Reversing The Old Market Adage "Stairs Up, Elevator Down"

As discussed in the webinar yesterday, if we are dealing with a larger degree correction now the old market adage of "stairs up, elevator down" could get flipped a little.

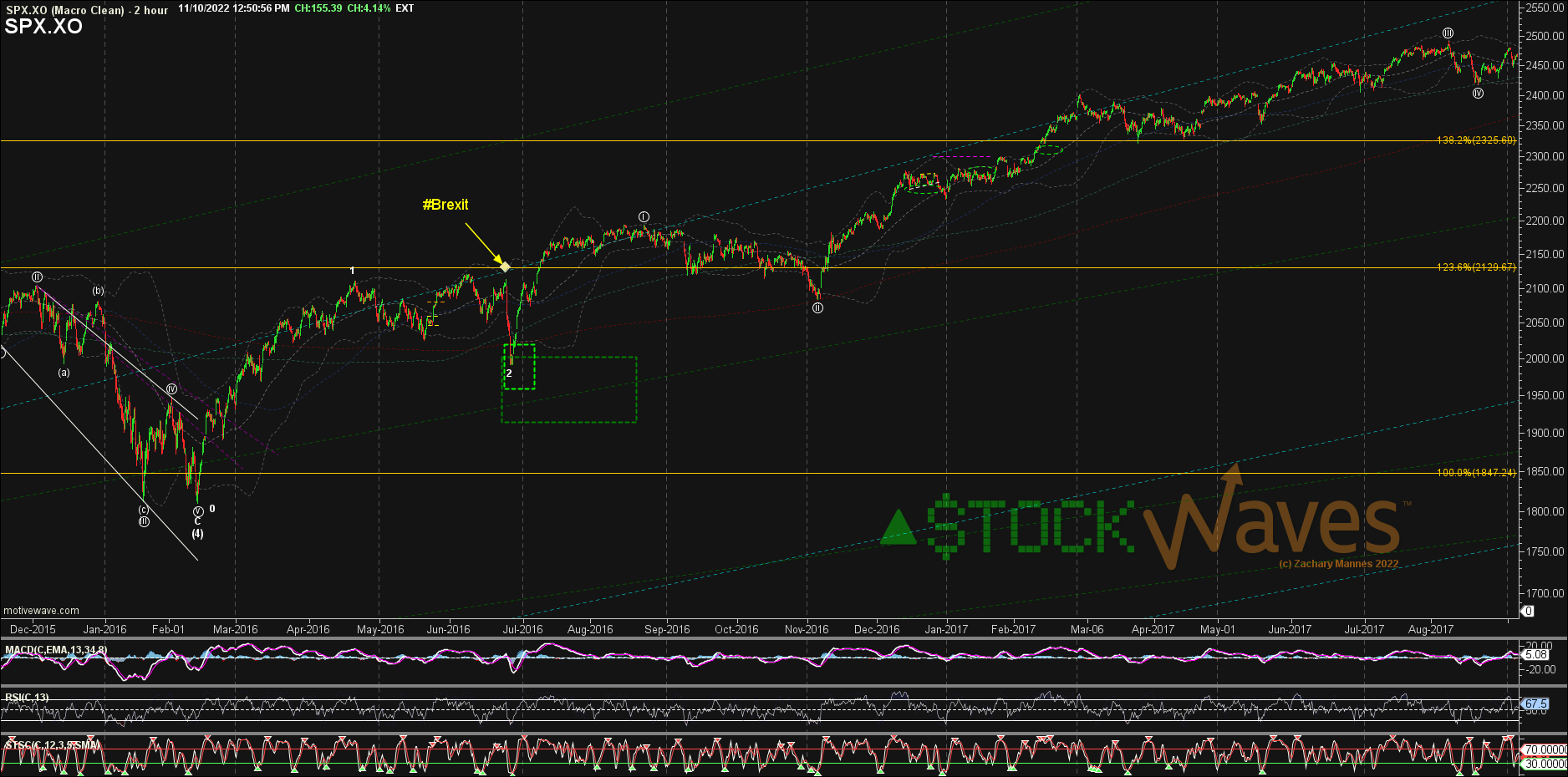

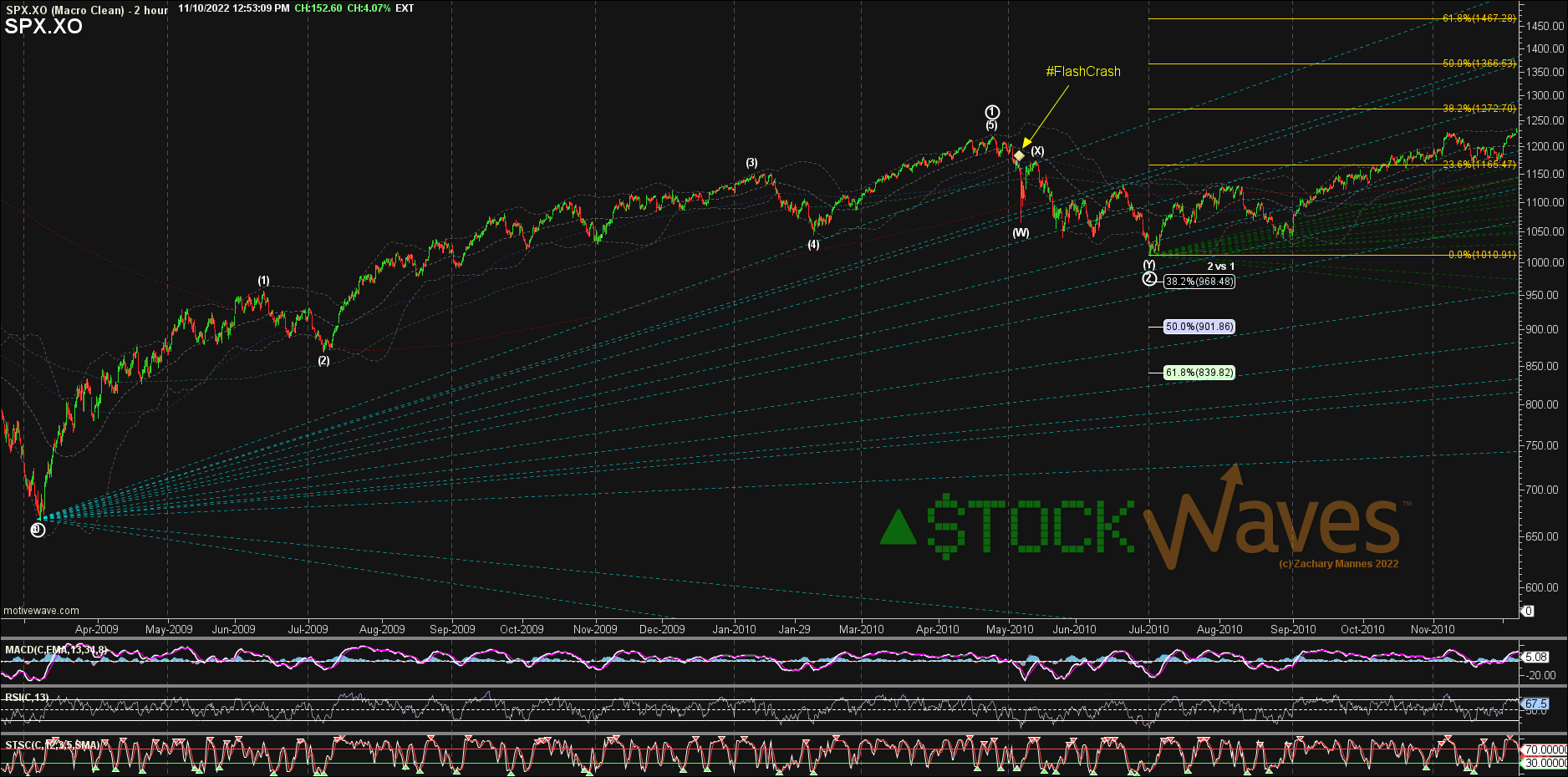

While we certainly need to be on-the-look-out for #BlackSwan events that could provide for some #FlashCrash type moves, usually there has been a setup* in the EW count for those drops prior to the event, and the event just magnified the expected drop. It is entirely possible that overall the moves down at larger degrees going forward are more stair-steppy and the counter trend bounces are the "elevator" (or beach balls if you prefer). There will certainly be plenty of opportunities to play both sides and adjust for different sector rotations, but time frames will become increasingly important.

Please remember to look at all time frames of charts posted by analysts and be aware of the degrees and context being shown.

*It is worth maintaining an awareness of this and so any clear abc up even if it should be part of something else that will hold support could be an opportunity for something worse particularly if at a larger degree. Caution should be exercised when the market is reaching these points even if your bias is for something else.

https://www.elliottwavetrader.net/trading-room/post/2893192

The 3 "Macro Clean" SPX charts are all highlighting past dates when the EW was setup for at least a small drop or the start of a pullback and a #catalyst accelerated the price action.