Russell 2000 Pushing Higher

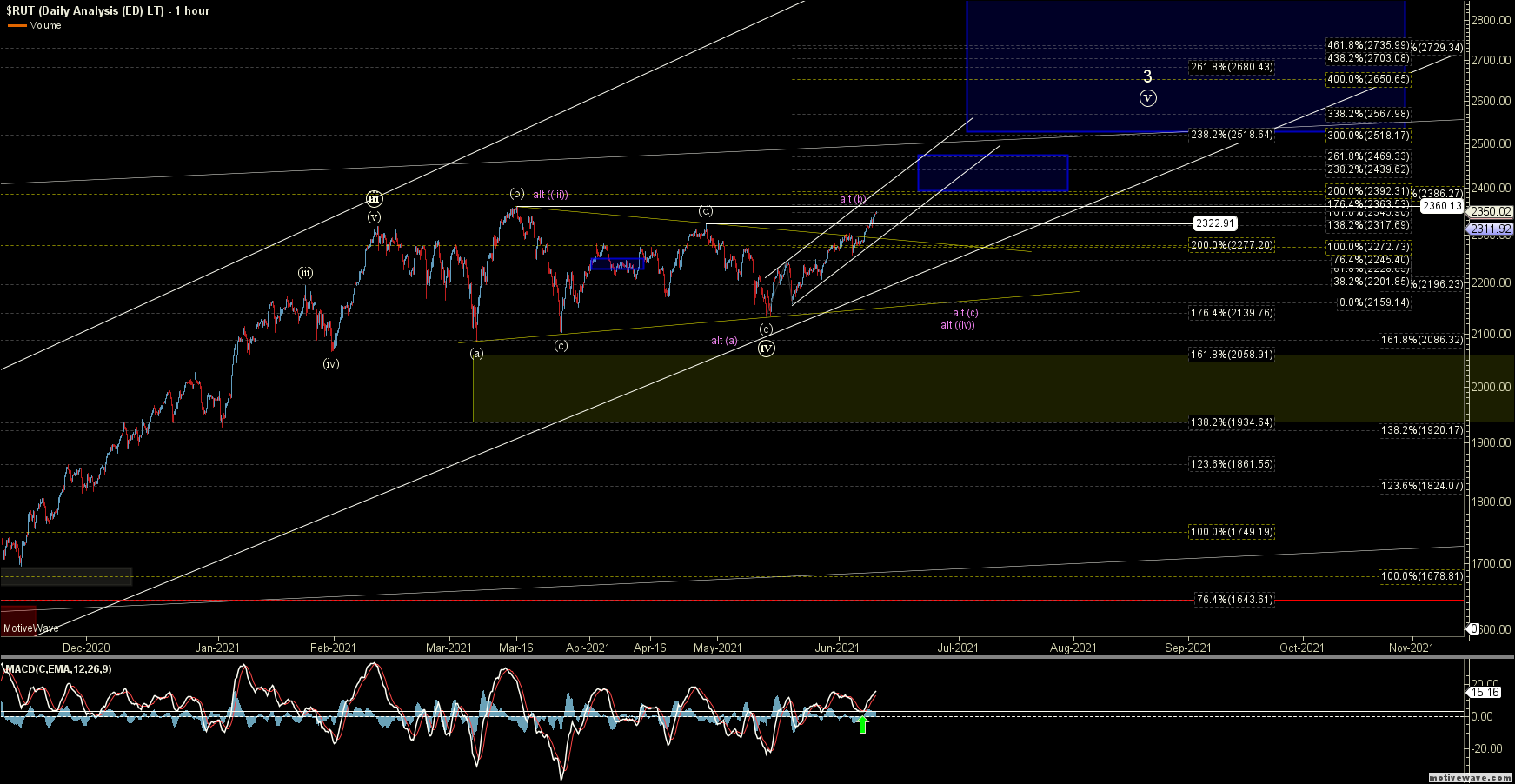

The Russell 2000 Index (RUT) is trading slightly higher this morning and still following the expected path quite well. As I noted yesterday we have officially invalidated the alternate purple triangle count on the RUT, which leaves only a very irregular wave (b) that I am showing in purple on the RUT chart as an alternate. I am still not viewing this as highly probable, but it is the only reasonable alternate major topping pattern I can come up with.

So, this continues to look like we have indeed bottomed in all of the wave ((iv)) under the white count and are simply breaking out higher in an impulsive push for wave ((v)). The final level to confirm this comes with a break over the 2360 high, which is now within striking distance.

The next near-term pivot on the RTY (Russell 2000 Emini Futures) comes in at the 2357 level, and moving through this level will further confirm the very nested path off of the May 13 low. If we can indeed move directly through this 2357 level, then I would not be surprised to see this push into the upper end of the target zone near the 2401-2421 area before finding a local top of wave 3 off of the lows.

If we are unable to clear that 2357 level with strength, then I will watch the 2326-2303 support zone below, and as long a that holds I think we still should be able to still see at least one more high a bit deeper into the 2340-2421 zone overhead before finding a local top for a wave 1 of larger ((v)). If we break below this 2303 support zone, then it would open the door for wave 1 top to already be in place, which I am showing in red.