trend month closing at highs is a great confirmation of strength.

As demonstrated, we spent the past few months buying all the dips with great initial risk vs reward as we prepared for the EOY ramp. Hardest part is done so now we’re just reaping the benefits. Again, we’ll continue to take profits into respective targets on many of our long positions and rotate our portfolio in order to take advantage of the incoming rotations + best risk vs reward setups.

Here our game plan for today;

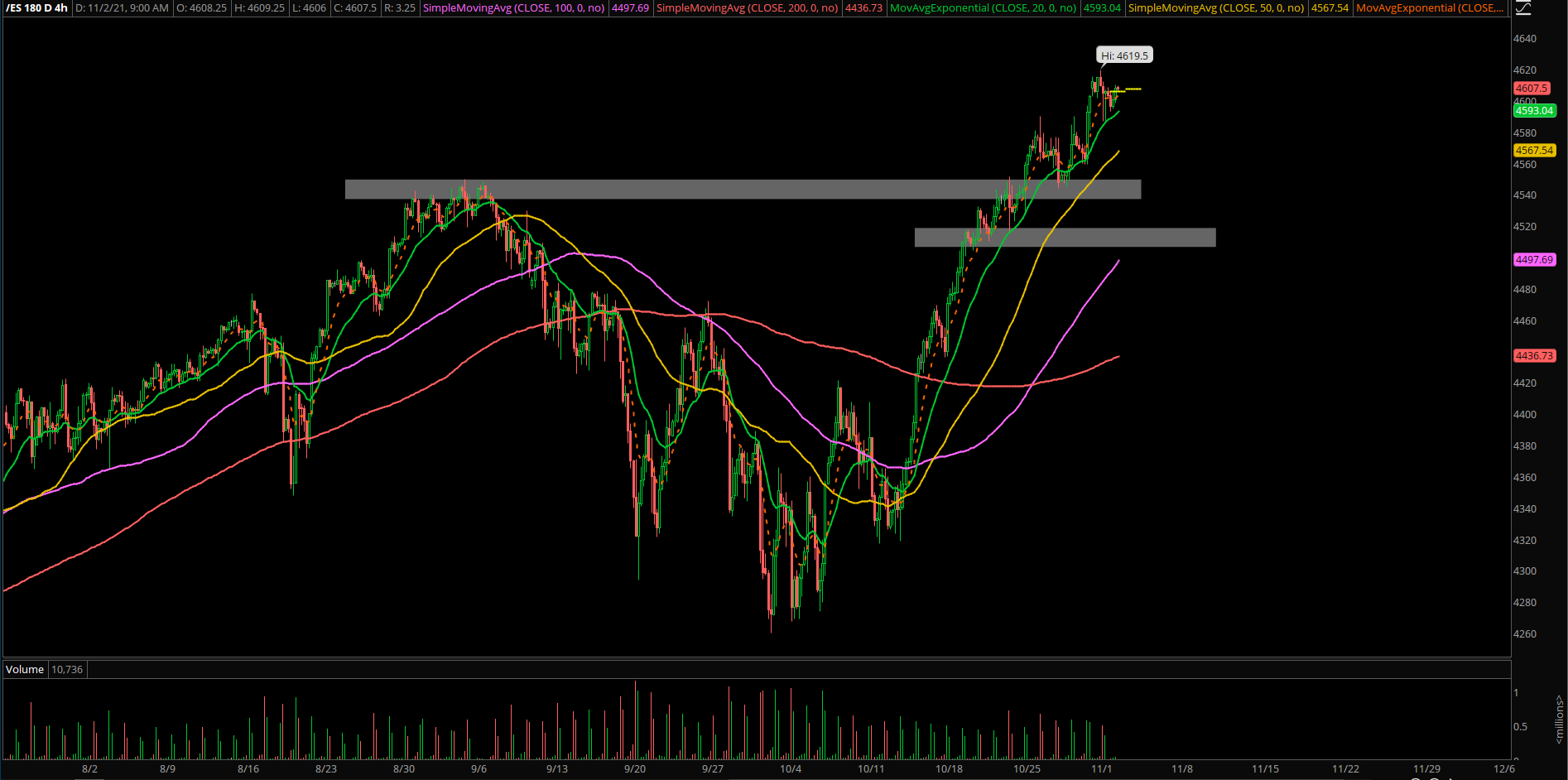

- O/N ES range = 4610-4593, price action consolidating around the 4600 round number as we expected. If you recall, yesterday’s session backtested into 4585 key level two times and it stick-saved for decent scalp opportunities. Overall, fairly typical action as we head into Wednesday FOMC timing catalyst.

- The immediate trending supports moved higher at 4585 and 4560, and all dips remain buyable. Likely more range/consolidation to setup another base around 4600s as we move into Wed's FOMC. Next key resistances/targets are at 4625/4650.

- Bonuses: RTY strong ongoing multi-month breakout formation. EOY is going for 2500+ target. All higher lows remain buyable when above 2300.

- ZW/Wheat strong with ongoing multi-month breakout. Yesterday solidified strength into 800. Next targets are 850/880/900. All higher lows remain buyable when above 765.

- Overall, majority of our best in breed stock portfolio are outperforming the market as expected with double digit % returns. We’ll continue to tighten up risk + trimming and trailing position as they hit respective targets. The hardest part was already completed throughout the past few weeks+months, so we’re now reaping the benefits. Will look to rotate some of the gains/cash into some other setups for EOY.

- As demonstrated in real-time in this room, it’s not very hard in this bull market to produce 85%+ win rate in stocks while outperforming the indices on percentage basis as we outlined the various setups (mostly tech heavy). Homework is key, the risk vs reward has been great.